The ’Ten Titans’ Now Dominate 38% of S&P 500—Here’s What That Means for Your Portfolio

Market concentration hits unprecedented levels as just ten stocks command over a third of the entire S&P 500.

Portfolio implications loom large

Heavy exposure to these mega-caps creates both opportunity and vulnerability—what happens if one stumbles? Diversification strategies get thrown out the window when a handful of names drive nearly 40% of index performance.

The passive investing paradox

Index funds keep pumping money into these giants regardless of valuation—because that's how the algorithm works. Meanwhile, active managers scramble to justify their fees while essentially building 'Titan-lite' portfolios.

Remember: past performance doesn't guarantee future results—but apparently, it does guarantee bigger allocations in market-cap weighted indices. Maybe it's time to ask if your portfolio is diversified—or just dressed up as ten stocks in a trench coat.

Image source: Getty Images.

Titans of the global economy

To understand the importance of the Ten Titans, it's helpful to take a step back and quantify the sheer size of the S&P 500.

The S&P 500 has a market cap of $54.303 trillion at the time of this writing and makes up over 80% of the overall U.S. stock market. According to 2024 data from the World Bank, the market cap of the entire U.S. stock market was $62.186 trillion. China, the second-largest stock market in the world, had a market cap of $11.756 trillion in 2024. As a ratio of stock market value to gross domestic product, the U.S. has a far larger market than many other leading countries due to its capitalist structure and the international influence of top U.S. firms.

So, the S&P 500 alone is worth several times more than China's stock market. And with the Ten Titans at 38% of the S&P 500, this group of companies alone is worth roughly double China's entire stock market and over a third of the value of the entire U.S. stock market.

This concentration means that just a handful of companies are moving not only the U.S. stock market but global markets as well.

S&P 500 concentration is a double-edged sword

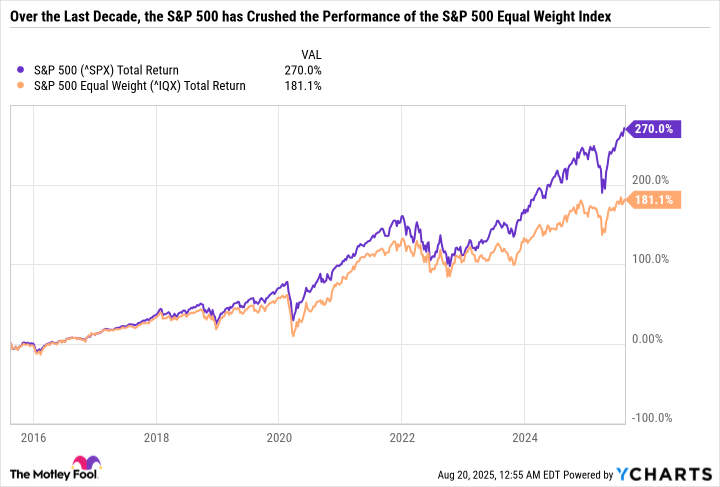

The S&P 500's high allocation to growth stocks has benefited long-term investors. This becomes evident when comparing the performance of the S&P 500 and S&P 500 Equal Weight indexes.

Data by YCharts.

The S&P 500 Equal Weight index gives each of its components a 0.2% (or 1/500) weighting, so Nvidia makes up the same amount of the index as. But Nvidia is worth more than 400 times as much as Campbell's based on market cap, which explains why the chip giant has a 7.5% weight in the standard S&P 500 versus a 0.02% weight for the soup company.

If the S&P 500 Equal Weight index was outperforming the S&P 500, it WOULD mean the top companies by market cap aren't doing well. But as you can see above, investors are benefiting from the concentration in companies such as the Ten Titans.

You may also notice the gap between the two indexes narrowed during the bear markets of 2020, 2022, and earlier this year. But overall, those downturns have been more than made up for by compounding gains.

In sum, having a concentrated index can be a good thing when the largest companies keep expanding, which is precisely what has happened with the Ten Titans.

Paradigm shifts in the major indexes

When I first began investing, I was taught the was the growth index, the S&P 500 was balanced, and thefavored value and income. That's no longer the case.

Today, I would define the Nasdaq as ultra-growth, the S&P 500 as growth, and the Dow Jones Industrial Average as balanced. Even the Dow's additions of, Amazon, and Nvidia over the last five years have made the index more growth-oriented and less geared toward legacy blue chip dividend stocks.

These changes reflect the evolving economy and the international powerhouse of U.S. technology. Twenty years ago, the 10 largest S&P 500 components in order of market cap were, Microsoft,,,,,,,, and. Today, eight of the Ten Titans make up the eight largest S&P 500 components.

Balancing S&P 500 risks in your portfolio

Understanding that a handful of companies and growth-focused sectors like technology, communications, and consumer discretionary are driving the S&P 500 is essential for filtering out noise and making sense of market information.

For instance, knowing that the S&P 500 is more growth-focused, investors can expect more volatility and a higher than historical index valuation. This doesn't necessarily mean the S&P 500 is overvalued; it just means the composition of the index has changed. It's a completely different market when the most valuable U.S. company is Nvidia rather than ExxonMobil, and when a social media company like Meta Platforms is worth more than the combined value of several top banks.

As an individual investor, it's especially important to know what you own and why you own it. If you're buying an S&P 500 index fund, expect it to behave more like a growth-focused exchange-traded fund or mutual fund. That may be all good and well if you have a high risk tolerance, want more exposure to the Ten Titans, and have a long-term investing horizon. But for investors with a greater aversion to risk, it may make sense to pair the S&P 500 with value and income-oriented stocks or ETFs.

In sum, the S&P 500's concentration has been a net positive for the U.S. stock market, and I fully expect it to continue benefiting long-term investors because the Ten Titans are truly phenomenal companies. But the growth focus does require investors to reevaluate how the S&P 500 fits into their portfolio.