Micron’s Stock Soars After Blowing Past Earnings Estimates - MU Delivers Stellar Financial Performance

Micron just delivered a knockout quarter that left Wall Street scrambling to upgrade their price targets.

Memory Market Momentum

The chipmaker's financial results smashed through analyst expectations, sending shares climbing as investors rushed to capitalize on the upside surprise. Memory demand continues to outpace even the most optimistic projections.

Execution Excellence

Micron's operational discipline translated directly to the bottom line, proving that in semiconductors, manufacturing prowess separates the contenders from the pretenders. Their supply chain management appears to have navigated global uncertainties with remarkable efficiency.

Forward-Looking Confidence

While traditional finance analysts were busy adjusting their spreadsheets—probably still using Excel 2010—Micron demonstrated why tech infrastructure plays remain critical in our increasingly digital economy. The company's guidance suggests this isn't a one-quarter wonder but sustainable momentum.

Another quarter, another reminder that betting against technological progress is like trying to stop the tide with a bucket.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

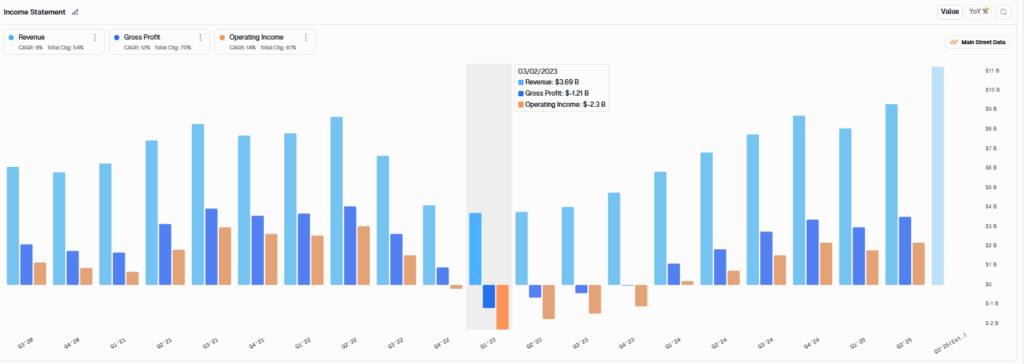

For what was its Fiscal fourth quarter, Micron announced earnings per share (EPS) of $3.03, which topped the $2.86 consensus expectation of analysts. Revenue in the period totaled $11.3 billion, surpassing forecasts of $11.2 billion. Sales were up 46% from a year earlier.

Micron also reported a gross margin of 45.7%, which came out ahead of estimates of 44.3%. In terms of guidance, Micron said that it expects earnings in the current quarter of $3.75 a share, which beat the consensus on Wall Street that called for a profit of $3.05. Revenue is forecast to come in at $12.5 billion, which topped estimates of $11.9 billion.

Micron’s income statement.Main Street Data

AI Opportunity

“As the only US-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead,” said Sanjay Mehrotra, the company’s CEO, in the earnings release. Micron’s memory chips and data storage technologies are widely used in artificial intelligence (AI) data centers.

Owing to strong data center demand, Micron took the unusual step of raising its Fiscal fourth-quarter guidance in August of this year from what it had been only two months earlier. Management at the company has said that they are racing to keep up with demand for Micron’s products. MU stock has nearly doubled in 2025, having risen 98% on the year.

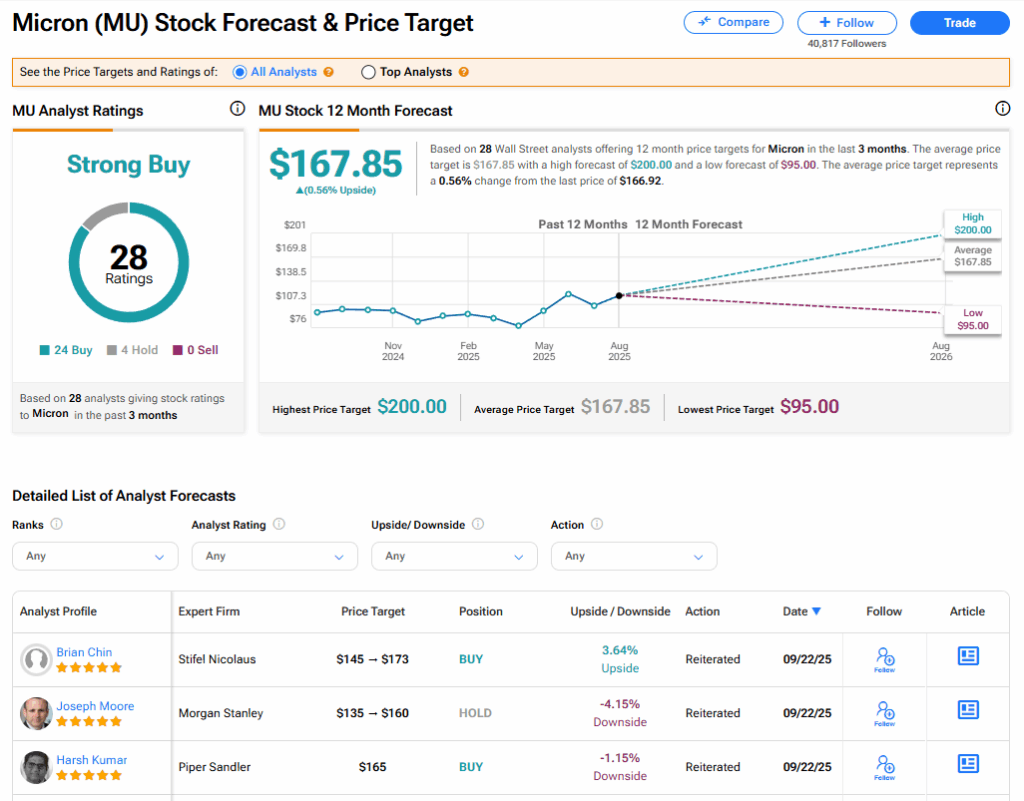

Is MU Stock a Buy?

Micron’s stock has a consensus Strong Buy rating among 28 Wall Street analysts. That rating is based on 24 Buy and four Hold recommendations issued in the last three months. The average MU price target of $167.85 implies 0.56% upside from current levels. These ratings are likely to change after the company’s financial results.