American Airlines Stock Soars: Here’s Why Traders Are Buzzing

Another week, another meme-stock rally—but this time, legacy airlines are catching the updraft. American Airlines (AAL) just defied gravity with a double-digit surge. Here’s the breakdown.

Fuel Dump: Oil Prices Tumble

Brent crude dipped below $80/barrel—the lowest since January—after Saudi Aramco flooded the market. Lower jet fuel costs mean fatter margins for carriers bleeding cash last quarter. Cue the algo-traders.

Short Squeeze Takes Off

With 18% of float sold short, AAL became a gamma play when it breached $15.50. Retail traders piled in, triggering a 14% single-day pop. Even the suits at Citadel couldn’t resist the FOMO.

Earnings Whisper Game Strong

Analysts suddenly ‘discovered’ that Q3 bookings are pacing 20% above 2019 levels. Never mind that pesky $28B debt load—this is a ‘reopening play’ again. Apparently.

So is this sustainable? Probably not. But when the Fed’s printing monopoly money and SPACs are back, why not YOLO some airline stocks? Just don’t cry when the IV crush comes.

Why American Airlines' stock took off

Usually, when a company issues an SEC filing warning that it has doubts over its ability to continue as a going concern, its peers sell off in sympathy. There's a logical sense to this because it indicates weak end-market conditions that all industry participants will suffer from.

Image source: Getty Images.

However, whendid just that earlier in the week, some of its peers, including American Airlines soared.

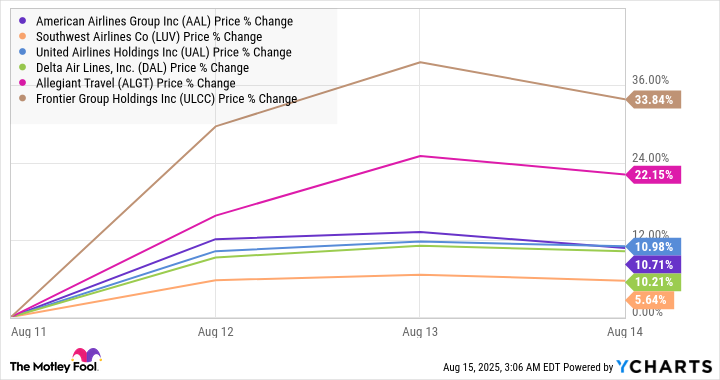

AAL data by YCharts

The reason is that the market is pricing in a removal of capacity in the marketplace, which should enable more pricing power, notably for the budget airlines that Spirit competes directly, and also with network carriers like American Airlines whose ticket prices are also pulled down by competition from budget carriers on specific domestic routes.

Where next for American Airlines

The issue of capacity matching demand is a constant stress point in a cyclical industry like airlines. Overcapacity can lead to slashed ticket prices and profit margins; undercapacity leads to the opposite. Given the reduction in demand caused by the tariff conflict, airlines are reducing capacity. That's why the Spirit news is taken as a positive.

That said, it makes more sense to buy best-in-class stocks likeand.

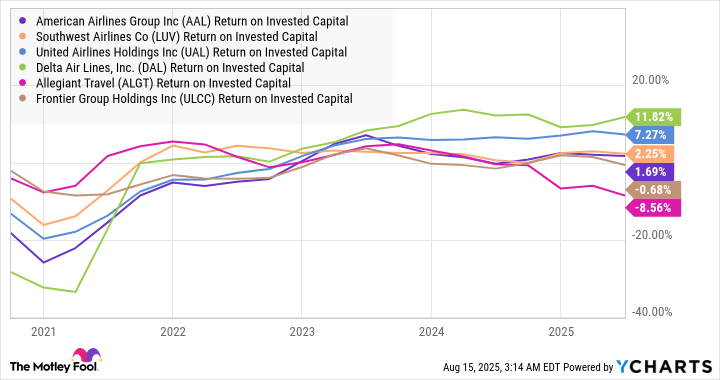

AAL Return on Invested Capital data by YCharts

Or at least it does until American Airlines can demonstrate an ability to improve its return on invested capital sufficient to cover its cost of capital consistently. Until then, Delta and United are the most attractive stocks in the sector.