Apple’s $500 Billion U.S. Investment Just Expanded—Time to Buy AAPL Stock?

Tech titan Apple just upped the ante—again. Its already-massive $500 billion U.S. investment just got bigger. But does dumping cash into Cupertino’s coffers make sense for your portfolio?

The bullish case: When Apple flexes, markets listen. This isn’t corporate virtue signaling—it’s a calculated bet on American infrastructure, talent, and tax breaks. The kind of move that makes Wall Street analysts swoon.

The bearish reality: Remember when ‘too big to fail’ meant something? Today’s mega-cap expansions often look more like financial theater than fundamental growth. But hey—at least those stock buybacks will keep the EPS machine humming.

Bottom line: Apple plays the long game better than most. Whether that justifies today’s premium? Well… there’s always crypto for the skeptics.

A $100 billion spending increase .... over four years

Last week, Apple claimed it would spend $600 billion in the United States. This is a large number, but it's also a bit misleading compared to other recent announcements from major tech companies such as. The parent company of Google is forecasting $85 billion of capital expenditures this year, with much of that going to artificial intelligence (AI).

Meanwhile, Apple's spending is over four years. The latest increase adds $25 billion in annual spending, bringing the grand total up from $500 billion to $600 billion. What's more, this includes various expenses such as employee salaries, data center buildouts, money paid to suppliers, and more -- it's not exclusive to capital expenditures. Other big tech peers are likely spending this amount or more if you cast as wide a net Apple does when calculating total spending.

The announcement may put Apple in good standing with the U.S. government, but it's not a radical change from management. The company is still doing the bulk of its manufacturing in China, and this new commitment only represents a slight deviation from its previously announced plans.

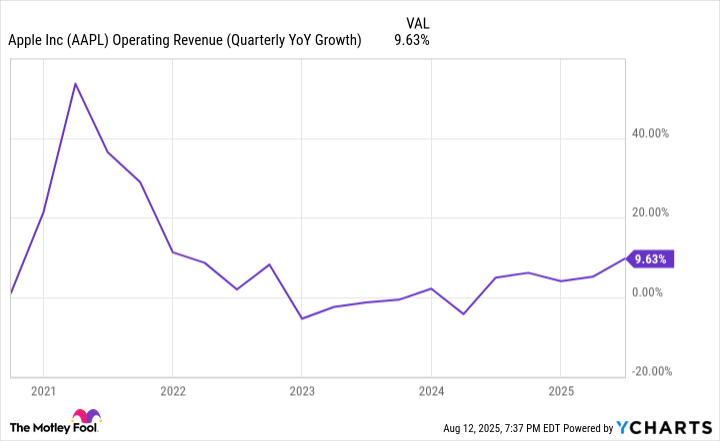

Data by YCharts.

Improving financial performance

Financial performance and earnings power are what matter for Apple stock. Last quarter, revenue growth hit its highest level since 2022, though it was still below 10% year over year.

The growth is coming from its software services division as well as the iPhone, the key drivers for the business over the last decade. iPhone sales showed strong growth but have posted many quarters of stagnation, which should worry investors. This is a mature product that has seen declining unit volumes and upgrade cycles for years.

Services revenue keeps growing quickly but is at risk of losing its cash cow Google Search payment if an antitrust lawsuit goes the wrong way. Apple receives an estimated $20 billion a year from Google to make it the default search engine, or about 15% of Apple's overall operating income. This could be wiped out overnight if the lawsuit doesn't work out for them.

Image source: Getty Images.

The big picture with Apple stock

In totality, Apple's announced spending plans may seem ambitious but are actually not a huge change from its long-term roadmap. It was already investing in component manufacturing in the United States, and this is just a modest increase in that context. The stock's 12% month-to-date gain may be fleeting as a result.

But should investors buy the stock today? Apple is the slowest-growing company among the "Magnificent Seven", outside of, which is grappling with declining sales. The others are putting up solid double-digit revenue growth quarter after quarter. Despite this slow growth, Apple stock trades at a premium to several of its peers on a price-to-earnings basis. Its P/E ratio of 35 is also significantly higher than that of theandindexes.

This leads me to believe that Apple is overvalued, especially following its recent gains from the $600 billion spending announcement.