ODP Stock Skyrockets Following Bold Plan to Go Private

Office Depot's parent company makes power move—shares surge as privatization plan drops.

The Wall Street Shakeup

Traders scrambled as ODP stock ripped upward on the announcement. The retail giant's board dropped the bombshell privatization strategy during morning trading.

Behind the Numbers

Market analysts tracked the rally minute-by-minute as volume spiked. The move signals major structural changes ahead for the office supply chain.

What's Next for Investors?

Short-term gains look solid, but long-term? Another classic case of corporate musical chairs—because nothing fixes fundamental business challenges like changing the ownership structure while doing the same thing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ODP noted that this deal will result in it going private. When that happens, shares of ODP will no longer trade on the Nasdaq exchange. This agreement has the support of the company’s Board of Directors and is set to close before the end of 2025. It still needs approval from ODP shareholders and to complete customary closing conditions.

Gerry Smith, CEO of ODP, said, “Atlas brings an understanding of our industry, along with the operational expertise, resources and track record of supporting its companies that will fast forward our B2B growth initiatives and strengthen our position as a trusted partner to our customers.”

ODP Stock Movement Today

ODP stock was up 0.45% on Tuesday and underwent a roughly 33% rally when the Atlas Holdings news was announced yesterday. Investors will note that the shares are up 22.34% year-to-date but have fallen 5.56% over the past 12 months.

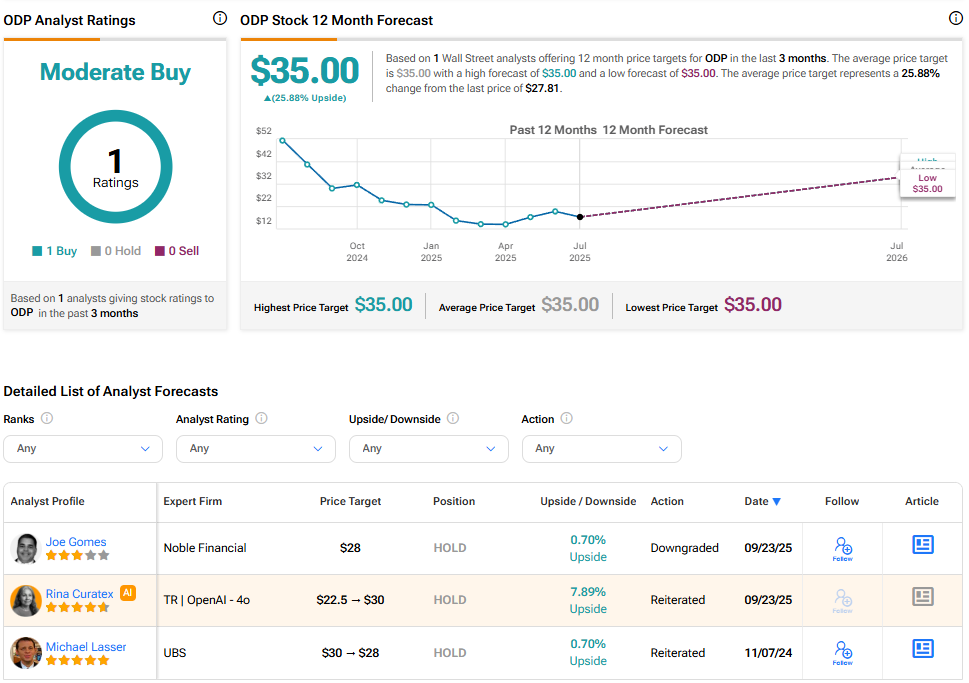

Noble Financial analyst Joe Gomes downgraded ODP stock to a Hold rating today, with a $28 price target, suggesting a potential 0.7% upside for the shares.

Is ODP Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for ODP is Moderate Buy, based on one Buy rating and one Hold rating over the past three months. With that comes a $35 price target, suggesting a potential 25.88% upside for the shares.