Got $3,000? 3 Artificial Intelligence (AI) Stocks to Buy and Hold Forever

AI Revolution Ignites Market Frenzy—Here's Your $3,000 Playbook

Forget Traditional Picks—These AI Titans Dominate Tomorrow's Landscape

Nvidia's chips power the entire machine learning ecosystem—data centers can't get enough. Microsoft's Azure AI platform captures enterprise clients at record pace. Tesla's autonomous driving data moat grows deeper every quarter.

Wall Street analysts keep chasing last quarter's winners while these AI foundations print cash. The smart money builds positions during hype cycles—not after.

Deploy that capital before mainstream investors realize AI isn't just another buzzword. Your future self will thank you.

Image source: Getty Images.

1. Taiwan Semiconductor Manufacturing

On the outskirts,(TSM 4.58%) -- also known as TSMC -- may not seem like an AI company, but it's just as important to advancing the technology as virtually any other participant. TSMC is a semiconductor (chip) foundry that manufactures chips for a wide range of applications, including smartphones, electric vehicles, game consoles, TVs, and graphics processing units (GPUs). The latter is why it's important to AI.

TSMC's AI role comes down to manufacturing the critical chips that go inside the data centers that train AI models. It has around a 70% market share in the global foundry industry, but when it comes to the advanced AI chips, it's virtually a monopoly. This new demand is largely why its high-performance computing (HPC) segment accounted for 60% of its total revenue in the second quarter.

TSMC is the start of the AI pipeline. Without it, companies likeandwouldn't be able to ship their AI chips at their current scale. TSMC expects AI-related revenue to double this year.

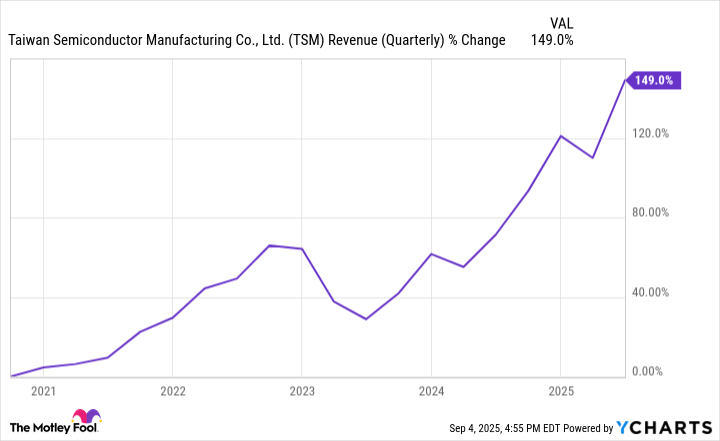

TSM Revenue (Quarterly) data by YCharts.

AI aside, TSMC's role in the tech ecosystem has made it indispensable. It's not as if there aren't other semiconductor foundries; they just don't compare to TSMC's effectiveness and scale. This position makes it a company that should be successful for quite some time.

2. Alphabet

Google's parent company(GOOG 0.41%) (GOOGL 0.34%) is also a key piece to the AI ecosystem, especially when it comes to research. It's responsible for key breakthroughs that have advanced the technology to where it is today.

Alphabet's Google Cloud also continues to grow impressively. In the second quarter, its revenue increased 32% year over year to $13.6 billion, leading all of Alphabet's segments. Having a strong in-house cloud platform allows the company to power and scale its own AI models.

It's not just for in-house use, either. It's a service that many companies can rely on, including, which just signed a six-year, $10 billion deal to make Google Cloud its main AI infrastructure provider. The co-signing by Meta shows that even Alphabet's big-name peers (and competitors) trust its capabilities.

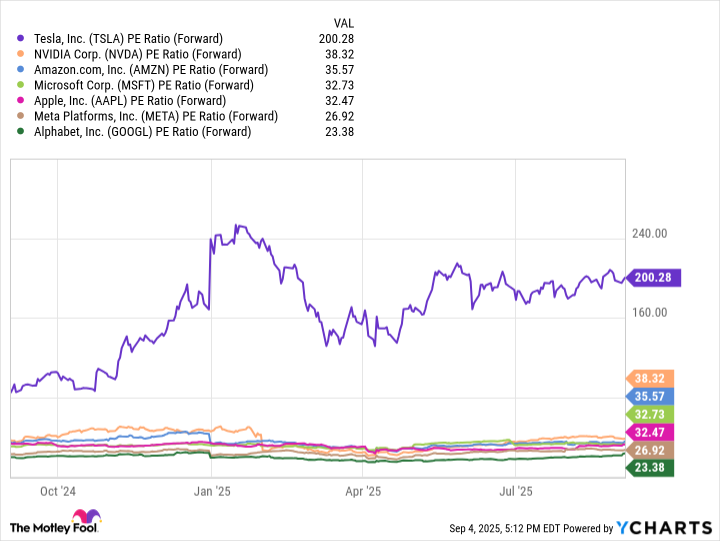

It also helps that Alphabet's stock seems to be valued cheaply right now. It's trading around 23.4 times expected earnings over the next 12 months, which is the lowest of the "Magnificent Seven" stocks, by far. If you're buying and holding onto the stock for the long term, this will likely work out well in your favor.

TSLA PE Ratio (Forward) data by YCharts.

3. Microsoft

Some tech companies excel at one thing, while others do a few things pretty well.(MSFT 0.74%) is one of the handful that does a lot of things extremely well. It has its hands in many industries and is a top player in virtually all of them.

Similar to Alphabet, Microsoft has a cloud platform (Azure) that allows it to be a key piece of AI infrastructure. It also has a long-term partnership with ChatGPT's creator OpenAI, which gives it direct and early access to industry-leading AI technology.

This is a key advantage for Microsoft because it allows it to integrate the technology into its ecosystem of products and services. Microsoft has Office software (Excel, PowerPoint, Teams, etc.), Windows operating systems, GitHub, and many other platforms, and all of these stand to gain from AI integration.

Microsoft already has a stronghold on enterprise software, which should only increase its value proposition as these products and services become more efficient. If you're going to be in the tech world for the long term, it helps to have corporate customers because they spend more, tend to have longer contracts, and are less likely to cut back on services whenever the economy isn't ideal.

Microsoft is a staple in the business world that thousands of companies rely on for their daily operations. If I had to pick one Magnificent Seven stock to hold onto for life, it WOULD be Microsoft.