Why Vanguard Value Index ETF Might Be Your Smartest Move in Today’s Volatile Market

Value investing makes a roaring comeback as growth stocks stumble—Vanguard's flagship ETF leads the charge.

Market Shifts Favor Value Plays

Traditional valuation metrics suddenly matter again. Investors flock to stable cash flows and reasonable multiples after years of chasing speculative growth. The Vanguard Value Index ETF positions itself as the purest play on this renaissance.

Institutional Money Rotates

Pension funds and asset managers quietly rebalance toward value strategies. They seek shelter from tech volatility while maintaining equity exposure. Vanguard's low-cost structure becomes irresistible for large-scale deployments.

The Contrarian Opportunity

While everyone obsesses over AI and crypto, value stocks quietly outperform. The ETF's diversified holdings across financials, energy, and industrials provide stability without sacrificing upside potential.

Timing the Cycle

Market history suggests value outperforms during late-cycle environments. With economic uncertainty looming, this ETF offers defensive positioning with offensive potential—a rare combination in today's overhyped investment landscape.

Just remember: in finance, yesterday's boring strategy often becomes tomorrow's genius move—right after everyone finishes chasing the latest shiny object.

Image source: Getty Images.

Why seeking value may be a good option right now

Growth stocks have been the go-to for many investors in recent years because of their high return potential. However, growth stocks often come with more risk and volatility because the stocks have future growth priced into them, and anything short of meeting investors' expectations can cause huge sell-offs.

Value stocks are typically more stable (though not exempt from volatility), trade at lower valuations, and are known for their consistent cash flows. The value focus of VTV means it's much less tech-heavy than the S&P 500 and growth ETFs. The top five sectors in the ETF are financials (22.8% of the ETF), industrials (16.5%), healthcare (13.5%), consumer discretionary (9.1%), and consumer staples (9%).

For perspective, tech stocks make up 34% of the S&P 500;,, andalone account for over 21%; and the top 10 holdings are close to 38% of the index.

What you're getting by investing in VTV

This ETF tracks the. To be included, a stock must be a large-cap company and meet certain metric requirements dealing with price-to-book, P/E, price-to-dividends, and price-to-sales metrics. These requirements ensure investors are getting exposure to companies that truly fit the value narrative. Below are VTV's top 10 holdings:

| JPMorgan Chase | 3.61% |

| Berkshire Hathaway (Class B) | 3.27% |

| ExxonMobil | 2.18% |

| Walmart | 1.95% |

| Oracle | 1.93% |

| Johnson & Johnson | 1.79% |

| Home Depot | 1.66% |

| Procter & Gamble | 1.60% |

| AbbVie | 1.51% |

| Bank of America | 1.35% |

Data source: Vanguard. Percentages as of July 31.

These companies are leaders in their respective industries, have stood the test of time, generate consistent cash flow, and pay an attractive dividend (except for Berkshire Hathaway). The ETF has averaged a dividend yield close to 2.5% over the past decade, outpacing the S&P 500's 1.5% average in that time.

Don't expect outsize gains from VTV

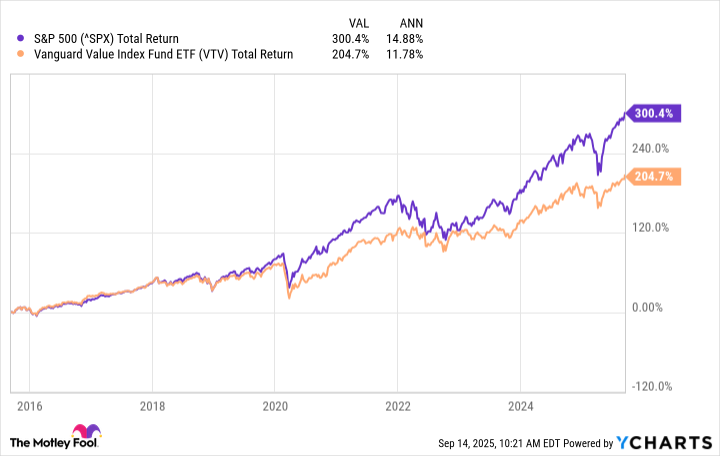

Over the past decade, VTV has averaged around 11.7% total returns, which is great by most standards. However, the S&P 500 has averaged 14.8% total returns over that time.

^SPX data by YCharts

I wouldn't invest in VTV expecting consistent, market-beating returns. Instead, I WOULD invest to hedge against the high valuation of the current market and the high tech concentration of the S&P 500. It has worked out in the S&P 500's favor in recent years, but the same factors that have lifted it can also be the same ones that drag it down.

A good example would be in 2022, when the S&P 500 declined by over 19%. VTV also finished the year in the red, but "only" 4.5%. It's a good investment to have in your portfolio when the market is down, and with only a 0.04% expense ratio, it's a cheap addition.