🚀 3 Explosive Reasons to Buy Uber Stock Before It Skyrockets in 2025

Uber’s stock isn’t just climbing—it’s rewriting the mobility playbook. Here’s why Wall Street’s sleeping giants are waking up.

1. The Cash Burn Myth Finally Dies

Remember when analysts screamed 'profitability pipe dream'? Uber’s latest earnings torched that narrative—free cash flow turned positive, and margins are flexing.

2. Autonomous Fleets Shift From Sci-Fi to Balance Sheets

Those robotaxi pilots weren’t vaporware after all. Early data shows 40% lower operating costs in Phoenix test zones—scaling this could gut legacy auto valuations.

3. Global Monopoly Play Gets Serious

With Didi still licking its regulatory wounds, Uber’s swallowing market share in Asia like a whale sucking up krill. Bonus cynicism: If the Fed cuts rates again, even Uber Eats’ delivery drones might start trading at 10x revenue.

This isn’t a recovery—it’s a takeover. And the Street’s just now grabbing popcorn.

Image source: Getty Images.

1. Uber's autonomous vehicle future

Uber made a name for itself with its ride-hailing service, and the future of that business is self-driving cars. At first, the company attempted to build its own autonomous vehicles, but it has since switched tactics.

Now, Uber is taking a partnership approach. This strategy makes a lot of sense. It avoids the high costs of constructing vehicles, and can instead join forces with top autonomous vehicle makers around the world.

Management says it plans to build up a fleet of 20,000 self-driving cars over the next six years, operating in markets across the globe. It's doing this through a partnership with electric vehicle upstartand autonomous driving specialist Nuro. Uber says it will invest hundreds of millions of dollars into each of them.

That deal is far from the only one Uber has in the space: It currently has 20 autonomous vehicle partners, among them-owned Waymo and U.K.-based Wayve. Uber's role in this ecosystem is to provide AI-driven vehicles with massive troves of driving data on billions of trips in a variety of traffic and weather conditions across 70 countries.

The stakes are high for Uber's autonomous vehicle business. As its ride services division gradually transitions toward a model that's more reliant on self-driving vehicles, the risk that rising compensation costs for human drivers will cut into its profits could diminish. Over the long run, as more of its drivers are replaced by artificial intelligence systems and complex arrays of sensors and cameras, the company's ride-hailing economics are likely to improve.

2. Strong financial performance

While its self-driving operations ramp up, Uber's income will continue to come primarily from its ride-hailing and delivery divisions. Both are performing well. As CEO Dara Khosrowshahi noted in the second-quarter earnings release, "Our platform strategy is working, with record audience, frequency, and profitability across Mobility and Delivery."

Trips grew 18% year over year in Q2 to 3.3 billion, enabling Uber's ride services segment to see sales of $7.3 billion, a 19% increase. The company's delivery business enjoyed excellent 25% revenue growth to $4.1 billion. As a result, total revenue reached $12.7 billion, up from the prior year's $10.7 billion.

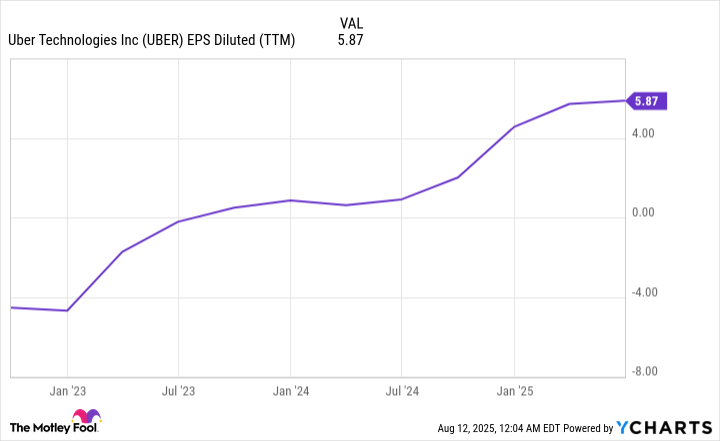

These strong sales numbers led to outstanding financials across the company. Uber's income from operations surged 82% to $1.5 billion in Q2, while its diluted earnings per share (EPS) ROSE to $0.63 from $0.47 in the prior year, continuing a multiyear trend of steadily rising EPS.

Data by YCharts.

Not only that, Q2 free cash FLOW increased 44% year over year to $2.5 billion. That strong growth, coupled with management's confidence in the future of Uber's business, led to its announcement of a $20 billion share repurchase program, which will be a boon for shareholders.

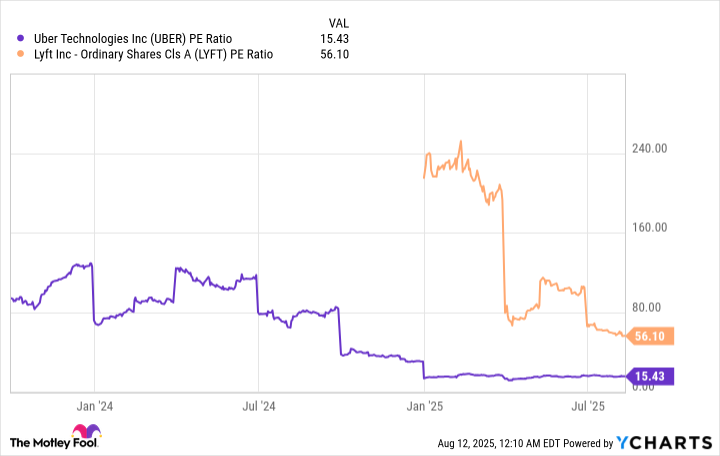

3. A compelling stock valuation

With the success Uber is seeing, it's no wonder the company's share price has gone up this year. And yet, Uber stock maintains a reasonable valuation.

This can be seen in the price-to-earnings (P/E) ratio, which tells you how much investors are willing to pay for a dollar's worth of a company's earnings.

Data by YCharts.

The chart shows Uber's P/E multiple is low relative to where it was in 2024 and earlier, indicating the stock is a better value now. Moreover, compared to the shares of competitorUber stock looks like a bargain.

Uber's promising future in autonomous vehicles, its outstanding financials, and its compelling share price valuation are just three of the reasons that make its stock a worthwhile long-term investment.

Its business is still growing, and there are more catalysts ahead. Consider the partnership it announced on Aug. 8 withto deliver the chain's household goods to customers. Uber has made significant strides in its business, and it looks like its best days still lie ahead.