CVS Health Stock Defies Gravity as Omnicare Unit Plunges into Chapter 11 Bankruptcy

While traditional finance stumbles, crypto continues its relentless march upward—but CVS just pulled off a corporate Houdini act that'd make any blockchain project jealous.

SHIELDING THE MOTHERSHIP

Omnicare's bankruptcy filing should've sent CVS stock tumbling—yet shares held firm while the subsidiary crumbled under its debt load. The healthcare giant somehow decoupled its fate from its failing unit, executing a risk containment strategy that Wall Street analysts are calling 'almost surgical.'

CORPORATE ALCHEMY

CVS managed what few traditional companies can: isolating financial contagion while maintaining investor confidence. Their playbook? Aggressive legal firewalls and preemptive damage control—moves that'd make any DAO proud, albeit with about 10,000% more paperwork.

Meanwhile in crypto land, we're busy building systems where failure doesn't require bankruptcy courts—just code upgrades and community consensus. But hey, at least CVS proved that sometimes, even legacy finance can learn a trick or two about resilience.

One subsidiary collapses while the parent company barely flinches—either CVS discovered corporate quantum entanglement or Wall Street's drinking its own Kool-Aid again. Probably both.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This type of bankruptcy proceeding enables businesses to reorganize their debts while continuing to operate under court supervision. Omnicare, which provides pharmacy services to long-term facilities such as nursing homes, said it voluntarily applied for the process to resolve issues related to its recent litigation with the federal government.

In July, the U.S. district court in New York had ordered Omnicare to pay a total of $949 million to settle a lawsuit accusing the company of fraudulently billing the U.S. government for wrongfully dispensed prescription medications. The amount breaks down to $542 million in restitution payment due to over 3 million alleged false claims, and $407 million in penalty payment.

Omnicare Slams ‘Unconstitutional Penalty’

In late 2019, the federal government joined a lawsuit filed against CVS Health by Uri Bassan, a former pharmacist at Omnicare. The government accused Omnicare of dispensing drugs using expired prescriptions. The U.S. Department of Justice, therefore, alleged that Omnicare fraudulently billed the government for these medications under the Medicaid and Medicare programs between 2010 and 2018.

CVS Health, which acquired Omnicare in 2015 for over $10 billion, at the time rejected the claims as lacking in merit. On Monday, Omnicare’s president, David Azzolina, further issued a statement criticizing the federal government for dragging the company to court “based on practices the government knew about and approved.”

Azzolina described the total sum imposed by the court on the company as “extreme” and an “unconstitutional penalty.”

Omnicare Eyes Reorganization

Meanwhile, Azzolina noted that the bankruptcy process will enable the company to resolve issues relating to the ruling and other challenges facing the business. The executive further gave assurance that the company will keep serving its customers without disruption while the process lasts.

Moreover, Omnicare said it has agreed to $110 million in debtor-in-possession financing as part of the bankruptcy protection proceeding. Once finalized, the company plans to use the fund, in addition to cash generated from its operations, to cover business needs and obligations during the court process.

Is CVS a Buy, Sell, or Hold?

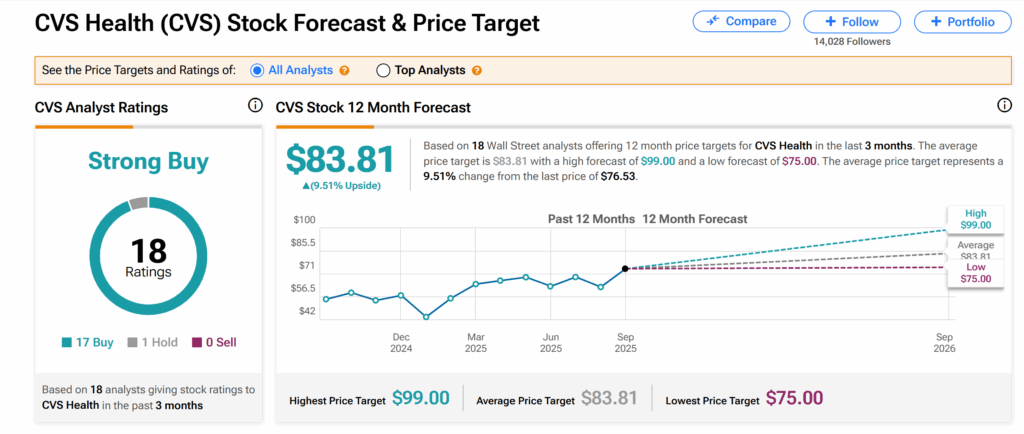

Meanwhile, across Wall Street, investor sentiment about CVS Health remains largely positive as its shares currently boast a Strong Buy consensus recommendation, as seen on TipRanks. This is based on 17 Buys and one Hold assigned by Wall Street analysts over the past three months.

Moreover, at $83.81, the average CVS price target indicates a 10% growth potential from the current level.