Prediction: 3 Stocks That’ll Be Worth More Than Apple 5 Years From Now

Forget AAPL—these three disruptors are positioning to eclipse the tech giant's market cap by 2030.

Tech's Next Titans

While Apple battles smartphone saturation and regulatory headaches, emerging players in AI infrastructure, quantum computing, and decentralized finance are scaling at breakneck speeds. Their secret? Building markets that don't yet exist—instead of fighting for slices of stale pies.

The Valuation Leapfrog

One quantum startup's patented photonic chips already process data 1000x faster than classical systems—attracting defense contracts worth billions. Another's AI-as-a-service platform just onboarded 47 Fortune 500 clients in a single quarter. The third? It's tokenizing real-world assets on-chain while traditional finance still debates blockchain use cases.

Wall Street's Blind Spot

Analysts obsessed with price-to-earnings ratios keep missing the narrative shift. These companies aren't selling products—they're selling new economic paradigms. Their growth curves resemble vertical lines while Apple's looks increasingly… horizontal.

Betting against the iPhone maker feels blasphemous—until you realize innovation cycles always favor the insurgents over the incumbents. The next trillion-dollar club won't wear black turtlenecks.

Image source: Getty Images.

This trio has AI upside that Apple does not

To say that Apple has stumbled in its artificial intelligence (AI) rollout is an understatement. Apple is far behind its competitors in this sector, and it may lose some smartphone market share if it doesn't quickly correct its course. While there hasn't been a defining AI feature that separates Apple from others quite yet, it may be on the horizon and could cause significant headwinds for Apple.

This trio is openly embracing the AI arms race, unlike Apple.

Alphabet is the parent company of Google, which has already evolved its search engine to include AI search overviews: integrated generative AI alongside a traditional search experience. It also has a leading generative AI model Gemini, which continues to perform quite favorably compared to other generative AI models that outperformed it at the start of the AI arms race.

Alphabet is also profiting from massive AI build-out thanks to its cloud computing division, Google Cloud. Alphabet is renting its computing capacity out to many AI companies, including OpenAI and, causing impressive growth for this division.

Amazon is in a similar boat to Alphabet, as its cloud computing division, Amazon Web Services (AWS), is also experiencing massive demand for AI. AWS is a significant part of Amazon's business, accounting for 53% of total operating profits despite comprising just 18% of total sales. AWS grew revenue 17% year over year in Q2, and while that's not nearly as fast as Google Cloud's 32%, AWS is also a much larger business, so achieving rapid growth rates is challenging. Still, there are significant tailwinds blowing in favor of cloud computing, and Amazon is well positioned to benefit.

Lastly is Broadcom, which has a long way to go to overcome Apple's head start. Its $1.7 trillion market cap is about half of Apple's, but it has the biggest growth tailwind of these businesses. Broadcom is heavily involved in the computing side of the AI arms race, manufacturing networking switches (which are necessary to stitch together information across multiprocessor devices) and custom AI chips.

Broadcom is working with end users (like Alphabet's Google Cloud) to design purpose-built computing hardware. This eliminates the middleman and enables them to tailor the chips to specific workloads, rather than relying on a broad computing device like a GPU. Broadcom's revenue is rapidly accelerating, and it could easily overtake Apple over the next few years.

What is required to overtake Apple?

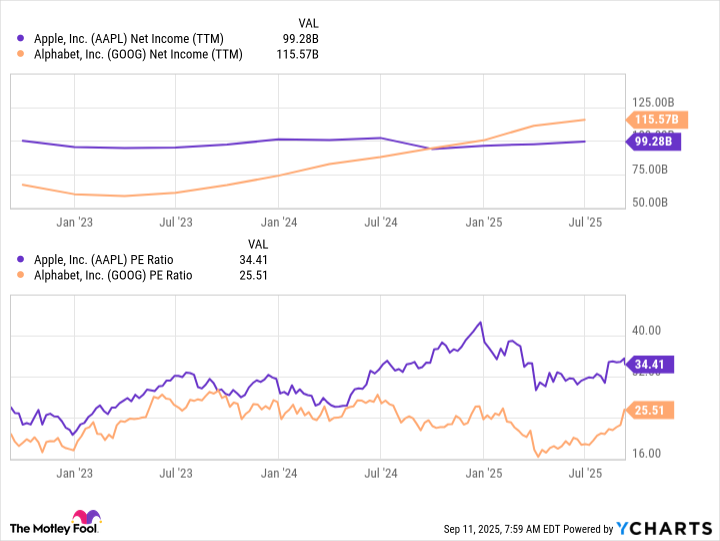

Each company has a different way to overtake Apple's valuation. For Alphabet, it's simple: Be on a level playing field. Alphabet generates more net income than Apple does already, so if these two had the exact same valuation, Alphabet WOULD already be worth more.

AAPL Net Income (TTM) data by YCharts

Considering Alphabet is growing faster and Apple appears to be overvalued, I wouldn't be surprised to see Alphabet pass Apple much quicker than just five years.

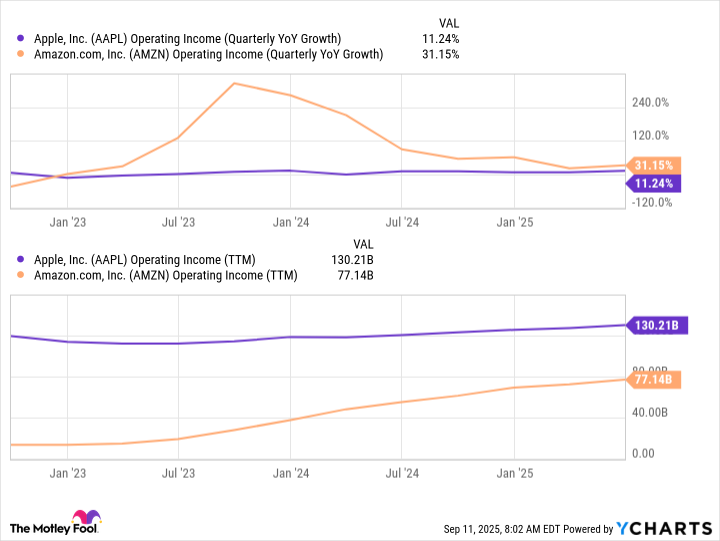

Amazon needs to continue growing its profits rapidly, which it's doing thanks to outsized growth from its high-margin divisions (like AWS and advertising services). If Amazon can maintain its impressive operating profit growth rate, it will likely surpass the point where it generates greater profits than Apple.

AAPL Operating Income (Quarterly YoY Growth) data by YCharts

Lastly, Broadcom has a steep uphill climb to surpass Apple, but its rapidly growing AI division could do that. In Q3 FY 2025 (ended Aug. 3), Broadcom's AI-related revenue increased 63% year over year to $5.2 billion. That's about a third of Broadcom's total revenue, but if it maintains that growth trajectory, Broadcom can easily outgrow Apple over the next five years to become a larger business.

I think all three stocks can be worth more than Apple by 2030, and each will be a strong investment along the way.