The Unstoppable AI Stock That Soared 112% in 6 Months—And It’s Just Getting Started

Forget everything you thought you knew about growth stocks—this AI powerhouse just rewrote the rulebook.

Rocketing Past Expectations

Six months. One hundred twelve percent gains. While traditional finance was busy over-analyzing P/E ratios, this AI juggernaut was quietly eating Wall Street's lunch. The stock didn't just climb—it absolutely demolished resistance levels like a hot knife through institutional butter.

The Engine Behind the Surge

Real adoption drives real value. Not the vaporware promises that typically pump tech stocks. This company's AI solutions are actually deployed—processing data, optimizing workflows, and printing cash while legacy systems struggle to keep up.

Why This Isn't Another Bubble

Fundamentals matter. Revenue growth isn't just keeping pace with the stock price—it's leading the charge. Client acquisition rates are hitting all-time highs while churn rates hit historic lows. That's not speculation—that's sustainable momentum.

The Road Ahead Looks Ridiculous

Analysts keep raising price targets, and the stock keeps blowing past them. The runway here isn't just long—it's practically vertical. With AI adoption still in its infancy across major industries, the total addressable market keeps expanding faster than anyone can model.

Sure, traditional investors will call it overvalued right up until it doubles again—because nothing makes Wall Street more uncomfortable than something that actually works.

Image source: Getty Images.

Ciena's networking components are in terrific demand thanks to AI

Ciena's revenue in fiscal Q3 increased by an impressive 29% from the year-ago period to $1.22 billion. However, its earnings nearly doubled on a year-over-year basis to $0.67 per share thanks to a favorable margin profile on account of a lower-than-expected impact from tariffs.

The company is known for manufacturing fiber optic components that are deployed in data centers and networking equipment. These components enable high-speed data transmission with low latency and high reliability. These characteristics make them ideal for deployment in AI data centers where huge amounts of data are to be transferred quickly to enable AI model training and to run inference applications.

Not surprisingly, major cloud computing companies are now lining up to purchase Ciena's equipment., for instance, reportedly accounted for 18% of the company's top line in the previous quarter. The good part is that Ciena has "strong partnerships with all of the major hyperscalers," as management remarked on the latest earnings conference call.

These hyperscalers are increasing their appetite for Ciena's "data center interconnect" components, which are used for enabling high-speed connections between two or more data centers, as well as within the components of a single data center. Ciena management says that it is on track to double its revenue from interconnect components in the current fiscal year. The trend is expected to continue in fiscal 2026 as well.

Even better, Ciena sees its addressable market expanding in the future beyond just the major cloud hyperscale companies. According to CEO Gary Smith:

There is another sizable emerging group of cloud providers beyond the four to five large well-known hyperscalers. This diverse group of network operators is now generally being referred to as neo-scalers, a term which is inclusive for AI compute specialists, such as GPU-as-a-service provider, cloud and edge service providers and smaller data center and co-location providers.

Importantly, Ciena says that it has "already secured multiple new wins with these cutting-edge neo-scalers." So the company seems to be in a solid position to make the most of the incremental $13 billion revenue opportunity it sees through 2028 on account of AI. In all, Ciena estimates its total addressable market to hit $26 billion over the next three years, though it wouldn't be surprising to see that number expanding on account of the potential improvement in its customer base mentioned above.

Why the stock could keep soaring

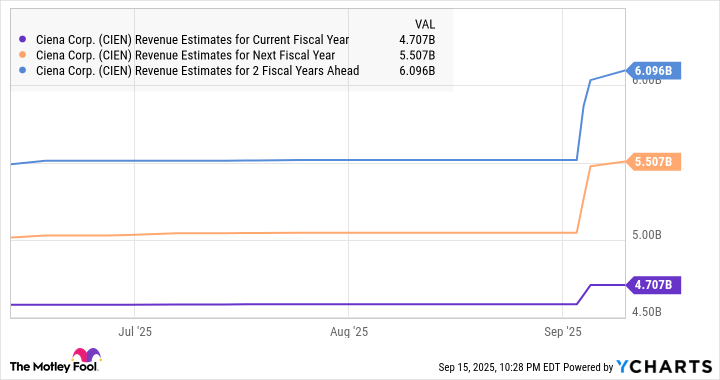

Ciena's guidance of $1.28 billion in revenue for the current quarter indicates that it will end the current fiscal year with $4.7 billion in revenue. That WOULD be an increase of 17% from last year's levels. Though analysts are expecting Ciena's growth to taper off in the next couple of fiscal years, the company has significantly raised its revenue expectations.

CIEN Revenue Estimates for Current Fiscal Year data by YCharts

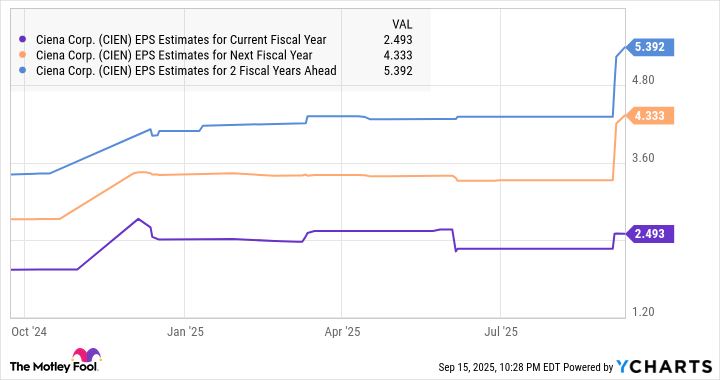

Ciena's expanding addressable market could eventually allow it to exceed Wall Street's expectations going forward. But what's even better is the projected growth in the company's earnings following an estimated increase of 37% in the current fiscal year to $2.49 per share.

CIEN EPS Estimates for Current Fiscal Year data by YCharts

The company's outstanding earnings growth is likely to be rewarded with more upside on the market going forward. For instance, if it hits $5.39 per share in earnings after a couple of years and trades at 32 times earnings at that time (in line with the tech-heavyindex's average earnings multiple), its stock price could be worth $172.

That points toward potential gains of 26% from current levels, though there is a good chance that this AI stock could do much better than that by clocking faster earnings growth.