Intuitive Surgical Stock Hits 52-Week Low: The Ultimate Long-Term Buying Opportunity?

Robotic surgery giant tumbles to yearly lows—just as institutional money starts circling.

Why the bleeding might be your gain

Intuitive Surgical's da Vinci systems dominate operating rooms worldwide, yet the stock's performing like it got hit with anesthesia. Trading near its 52-week low while maintaining revolutionary tech? That's what finance folks call a 'disconnect'—or as traders say, 'blood in the water.'

The real incision

Hospitals aren't abandoning robotic surgery. If anything, they're doubling down on precision tech that reduces human error and shortens recovery times. Intuitive's ecosystem—from systems to instruments to services—creates a revenue model that would make any subscription-based SaaS company blush.

Long-term scalpel or short-term bleed?

Forget quarterly whispers from Wall Street analysts who probably can't tell a forceps from a Fibonacci retracement. The real question is whether automation in healthcare continues its relentless march forward. All signs point to yes—aging populations, surgical precision demands, and frankly, humans being terrible at repetitive tasks.

Buy when there's fear, sell when there's greed. Or as the crypto crowd says: 'BTFD'—just maybe don't yell that in an operating theater.

Image source: Getty Images.

Telesurgery could be a game changer for healthcare

You may have heard of telehealth, where patients can video chat with a doctor or nurse, but telesurgery could be much more transformative in the long term for healthcare. Intuitive recently demonstrated the potential for telesurgery where two doctors, one in Georgia and the other in France, were able to work together on a procedure (on an advanced tissue model) with the company's da Vinci 5 system.

The company says "there's still a long way to go," and it has been working on telesurgery for years, but there's significant potential here. If a patient can obtain access to care without needing to physically be where a surgeon is, that can drive down costs and also result in obtaining the necessary care sooner.

The telesurgery market was worth just $2 billion in 2023, based on estimates from Grand View Research. But it is growing and could be worth nearly $6 billion by the end of the decade. In the longer run, there may be even more growth, particularly as AI adds efficiency and helps bring down costs.

Intuitive's business has grown significantly in recent years

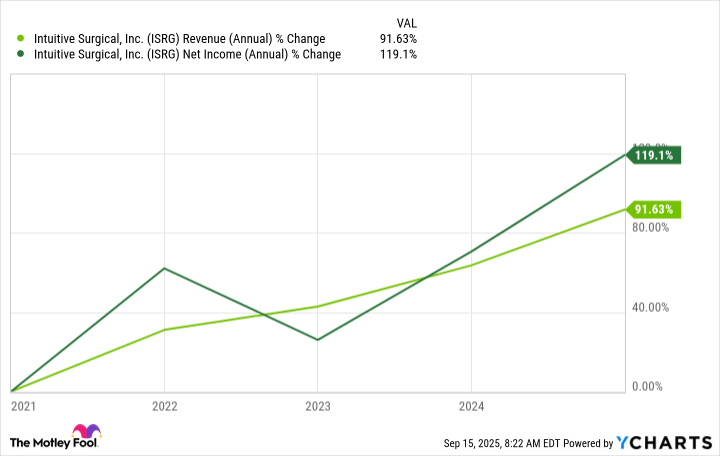

Intuitive's machines aren't cheap, and the new da Vinci 5 surgical system can cost well over $2 million. But given how much they can aid in surgery and improve outcomes for patients, the company has still been able to do well and grow its operations at a fairly high rate. And what's particularly promising is that Intuitive has been able to grow its bottom line at a faster rate than earnings in the past five years.

ISRG Revenue (Annual) data by YCharts

As of June 30, the company's install base of surgical systems totaled 10,488 -- an increase of 14% from a year ago. And in its most recent quarter, there was a 17% increase in the number of da Vinci procedures compared with the prior-year period. Despite not being cheap machines, demand has been fairly strong.

Tariffs are weighing on the company's earnings, but Intuitive is still projecting growth of up to 17% in the number of da Vinci procedures this year (a key metric for the company to show adoption is high), which is similar to its growth rate from a year ago. It expects its gross profit margin to fall by a percentage point due to tariffs, but overall, it should remain fairly strong, between 66% and 67%.

Is Intuitive Surgical stock a steal of a deal?

Intuitive's stock normally isn't cheap, and despite its decline this year, it's still trading at a fairly high price-to-earnings (P/E) multiple of 63. And its forward P/E, which factors in analyst projections of future earnings, is also high at nearly 50.

While it may not seem like a bargain right now (it is, after all, up around 700% in 10 years), the stock can still be an excellent investment in the long run, given the growth potential it possesses. It'll require patience, but if you're looking for a stock to hold for 10-plus years, Intuitive can make for a great investment to put in your portfolio for the long haul.