$500 in The Trade Desk Stock 5 Years Ago? Here’s the Life-Changing ROI You Missed

The ad-tech darling that turned skeptics into believers—and pocketbooks into goldmines.

From spare change to serious gains

Five years back, dropping $500 on The Trade Desk (TTD) seemed like a gamble on programmatic ads. Today? That bet would’ve shredded the S&P 500’s returns—while Wall Street analysts were busy downgrading it.

Why the algorithms won

No media buyers. No gut feelings. Just cold, hard data targeting eyeballs across streaming platforms—while legacy ad agencies still faxed their PowerPoint decks.

The cynical kicker

Meanwhile, your financial advisor probably told you to ‘diversify’ into index funds. Oops.

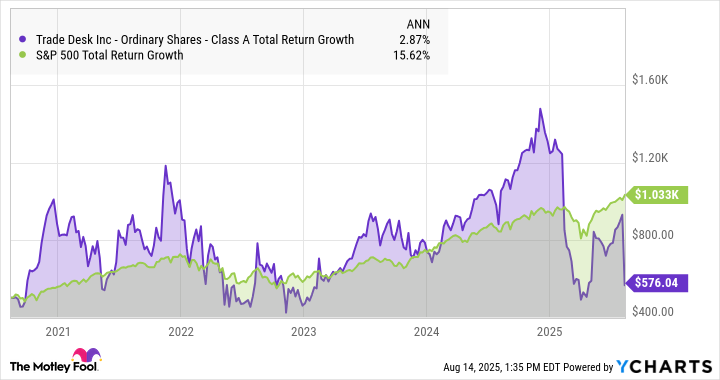

TTD Total Return Level data by YCharts

The(^GSPC -0.13%) market index more than doubled over the same period, in terms of total returns. That's an above-average compound annual growth rate (CAGR) of 15.6% versus The Trade Desk's anemic 2.9%.

Image source: Getty Images.

Silver lining of the reality check

These days, you can buy The Trade Desk's stock at a less outrageous valuation of 33 times free cash Flow and 9 times sales. If the stock price doubled today, the shares would still carry lower valuation multiples than Nvidia's 62 times free cash flow and 30 times sales.

Mind you, The Trade Desk is still far from a deep-discount value stock. These multiples are appropriate for a fast-growing business addressing a large target market.

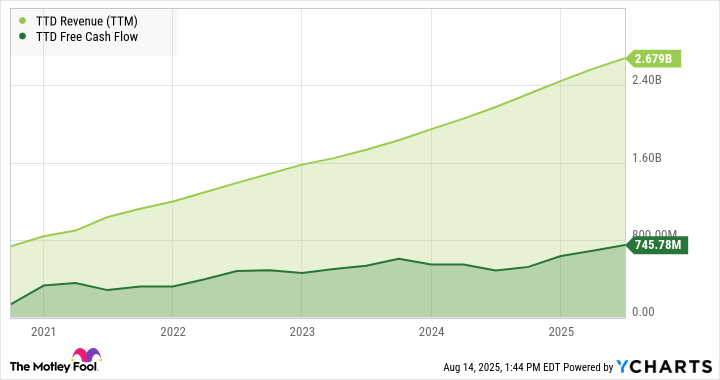

And I would argue that The Trade Desk fits that description. Its sales have been soaring for years, and free cash flows are richer than ever:

TTD Revenue (TTM) data by YCharts

The company's near-term outlook has been less bullish in recent quarters, but management still expects roughly 14% sales growth in the third-quarter report. This growth story is far from over. The 2025 stock price cuts simply made this top-notch company more affordable.