This Stock Skyrocketed 467% in 2025 - Meet the Game-Changing New CEO Driving the Momentum

Wall Street's latest rocket ship just got a new pilot at the helm.

Leadership Shakeup Sparks Fresh Optimism

The company's board taps industry veteran with proven track record—because nothing says confidence like changing captains mid-moon mission. Markets respond with typical euphoria, ignoring how most CEO announcements generate more press releases than actual value.

From Obscurity to Market Darling

That staggering 467% surge isn't just luck—it's a masterclass in riding the bullish wave while traditional finance dinosaurs still debate whether digital assets are 'real'. The stock's performance leaves legacy institutions scrambling to explain how they missed the boat.

Fresh Blood, Familiar Hype Cycle

The new CEO steps into a spotlight already blinding with investor expectations. Another charismatic leader promising disruption—because if there's one thing Wall Street loves more than profits, it's a good narrative to justify those P/E ratios.

When your stock climbs 467% in months, you could appoint a golden retriever as CEO and analysts would still call it 'strategic vision'. But this time, they might actually be right.

Image source: Getty Images.

In the same announcement as Nejatian, Opendoor also announced changes to its board of directors. Keith Rabois and Eric Wu, co-founders of the company, are returning to the board, along with Nejatian.

Opendoor is clearly remaking its entire management team. Is this something that continue propelling the comeback story for Opendoor stock?

How Opendoor makes money

Opendoor's business model is commonly called iBuying -- it gives sellers a cash offer for their home and then, once the offer is accepted, it makes necessary repairs before reselling. Therefore, it must find good deals and MOVE fast to make a profit.

It's true that Opendoor has other ways of making money. The company allows sellers to get a cash offer, but still work with an Opendoor-affiliated agent to try to get a better offer elsewhere. It also has an online marketplace and provides title and escrow services. But the vast majority of revenue comes from selling the houses it directly owns.

Opendoor's business model fights an uphill battle when it comes to profitability. When housing is hot, it's hard to find a deal. The company is more APT to get a good deal when the housing market cools down. But a cooler market means that it can hold on to a house longer than hoped. And when that happens, there are holding costs that hinder profitability.

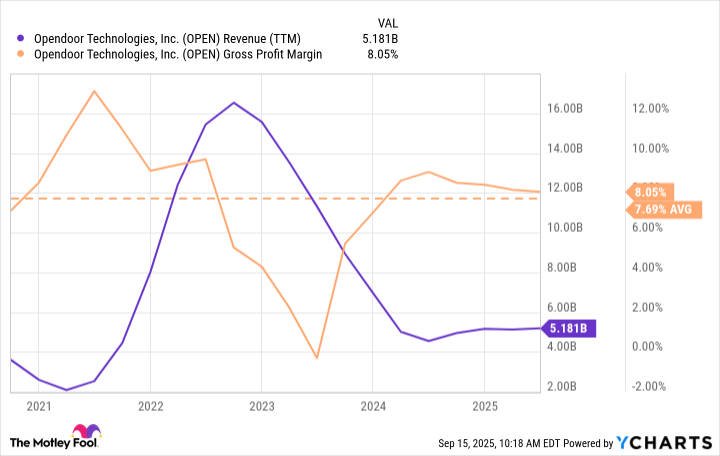

As the chart shows, Opendoor's gross profit margin has only averaged 8% since going public several years ago. That doesn't leave much to work with when it comes to paying its operating expenses.

OPEN Revenue (TTM) data by YCharts

This is why Opendoor hasn't reported positive operating income on a trailing-12-month basis since going public.

Hold on to your iBuying hats

There's new management in town for Opendoor, and it's not business as usual. Big changes could be coming down the pipe.

Rabois is the new Opendoor chairman, and he's wasted no time saying that most of the company's workers aren't needed. He believes that perhaps 85% of employees can be let go. Even assuming he's 100% correct, this will take some time and money to implement.

According to Rabois, the problem with Opendoor's profitability has nothing to do with buying and selling homes. Indeed, he seems to believe that the business model is fine. By contrast, he views general and administrative (G&A) expenses as the real culprit -- these are expenses related to corporate overhead. As COO, Nejatian helped Shopify lower its G&A expenses as a percentage of revenue, and Rabois believes he can do the same for Opendoor.

Both Rabois and Wu also believe that Opendoor needs to innovate, which is another reason to bring in Nejatian. He led a team building products at Shopify, and Opendoor's board hopes that he can do the same at Opendoor after several years of innovation drought at the company.

In other words, Opendoor got new management and now enters a season of change, both from a head count and product perspective.

Is Opendoor stock a buy?

Lowering expenses is always helpful when profits are missing. But if I may gently push back against Rabois' assessment of G&A, this line accounted for less than 4% of Opendoor's revenue in 2024 and less than 3% in the first half of 2025. That's actually lower than Shopify.

Moreover, even if Opendoor were somehow magically able to run its business with zero G&A expenses, it WOULD still have negative operating income. Therefore, it seems that improving its gross margin is the real key to unlocking profitability.

The iBuying business model is hard, and I would say gross margin improvement is easier said than done. For this reason, I wouldn't buy Opendoor stock today.

Perhaps product innovation can deliver margin improvements for Opendoor, and I hope that's the case. But it will take time and money to deliver these changes for shareholders, so I'll patiently watch and wait from the sidelines for the time being.