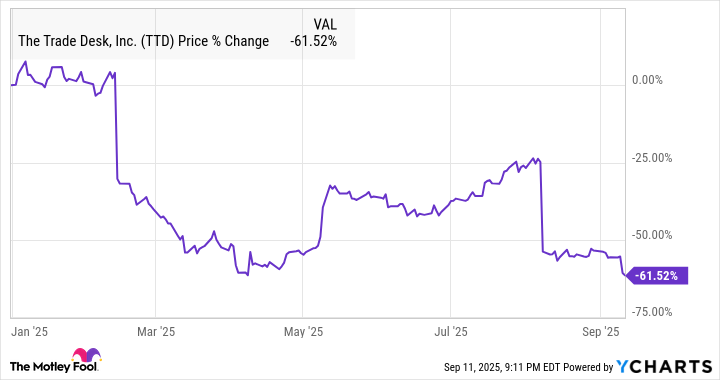

The Trade Desk Plunges to Become 2025’s Worst S&P 500 Performer—Buying Window or Major Red Flag?

The ad-tech giant just hit a brutal milestone—dead last in the entire S&P 500 this year. No sugarcoating it: investors are running for the exits.

What Went Wrong?

Supply chain headaches, privacy regulation pressures, and a brutal macro environment slammed growth projections. The stock's bleeding—no sign of a bandage in sight.

Opportunity or Trap?

Bargain hunters are circling. They see oversold conditions and a long-term play on digital advertising. But let's be real—catching a falling knife requires nerves of steel (or a serious disregard for risk).

Wall Street's Take

Analysts are split. Bulls argue innovation and market position justify patience. Bears see structural headwinds and whisper 'value trap.' Typical finance flip-flopping—nobody wants to be wrong alone.

Bottom Line: High risk, potential reward. Or just... high risk. Your move.

Data by YCharts.

Let's review the challenges facing The Trade Desk before discussing whether or not the stock is a buy.

Image source: Getty Images.

What's ailing The Trade Desk?

When The Trade Desk plunged in February, it was the first time in its publicly traded history that the company had missed its guidance.

CEO Jeff Green admitted that on the earnings call, and explained it wasn't due to competition or new technology, or any significant change like that. The Trade Desk just had a few internal errors, or what Green called "a series of small execution missteps." However, he attempted to reassure investors, saying, "We see a larger and faster-growing market than we originally expected."

The company's first-quarter earnings report in May reassured investors as revenue growth accelerated again, but the stock then plunged again as the company posted its slowest quarter of growth in its history (just 19%), with the exception of the beginning of the pandemic.

For the third quarter, it called for revenue growth to slow to at least 14%, though it WOULD be 18% adjusting for the decline in political ad spend. This time around, Green cited headwinds from tariffs on some of its biggest customers and downplayed the threat from Amazon, which has made more investments in its DSP.

The stock received several analyst downgrades on the report as its growth is decelerating even as digitial advertising growth is strong at industry leaders like Meta Platforms, key verticals like Connected TV (CTV) are maturing, and increasing competition from alternatives like Amazon.

Is The Trade Desk a buy?

Following the earnings report,ended its exclusivity deal with The Trade Desk for advertisers using its shopper data, according to The Information, and it was later hit by the news of the Amazon-partnership, allowing Netflix ad inventory to be purchased through Amazon's DSP.

Despite Green's efforts to reassure investors, there's not much reason to be positive about The Trade Desk right now. Its growth rate seems to have fallen below 20% for good, and its underperformance relative to the rest of the digital advertising market is notable.

It's not fully clear what's pressuring the company, though competition appears to be a factor, as does the dominance of walled gardens, which are continuing to perform well.

The Trade Desk has become more attractive on a valuation basis as the stock has fallen, trading at a price-to-earnings ratio of just 26 based on adjusted earnings per share.

However, The Trade Desk stock could head lower if its growth continues to decelerate. The company has a long history of delivering results, and it should eventually be able to recoup some of its recent losses, but patience seems like the best approach at this point for would-be buyers.