This Ultra-High-Yield Dividend Stock Just Crushed 2025 With a 25% Surge—Here’s Why

Wall Street’s latest cash cannon is firing on all cylinders—and leaving bond yields in the dust.

While traditional investors chase meager 5% Treasury bills, this dividend juggernaut has already delivered a 25% price explosion in 2025. The kicker? Its monstrous payout makes fixed income look like pocket change.

The Yield Play That’s Beating the Market

Forget ‘safe’ assets—this stock is printing money while others count basis points. Ultra-high dividends? Check. Capital appreciation? Apparently that too. The only thing missing? An apology letter from your financial advisor for never mentioning it.

The Cynical Take

Of course, nothing screams ‘sustainable returns’ like a yield so high it could fund a small country. But hey—while the music’s playing, might as well dance… just don’t be the last one holding the bag when hedge funds flip the switch.

Price increases and cash flow

Altria holds the rights to the famed Marlboro cigarette brand in the U.S. It has employed a consistent strategy for decades to optimize cash flows from the shrinking cigarette category. In the face of consistent volume declines and waning demand from consumers in the country, Altria regularly raises prices on cigarettes, counteracting the volume declines.

Q2 numbers illustrate this dynamic. Altria's cigarette volume declined 10.2% year over year, while revenue net of excise taxes was flat year over year. Operating income still grew 4.4% for the smokeables category, which was helped by the cigars segment where the Black & Mild brand posted volume increases.

These price hikes are how Altria consistently increases its free cash flow. In the last 12 months, the company generated $8.7 billion in free cash flow, which is close to a record high (excluding a 2020 period of irregular inventory and working capital dynamics). As price hikes continue, Altria Group should see stable cash flows from the cigarette and smokeables division as a whole.

Image source: Getty Images.

Can nicotine pouches save the day?

Like the other nicotine giants, Altria Group has made investments into alternative nicotine categories such as vaping and nicotine pouches. Some of these have been successful, while others were wild failures, such as its investment in Juul vaping before the brand's collapse. Today, the company is showing growth with its On! nicotine pouch brand and NJOY vaping division.

On! volume grew 26.5% year over year last quarter to 52.1 million cans sold. However, this didn't even fully counteract the volume declines from chewing tobacco brands such as Copenhagen as overall oral nicotine volumes were down 1.0%. Oral nicotine revenue net of excise taxes was $728 million last quarter, or just 16% of the size of Altria's smokeables division.

Something that could affect Altria's growth going forward is a government crackdown on illicit vaping devices, which have flooded the U.S. market. These devices are technically illegal, but they're wildly popular and eat into sales for Altria's nicotine pouches, vaping products, and even cigarettes. A stricter regulatory environment could be a boon for volume growth across the business.

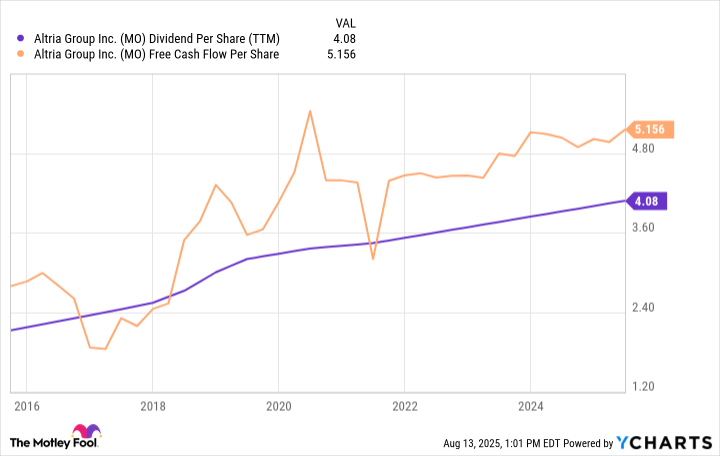

Data by YCharts.

The math behind the dividend growth

At the end of the day, cash flows from legacy smokeable products will continue to drive the business for years to come. With these cash flows, management returns capital to shareholders through share repurchases and dividends.

Altria's free cash FLOW per share was $5.16 over the last 12 months. This gives the company plenty of coverage for its $4.08 dividend per share payout to shareholders. With the excess cash accumulating on the balance sheet, management is retiring shares outstanding through stock buybacks, which will further boost free cash flow per share and help with future dividend growth. Over the last 10 years, Altria's shares outstanding have fallen 14%.

Price increases, margin expansion, and a little help from newer categories like nicotine pouches can help Altria maintain its overall free cash Flow levels, allowing Altria to sustain its streak of annual dividend increases. With a 6.2% yield, Altria Group still looks like a good dividend stock to buy today, even after its strong gains year to date.