This Bold Vanguard ETF Bets Big—57.7% of Its Portfolio Is Riding the "Magnificent Seven" Wave

Wall Street’s latest love affair? A Vanguard ETF going all-in on tech’s high-flying elite.

Heavy hitters only

Nearly 60% of its holdings are parked in the so-called Magnificent Seven—because why diversify when you can YOLO on mega-caps?

The passive-aggressive playbook

Index funds preach ‘broad market exposure,’ but this one’s flirting with concentrated risk. Guess old habits die hard—even for the low-cost investing cult.

Final thought: If past performance guaranteed future results, we’d all be retired on Bitcoin beach by now.

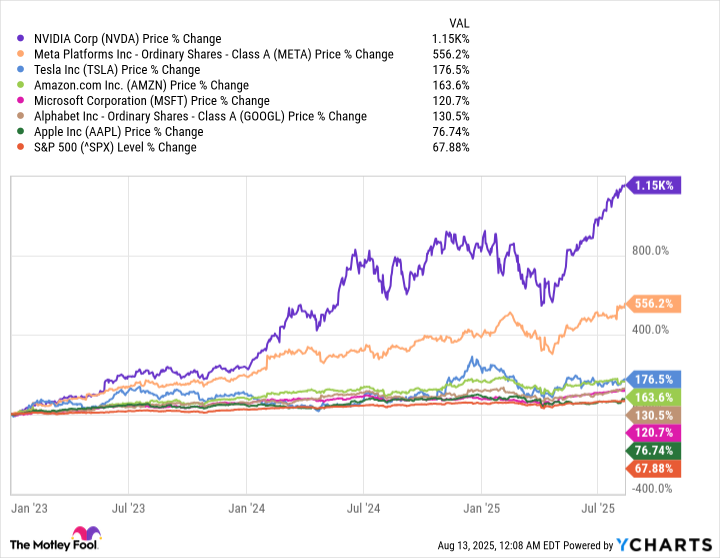

NVDA data by YCharts

In other words, investors who don't own the Magnificent Seven stocks are likely underperforming the broader market. Fortunately, there is a simple way to buy them all right now, with a splash of diversification from some of America's other stock market giants.

The(MGK -0.35%) is an exchange-traded fund (ETF) that invests exclusively in America's largest companies. It holds a portfolio of just 69 stocks, but it's highly concentrated with the Magnificent Seven representing 57.7% of its entire value.

Image source: Getty Images.

The Magnificent Seven are leading the AI race

The companies in the Magnificent Seven operate very different businesses, but they have one thing in common: They are betting big on AI right now:

Although the Magnificent Seven stocks represent 57.7% of the Vanguard ETF's portfolio by value, the other 42.3% includes several non-technology heavyweights like,,,,,, and more. In other words, the ETF does offer some diversification.

This ETF can supercharge a diversified portfolio

The Vanguard Mega Cap Growth ETF shouldn't be treated as a complete portfolio on its own, because its high degree of exposure to themes like AI can create significant risks. The Magnificent Seven stocks WOULD likely underperform the broader market for a period of time if AI fails to live up to expectations, which would weigh on the ETF.

But the ETF could supercharge a diversified portfolio of other funds and individual stocks. It has delivered a compound annual return of 13.5% since it was established in 2007, comfortably beating the average annual gain of 10.1% in the S&P 500 over the same period.

Had you invested $20,000 in the S&P 500 in 2007, it would be worth $113,032 today. But had you invested $10,000 in the S&P and the other $10,000 in the Vanguard ETF, your $20,000 would have grown to $154,222 instead. This strategy also would have smoothed out some of the volatility the Vanguard ETF experienced along the way as a result of its concentrated holdings.

Cathie Wood's Ark Investment Management predicts that AI will create a $13 trillion opportunity in the software industry by 2030, and on the hardware side, Nvidia CEO Jensen Huang says annual data center spending could top $1 trillion by 2028. Those forecasts suggest the AI revolution is still in the very early stages, so investors who don't have exposure to the Magnificent Seven stocks might want to consider buying this Vanguard ETF today.