Investors Might Finally Know Why The Trade Desk’s Growth Has Slowed So Much

The digital ad giant hits a wall—and the reasons are finally coming to light.

What's Really Slowing The Trade Desk Down

Market saturation bites hard. The programmatic advertising space gets crowded—every platform fights for the same ad dollars. Consumer privacy regulations tighten their grip. iOS updates and cookie restrictions chop targeting capabilities right at the knees.

Competition Heats Up

Google's ad dominance doesn't budge. Amazon's retail media network grabs market share faster than startups burn VC cash. Social media platforms innovate while The Trade Desk plays catch-up.

The Growth Equation Changes

Client budgets shrink as economic uncertainty looms. Brands prioritize measurable ROI over experimental campaigns. The 'growth at all costs' mentality gives way to sustainable scaling—or what Wall Street calls 'disappointing earnings.'

Investors get what they wanted—answers. Whether they like what they hear is another matter entirely. Another quarter, another excuse—but at least this time they're calling it 'strategic repositioning.'

Image source: Getty Images.

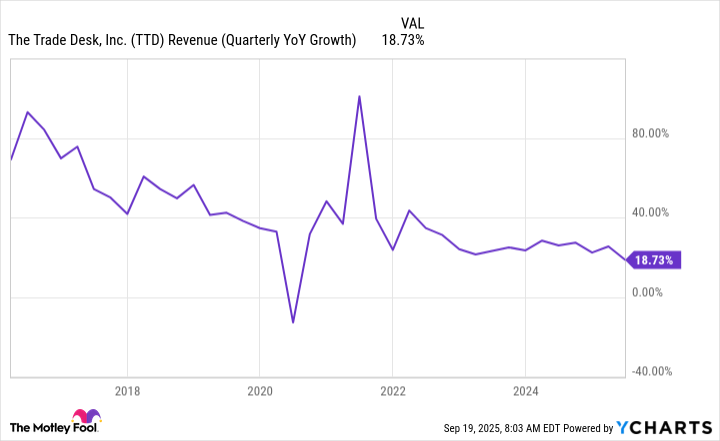

On Aug. 7, The Trade Desk reported financial results for the second quarter of 2025. But it also gave guidance for the upcoming third quarter. And for Q3, management expects to generate revenue of $717 million. This represents a revenue growth rate of just 14%.

The Trade Desk has only ever reported one quarter with growth as slow as what it's projecting for Q3, and it was the first quarter of the COVID-19 pandemic -- hardly an ordinary three months.

Data by YCharts.

Here's the kicker: The Trade Desk just released an artificial intelligence (AI)-powered version of its platform, called Kokai. Management said this new software is the "most significant platform upgrade to date, and one that represents a new frontier in digital advertising trading."

When investors hear things like "most significant" and "new frontier," they expect it to serve as a catalyst for new growth. This is why they're so disappointed with The Trade Desk, saying that business is about to significantly slow down. It seems contradictory.

Investors might finally have better information to explain the apparent contradiction. And it could be the key to knowing whether The Trade Desk stock is a beaten-down stock to buy now or not.

What's going on with Kokai?

On the Q2 conference call, The Trade Desk CEO Jeff Green excitedly said, "We expect all of our clients to be using Kokai by the end of this year." But it seems like not all of the company's clients are happy about it. According to Adweek, many of The Trade Desk's clients may prefer its old Solimar platform over its new Kokai platform. There are features that might not be as user-friendly. And this might be causing some customers to give other adtech options a try.

While Green pointed out that client spend is increasingly moving through Kokai, it's worth noting that it's also becoming the default option. And as that happens, it seems some customers are turning elsewhere in frustration. Many investors have been concerned about competitive pressures on The Trade Desk from's fast-growing advertising business. Adweek also points out that some advertisers are even turning to Yahoo! because its take rate is just a fraction of The Trade Desk's take rate.

The Trade Desk's customers could keep using the Solimar platform if they're discontent with the new Kokai platform. But it's possible that some of them aren't clear on this. According to AdExchanger, some of The Trade Desk's clients may believe a rumor that Solimar is being phased out soon, which WOULD force them to use a Kokai platform that they don't like. So this could also be contributing to experimentation with other adtech platforms such as Yahoo!.

This could all perfectly explain why a growth stock such as The Trade Desk is forecasting a meager 14% growth rate right after launching its "most significant platform upgrade" ever.

The Trade Desk isn't lying down

It's very possible, if not likely, that The Trade Desk is looking at a user interface problem, not a technology problem. And that would be very relieving for shareholders. After all, user interfaces are easily improved.

Indeed, Green on the Q2 call said, "The iteration on client feedback has been really rapid," when it comes to Kokai. In other words, the company's customers are telling it what they don't like, and it's making improvements as fast as it can. That's good.

Moreover, Green had promising things to say about Kokai when it comes to the technology. He said that, in aggregate, customers using Kokai are getting better results for their money. And this is key. At the end of the day, a company can overcome a bad user interface if the technology can give wins to its customers.

To conclude, here's what I think is the most likely outcome here: Given its long track record of success, I think The Trade Desk will relentlessly work until it fixes its problems. That could take a couple of quarters. But I think the company will get past the issues that are holding back its customers right now. And once that happens, investors will finally see the growth rate that they've been expecting from the launch of Kokai.