Bank of America’s Top Analyst Slaps Palantir (PLTR) with Street-High Price Target - Here’s the Bull Case

Wall Street's getting a reality check as Bank of America's lead analyst throws down the gauntlet with a Street-high price target for Palantir.

Why This Matters Now

Forget the usual analyst caution—this call cuts through the noise with conviction. The numbers speak louder than the typical Wall Street hedging that usually enables mediocre projections.

The Data-Driven Edge

Palantir's government contracts and commercial expansion bypass traditional software valuation metrics. The firm's classified work with defense agencies creates a moat most tech companies can't touch—while their commercial arm keeps landing Fortune 500 clients.

Street Psychology vs. Reality

Analysts love downgrading after rallies—but this target acknowledges what the charts already show: institutional money's betting big on data analytics platforms that actually deliver results. Another quarter of beating estimates might finally shut up the skeptics who still think this is just a government contractor.

Bottom line: When a top-tier bank breaks ranks with consensus, it's usually because they've crunched numbers the rest of the Street missed—or because they're tired of being wrong. Either way, Palantir's narrative just got a serious credibility boost from the last place you'd expect: a traditional finance institution that usually undervalues tech disruption until it's already happened.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PLTR stock has rallied more than 141% year-to-date, driven by the company’s solid financial performance and robust demand for its AI-powered offerings.

Top Bank of America Analyst Is Bullish on PLTR Stock

Following the AIPCon 8 event, Mora highlighted that the Ontology architecture and the forward-deployed engineers (FDEs) go-to-market strategy continue to be Palantir’s “secret sauce.” The analyst’s meeting with Krishnaswamy last week focused on the role of the FDEs and how the company is already capitalizing on its Agentic AI capabilities to extend this “idiosyncratic skillset” to more use cases.

Mora noted that the award from the UK’s Ministry of Defense (MOD) builds on Palantir’s momentum as the global digital battle-management system. The 5-year-long award, which is worth up to £750 million, marks Palantir’s first billion-dollar (in U.S. dollars) contract outside the U.S. and builds on the company’s existing UK exposure (NHS and MOD) and growing international demand among U.S. allies.

The top-rated analyst noted that Palantir’s Maven Smart System continues to grow in the U.S. (8x since early 2024) and was selected in April by NATO to enhance intelligence, target recognition, battlespace awareness, and decision-making capabilities for warfighters. Mora expects other countries to increasingly consider Maven as their global digital battle-management system, given its interoperability with the U.S. and allies as well as governance of their own data. Mora now expects Palantir’s government sales to exceed $8 billion by 2030, indicating a 30% estimated compound annual growth rate (CAGR) over the 2025 to 2030 period.

Is Palantir a Good Stock to Buy?

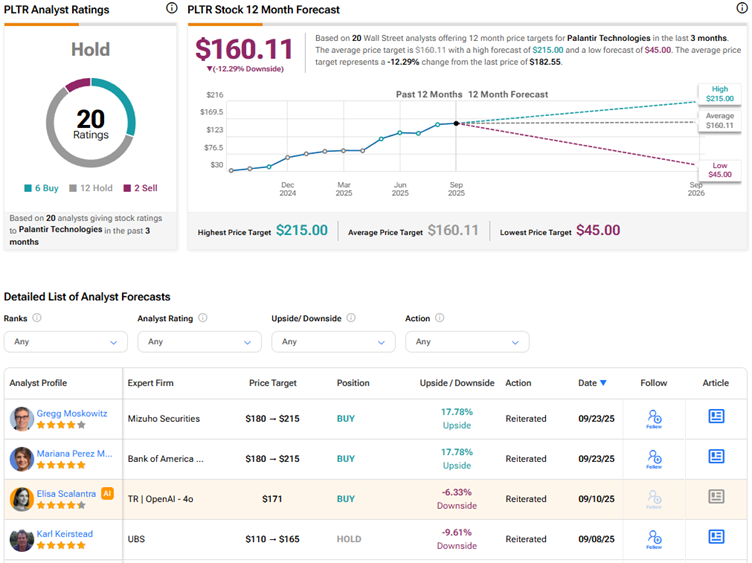

Currently, many analysts are sidelined on Palantir Technologies stock, mainly due to its elevated valuation. Wall Street’s Hold consensus rating on PLTR stock is based on 12 Holds, six Buys, and two Sell recommendations. The average PLTR stock price target of $160.11 indicates a possible downside of 12.3% from current levels.