Why Coupang Stock Isn’t Getting Nearly Enough Investor Attention

Coupang's flying under the radar—and that might be your edge.

South Korea's e-commerce titan keeps delivering staggering growth while Wall Street snoozes. The 'Amazon of Korea' narrative? Underplayed. Their logistics network? Outpacing global competitors with frightening efficiency.

Rocket Delivery isn't just a slogan—it's a operational moat most rivals can't cross. Same-day delivery covering 70% of the population? That's not logistics; that's market domination in real-time.

Financials whisper 'growth story,' but the street's still chasing crypto memes and AI hype. Coupang's scaling profitability while tech darlings burn cash—but sure, keep betting on metaverse real estate.

Here's the kicker:当他们还在讨论“下一个亚马逊”时,Coupang已经在成为第一个Coupang的路上狂奔——而市场居然还没定价这一点。

Image source: Getty Images.

"The Amazon of South Korea"

Admittedly, referring to companies as "the Amazon of" something has become clichéd. That said, the strategies that Coupang has followed make this comparison extremely apt.

For starters, Coupang has built itself into the top player in the South Korean e-commerce market.

In the second quarter, Coupang boasted nearly 24 million product commerce active customers. That's nearly half of South Korea's population of approximately 52 million. Millions of items are available for same-day, early morning, and next-day delivery, and for customers, the process for returns is as simple as leaving the product they want to send back outside their door for pickup.

For a monthly fee, customers can join Coupang's Rocket Wow membership program, which provides additional benefits like meal delivery, streaming content, and a payment system that's built into the company's app. The similarities between Rocket Wow and Amazon Prime are obvious.

Logistics at the core

Coupang claims it can deliver 99% of its Rocket Delivery orders to its Korean customers within 24 hours, and among its services, it delivers fresh food to people's doors by 7 a.m. the day after it's ordered.

It achieved those impressive delivery capabilities by building an expensive, but comprehensive, logistics operation. And it's not done. Coupang is spending another $2.2 billion to further expand its reach by 2027. When that build-out is complete, the company will be able to deliver orders overnight to approximately 88% of South Korea.

This logistics advantage also benefits its third-party sellers, and it widens Coupang's moat, making it more expensive and difficult for competitors to win market share away from it.

Achieving profitability

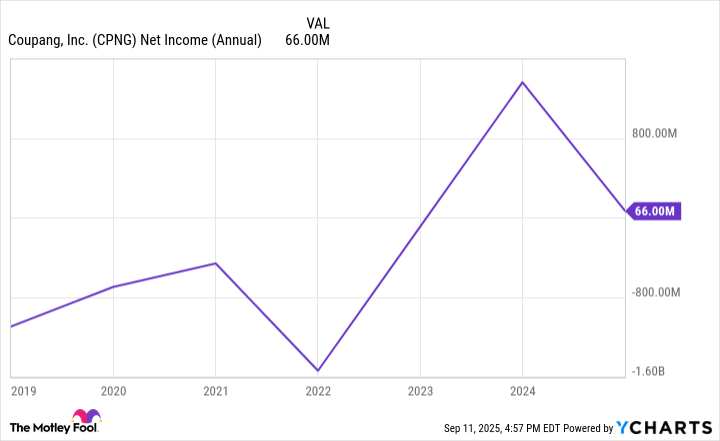

As one might imagine, the company's focus on building its massive logistics network has weighed down its bottom line: Coupang posted net losses in each of the first three years after it went public. But in 2023, its bottom line turned positive.

CPNG Net Income (Annual) data by YCharts.

Analysts' consensus estimates call for this profitability trend to continue, which is important because Coupang isn't done expanding. Management is now focused on expanding into Taiwan, and spending heavily on building its offerings there. This has paid off so far: Coupang reported triple-digit percentage revenue growth year over year in Taiwan in Q2.

Valuation concerns

Thanks to Coupang's strong results, the stock is trading at a premium valuation of 1.8 times trailing sales, which is well above its 3-year average. However, management has pointed out that its growth arc in Taiwan so far looks similar to what it experienced early on in South Korea. If it can continue to grow its operations in that new market in the same way that it did in its home market, the stock WOULD be reasonably priced at today's valuation.