Undervalued and Ignored: This Artificial Intelligence (AI) Stock Has Massive Room to Run in 2025

Wall Street's sleeping on an AI gem while chasing crypto hype—here's the real intelligence play they're missing.

The Hidden AI Powerhouse

While retail traders pile into meme coins and overhyped tech stocks, one AI company quietly builds revolutionary machine learning infrastructure. Its algorithms process data 40% faster than legacy systems—yet trades at a fraction of big-tech valuations.

Institutional Blind Spots

Major funds overlook this stock because it doesn't fit clean AI narratives. No flashy robot demos, no chatbot hype—just pure computational advantage that's already landing Fortune 500 contracts. Meanwhile, hedge funds pour billions into AI tokens with zero revenue.

The Execution Edge

This company delivers real-world AI solutions while competitors promise metaverse integrations. Its clients report 30% operational improvements—actual results, not speculative roadmaps. The stock's momentum suggests smart money's finally noticing.

Watch this space: When traditional finance wakes up to real AI value—not just buzzwords—this stock could mirror crypto's best rallies without the volatility.

Image source: Getty Images.

AI adoption in the cloud contact center market is accelerating this company's growth

(TWLO 1.49%) stock trades down about 5.5% so far in 2025 as of this writing. For comparison, the tech-focused(^IXIC -0.33%) is up 15.7% so far this year. The stock's weak performance explains why it can be bought at an attractive 3.4 times sales right now, which represents a discount to the Nasdaq Composite's price-to-sales ratio of just over 5.

What's more, the cloud communications specialist's forward earnings multiple of 19 is also quite attractive when factoring in its healthy growth rate. Twilio is known for its application programming interfaces (APIs) that allow businesses to use various communications channels, such as voice, email, text, chat, and video to get in touch with their customers. It has been integrating AI tools into its offerings.

Twilio's APIs have replaced traditional contact centers, wherein customer service agents used to receive or make phone calls while sitting in offices. Instead, customer service associates simply need an internet connection, a computer, and relevant APIs to carry out their tasks. What's more, the integration of APIs helps businesses automate their marketing campaigns, improve customer support, and support sales functions.

And now, Twilio's AI-focused tools are helping its clients automate customer support functions, transcribe interactions to gain better customer insights, provide agents with real-time suggestions to improve customer service experience, and send personalized messages to customers to improve conversions, among other things. The good part is that its AI push is generating results.

Twilio's Q2 revenue jumped 13% year over year to $1.23 billion. That was a marked improvement over the 4% growth it recorded in the year-ago period. Additionally, Twilio's non-GAAP (generally accepted accounting principles) earnings increased by 37% year over year to $1.19 per share. The company benefited from an increase of 10% in its active customer accounts last quarter, as well as a jump of six points in the dollar-based net expansion rate to 108%.

The higher expansion rate suggests that Twilio's existing customers are spending more on its solutions, and that can be attributed to the increased cross-selling opportunities its AI tools are opening for the company. Importantly, the contact center market is expected to grow almost 5x in size by 2030 as compared to 2023 levels, generating close to $150 billion in revenue at the end of the forecast period.

Twilio, therefore, seems built for healthy growth in the long run. Also, the potential acceleration in the company's earnings on account of its improving customer base, as well as the higher spending by existing customers, could lead the market to reward it with a higher valuation, paving the way for a jump in its stock price.

Twilio stock has solid upside potential

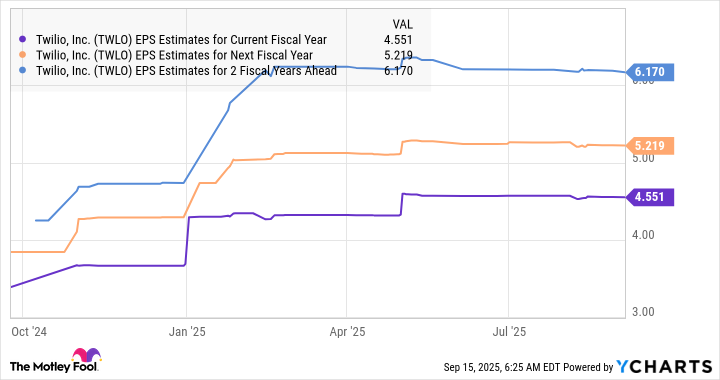

Twilio's 12-month median price target of $132, per 32 analysts covering the stock, indicates that the stock could jump 29% in the coming year. However, it can do better than that. We have already seen that Twilio's earnings increased at a remarkable pace last quarter. Looking ahead, it can sustain that momentum thanks to the reasons discussed, which explains why analysts are expecting its bottom-line growth to accelerate.

Data by YCharts.

Assuming Twilio can live up to consensus estimates and deliver $6.17 per share in earnings in 2027, its stock price could hit $163 at a forward earnings multiple of 26.4 (in line with the tech-ladenindex's forward earnings multiple, using the index as a proxy for tech stocks). Twilio, therefore, has the potential to deliver 60% gains within the next two years.

That's why investors WOULD do well to buy this underrated AI stock before it steps on the gas.