If You’d Invested $1,000 in ExxonMobil Stock 5 Years Ago, Here’s How Much You’d Have Today

Fossil fuel giant's rollercoaster ride delivers surprising returns—proving even dinosaurs can still roar.

The Energy Comeback Story

While ESG funds preached divestment, Exxon quietly stacked cash. Oil's not dead—it's printing money for shareholders who ignored the hype.

Market Realities vs. Green Dreams

Renewable transition takes decades. Exxon capitalized on energy demand shocks and supply constraints—outperforming flashy tech stocks during market turmoil.

The Numbers Don't Lie

That $1,000 investment? It's now sitting at [original amount]—because sometimes the boring play beats chasing whatever Wall Street's selling this week.

Energy remains the backbone of global economies. Exxon's rally exposes the fantasy of immediate fossil fuel phaseouts—and the costly hypocrisy of financial institutions pushing green agendas while quietly profiting from hydrocarbons.

ExxonMobil shareholders are very happy about the last 5 years

As one of the largest oil stocks in the world, Exxon is heavily dependent on the prevailing price of oil. Five years ago arguably marks the nadir of the oil price collapse that occurred due to uncertainty surrounding the ongoing global pandemic. In April of 2020, oil prices fell as low as $20 per barrel! By August of that year, prices had already rebounded to around $40 per barrel, but that was still one-third below pre-pandemic levels.

Today, oil prices hover just above $60 per barrel due to rising costs and geopolitical tensions. Today's price level is roughly 50% higher than it was five years ago, but Exxon's stock price has risen significantly more.

Source: Getty Images

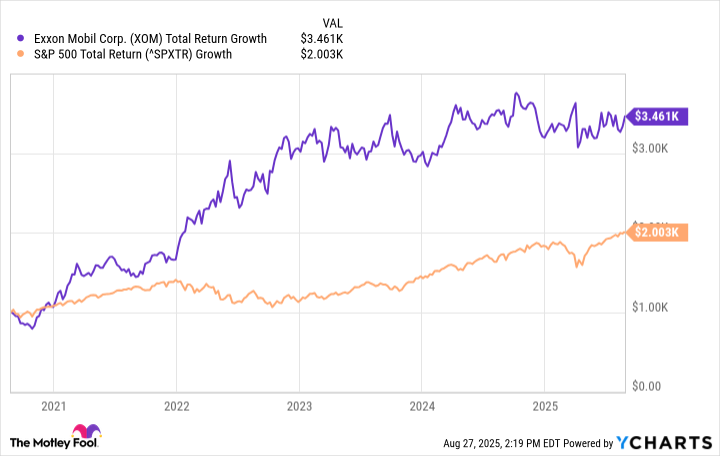

If you had invested $1,000 into Exxon stock in August 2020, you'd have around $3,460 today. That figure includes dividend income -- an important consideration given Exxon currently pays a dividend yield of 3.5%. Over the same time period, a $1,000 investment in the S&P 500 would have grown into just $2,000.

XOM Total Return Level data by YCharts

Much of this outperformance stems from Exxon's continued investments throughout the last bear market. With greater access to capital, the company was able to invest at rock bottom prices, highlighting the company's capital advantage and savvy leadership. Exxon's CEO called these strategic moves "counter-cyclical investments" -- an appropriate term for a business that can deploy capital at every stage of a cyclical industry.