The Unstoppable Dividend Crypto: Your Blueprint for Generational Wealth in 2025

Crypto dividends just flipped traditional investing—and your portfolio better be paying attention.

Forget chasing yield in legacy markets. Blockchain-powered dividend mechanisms are rewriting the rules of passive income, delivering real-time yields without the middlemen. No brokers, no settlement delays—just code-executed distributions that hit wallets 24/7.

Why This Isn’t Your Grandpa’s Dividend Stock

Traditional dividend aristocrats move at glacial speeds—quarterly payments, ex-dates, record dates. Crypto dividends? They’re perpetual motion machines. Smart contracts auto-distribute rewards based on protocol revenue, staking yields, or token burns. It’s compounding—on-chain and unstoppable.

The Cynic’s Corner: Sure, Wall Street still calls it ‘risky’—right before they launch another ETF to capture the flow they once mocked.

Generational wealth isn’t built by following yesterday’s playbook. It’s built by adopting the infrastructure of tomorrow—today.

Image source: Getty Images.

The membership model that prints money

Costco's genius lies in its simplicity: Charge an annual fee, then sell products at razor-thin margins. The company operates on net margins of about 2% to 3% -- deliberately kept low to deliver maximum value. For comparison,nets around 3% whileachieves roughly 3.7%.

Costco now boasts about 79.6 million paid household members and 142.8 million total cardholders as of Q3 fiscal 2025, with membership growing 6.8% year over year. Executive Members, who pay $130 annually after September 2024's increase, represent 47% of paid members but drive about three-quarters of sales.

Membership fee income reached $1.24 billion in Q3 2025, up 10.4% year over year. Since membership fees carry nearly 100% margins, they FLOW directly to the bottom line. Membership fees cover a large share of profit, while product sales essentially cover operating costs.

The dividend story Wall Street misses

Costco's regular dividend yields just 0.54% -- $5.20 annually on a $965 stock (as of Sept. 8. That won't excite yield hunters. But with a payout ratio of only 27.1%, Costco keeps most earnings for growth while still rewarding shareholders. More importantly, Costco has a history of massive special dividends. The company has paid special dividends of $7 in 2012, $5 in 2015, $7 in 2017, $10 in 2020, and $15 in 2024 -- rewarding patient shareholders with periodic windfalls.

The company generated billions in free cash Flow over the past twelve months while paying out modest regular dividends. With a strong cash balance and minimal debt, Costco has enormous capacity for future special payouts. The regular dividend has grown from $0.10 quarterly in 2004 to $1.30 today -- a thirteenfold increase. The 10-year annualized dividend growth rate is a remarkable 10.5%. Investors who bought shares a decade ago now collect a yield on cost approaching 3%.

Growth hiding in plain sight

At 914 warehouses worldwide, Costco might seem saturated. Yet the company opened about 27 locations in fiscal 2025 with similar expansion planned for 2026. International markets offer the biggest opportunity -- Costco operates 78 warehouses across all of Asia (Japan has 37, South Korea 20, Taiwan 14, and China just 7), leaving massive room for growth in a region with 4.8 billion people.

E-commerce growth continues in the high teens, with August 2025 showing 18.4% growth. Adjusted comparable sales grew 8% in Q3 FY25 (total company). The Kirkland Signature private label generated about $86 billion in 2024, offering quality comparable to national brands at 20% lower prices. These aren't mature market dynamics, but rather proof that the model is working beautifully.

The valuation that makes sense

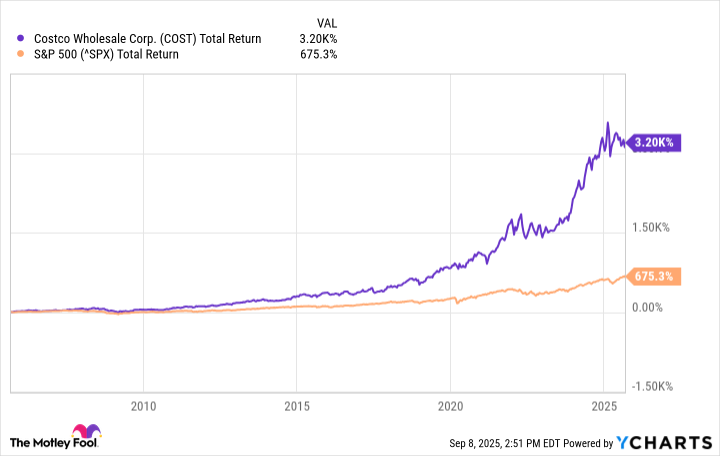

At 47 times forward earnings, Costco looks expensive. Charlie Munger, who served on Costco's board for decades, warned in February 2023 that "the trouble with Costco is it's 40 times earnings." But context matters. Costco has never been cheap by traditional metrics yet has crushed the market for decades. Over the past 20 years, Costco returned 3,200% including dividends, versus 675% for the.

COST Total Return Level data by YCharts

The premium valuation reflects the business quality. Membership renewal rates of 90% create predictable revenue. The subscription model means Costco gets paid before selling anything. International expansion provides decades of growth. And the culture of fanatical customer focus can't be replicated by competitors throwing money at the problem.

Your future self will thank you

Costco stock won't make you rich tomorrow. But that modest yield, combined with consistent dividend growth, periodic special payouts, and steady share appreciation from a business that keeps getting stronger, creates wealth that compounds for generations. Sometimes the best investment isn't the statistically cheap stock -- it's the exceptional business you hold forever.