Microsoft and Amazon Poised to Dominate UK’s $42 Billion AI Infrastructure Gold Rush

Tech Titans Positioned for Windfall as Britain Bets Big on Artificial Intelligence

The Cloud Crown

Microsoft's Azure and Amazon's AWS stand to capture the lion's share of Britain's massive AI infrastructure investment—because when governments throw money at technology, they inevitably write checks to the usual suspects. These cloud giants already dominate European data center markets, making them default beneficiaries of public spending masquerading as innovation.

The $42 Billion Question

UK taxpayers are funding what essentially becomes a corporate subsidy for American tech behemoths. While politicians tout 'national AI sovereignty,' the reality involves wiring public funds directly to Seattle-based balance sheets—a classic move where government ambitions meet private profit margins.

Wall Street's Silent Cheer

Investors quietly add another line item to their growth projections while analysts nod approvingly at yet another government-sponsored revenue stream. Because nothing fuels tech stock rallies quite like taxpayer-funded infrastructure deals dressed up as technological progress.

Image source: Getty Images.

Microsoft's $30 billion investment

Just last week, Microsoft and other U.S. players including Nvidia andannounced investments in the U.K. totaling $42 billion. Microsoft pledged to invest $30 billion in the country by 2028, and that includes an infrastructure buildout to support its creation of the U.K.'s biggest supercomputer. This would involve more than 23,000 graphics processing units (GPUs), or the chips supporting the most crucial of AI tasks such as the training and inferencing of large language models.

This follows news from a few months ago: Then, Amazon announced it would spend more than $54 billion over the coming three years to boost its cloud computing and AI infrastructure in the U.K. -- and invest in new fulfillment centers to support its e-commerce business in the country.

So, U.S. companies clearly see the potential for growth in the U.K. and have committed to it at just the right moment, as the momentum for AI infrastructure buildout picks up. Nvidia chief Jensen Huang recently predicted global AI infrastructure spending will reach a mind-boggling $4 trillion by the end of the decade.

Among all of the companies involved in the U.K. buildout, though, Microsoft and Amazon may benefit the most, and here's why. One key element is these companies both are leaders in the world of cloud computing. Amazon's Amazon Web Services (AWS) holds the biggest share at about 30% of the market worldwide, while Microsoft Azure holds 20%. And specifically in the U.K. market, each of these players holds about a 40% share, putting them on equal footing. This leadership positions them well as demand for AI capacity grows -- current Azure and AWS customers may stick with these cloud providers that they know well for their AI workloads.

The ability to ramp up quickly

These players also have the financial strength and presence on site to quickly ramp up and follow through on their investment plans, which means they might be ready to meet this growing demand in the U.K. market. So, as the U.K. and its businesses focus on AI, Microsoft and Amazon should see their cloud revenues in the country take off.

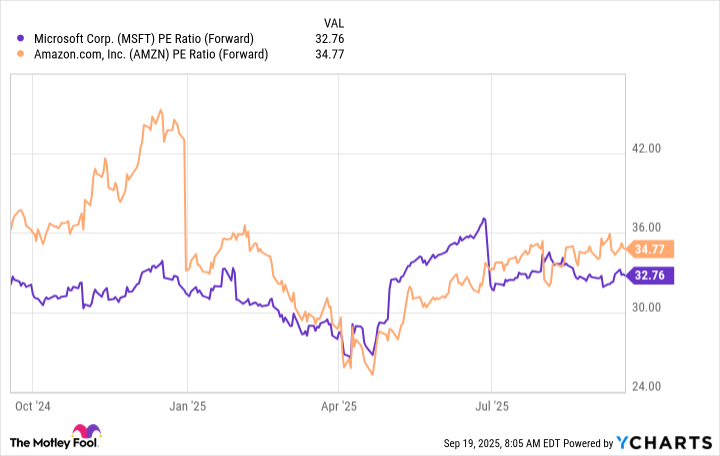

What does all of this mean for you as an investor? Should you buy shares of these players because of this potential growth in the U.K.? I wouldn't invest in these stocks for this reason only -- but it represents a positive point to add to an already strong buy case. Each of these players trades at interesting levels today, particularly Amazon, which has seen its valuation decline considerably from late last year.

MSFT PE Ratio (Forward) data by YCharts

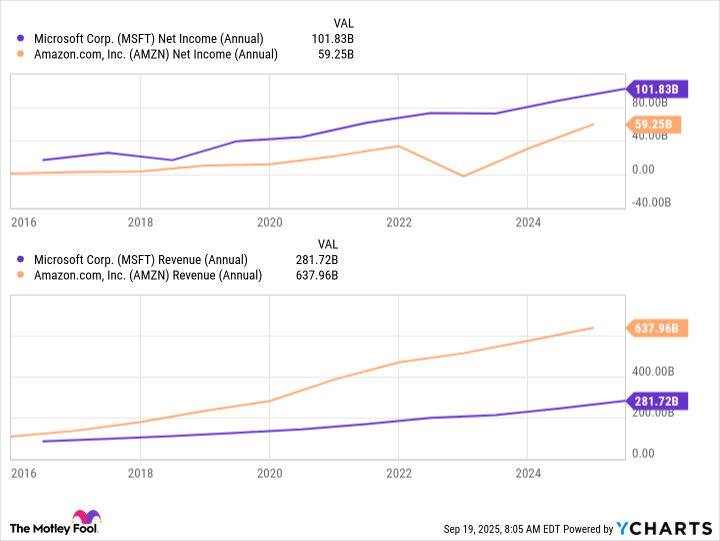

Meanwhile, these players are highly profitable and have delivered a strong track record of revenue and net income growth over the past several years.

MSFT Net Income (Annual) data by YCharts

The AI opportunity ahead now offers these well-established companies that have proven themselves over time a new growth driver. And since they're leaders in the cloud market, as mentioned, they're well positioned to benefit significantly -- especially in a market where they dominate, such as in the U.K.

All of this means that now makes an excellent time for both cautious and aggressive investors to buy shares of these current and future winners -- they're set to gain from the AI boom at home, in the U.K., and potentially in other parts of the world as well.