Is NuScale Power Stock a Buy Now? The 2025 Investor’s Guide to Nuclear Innovation

Nuclear energy's comeback kid just hit the radar—and Wall Street's taking notes. NuScale Power's modular reactor technology represents the most significant atomic innovation in decades, promising cleaner energy with smaller footprints and smarter scalability.

The Regulatory Landscape Shift

Recent policy tailwinds favor advanced nuclear deployment. The 2025 Energy Act provisions create unprecedented incentives for next-generation reactors—NuScale stands positioned to capitalize.

Financial Reality Check

While the technology dazzles, execution risk remains. The company burns cash like reactor fuel—typical for pre-revenue tech plays—but the potential payoff could redefine energy infrastructure.

Market Timing Considerations

Energy transition portfolios increasingly demand nuclear exposure. NuScale offers pure-play access to modular nuclear growth—if you believe the hype over the current financials.

Bottom Line: Speculative Growth Play

This isn't for risk-averse investors. But for those betting on nuclear's renaissance? NuScale represents the sharp end of the spear—just don't bet the retirement fund until they actually generate revenue.

NuScale's modular reactors are a promising nuclear technology

After cooling off for several years following the Fukushima disaster in 2011, many countries see nuclear power as a key source of energy to help reduce carbon emissions and meet the growing energy demand from data centers. As of last year, 31 countries have signed a pledge to triple nuclear energy capacity by 2050.

NuScale hopes to play a key role in nuclear power's resurgence. NuScale's Core offering, the NuScale Power Module (NPM), is a modular, scalable electric light-water reactor. It can be scaled from one to 12 modules in a single installation, offering customers the flexibility to rightsize their initial investment and expand capacity over time.

NuScale's technology leverages existing light water nuclear reactor technology and conventional low-enriched uranium fuel, which has been in use for over 60 years globally. This contrasts with many other advanced reactor designs that require High-Assay Low-Enriched Uranium (HALEU) fuel, which currently lacks a commercial supply chain and faces national security concerns, potentially delaying commercialization by a decade or more for others.

Image source: Getty Images.

What's next for NuScale?

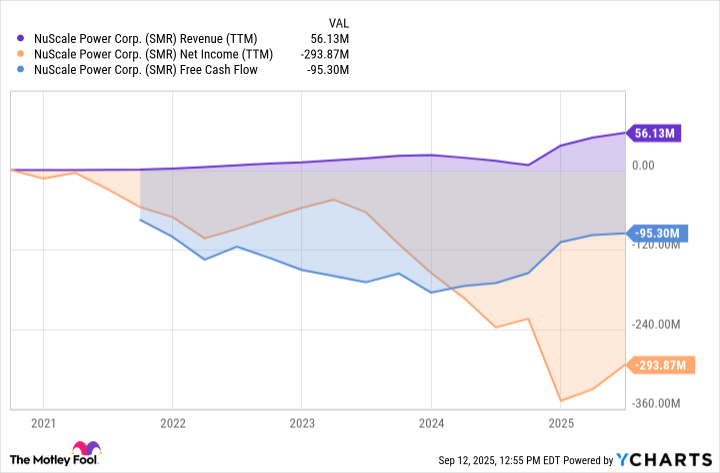

NuScale doesn't have any commercial products at the moment and isn't generating any revenue from operations yet.

The company is currently performing front-end engineering work for RoPower's 462-megawatt-electric (MWe) power plant in Romania, which is planned to house six NPMs at the site of a decommissioned coal-fired power plant in Doicesti. The RoPower project is currently generating revenue for NuScale through engineering and licensing fees, as well as precommercial operation services. The company hopes this plan is commercially operable by 2030.

Keep a close eye on its finances

NuScale anticipates an increase in operating expenses in the second half of 2025 as it continues to invest in its supply chain and manufacturing readiness in anticipation of commercial contracts.

NuScale aims to maintain approximately two years of operating cash runway and hopes to extend this runway with a major contract. The company currently has $421 million in cash and short-term investments. It has historically incurred significant operating losses.

SMR Revenue (TTM) data by YCharts

Management believes current cash resources are sufficient to cover research and development, along with operating cash needs, for the next 12 months. Still, it acknowledges that additional funds may be required in future years. This could lead to equity raises that ultimately dilute the company's shareholders.

The most immediate and critical item to watch for is the announcement of a firm customer order by the end of 2025, particularly from one of the U.S.-based customers in advanced discussions. This WOULD be pivotal in validating NuScale's product while also providing it with some much-needed cash.

Is NuScale a buy?

I'm keeping a close eye on NuScale and its NPM technology, as it could play a key role in addressing the United States' growing demand for clean energy over the next several decades. The technology has great potential to provide energy independently to data centers, industrial warehouses, or other operators.

With that in mind, it will be several years before the company has a commercial product that produces steady revenue. In the meantime, it will continue to incur costs as it looks to build out its RoPower facility and add more clients. For this reason, I think most investors should avoid the stock for the time being.