United Airlines Stock (UAL) Soars While Tech Glitches Ground Planes - What Wall Street Isn’t Telling You

Another day, another system failure—but United's stock just keeps climbing.

Tech Turmoil, Market Triumph

United Airlines planes sit grounded across tarmacs worldwide as operational systems buckle under pressure. Meanwhile, traders push UAL shares to fresh heights in a display of market logic that would confuse anyone actually trying to travel this week.

The Resilience Paradox

Investors shrug off the third major technical disruption this quarter, treating the stock like some unstoppable crypto asset instead of an airline dependent on functional technology. Trading volumes spike 40% as algorithms feast on the volatility.

Wall Street's selective blindness strikes again—rewarding companies for surviving their own failures while actual passengers miss weddings and business meetings. Because nothing says 'strong investment' like a business that can't perform its basic function.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Flights Paused

United Airlines requested the Federal Aviation Administration to pause departures of its planes at U.S. and Canadian airports early this morning – September 24.

Thankfully for United Airlines, its passengers and its investors the ground stop was short-lived with planes back in the air after only less than an hour’s delay.

United said it had experienced a ‘brief connectivity issue’ but has since resumed normal operations.

The reason given by the Air Traffic Control System Command Center (ATCSCC) was simply “Company / Technology.”

Reportedly FlightAware’s Misery Map showed delays across the country. It revealed 42 delays and 4 cancelations between 12 a.m. ET and 4 a.m. with LAX the worst effected.

Reputation Risk

It will be a concern for the company however, given that back in August a glitch forced United Airlines to ground flights across major U.S. airports including Newark, Denver, Houston and Chicago, causing widespread delays throughout its network. The outage was resolved within a few hours.

The issue then was with the company’s Unimatic system, which stores flight data and feeds it to other systems.

It is why United Airlines’ ‘Ability to Sell’ is such a key risk to its business and something investors need to be aware of when looking at the stock. Ability to Sell incorporates areas such as brand reputation which is clearly something which could be impacted by groundings of planes – see below:

Its resilient share price today, however, continues a strong year for the group. The price is up over 7% helped by double-digit acceleration in business demand despite wider economic uncertainty.

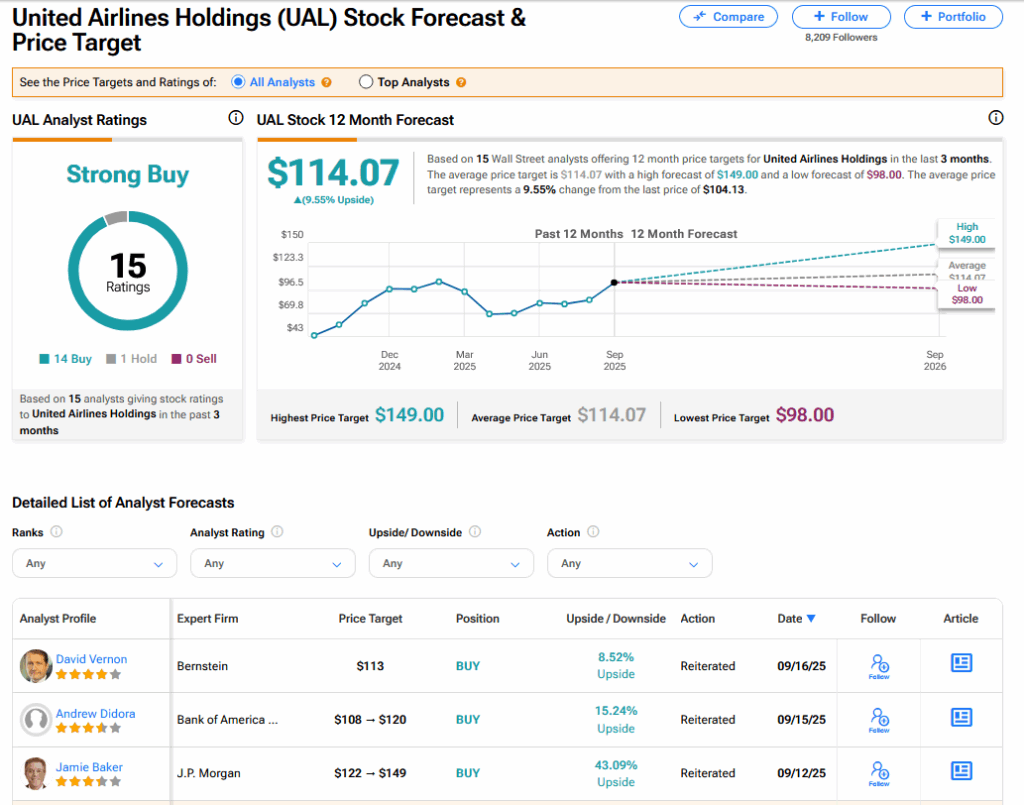

Is UAL a Good Stock to Buy Now?

On TipRanks, UAL has a Strong Buy consensus based on 14 Buy and 1 Hold ratings. Its highest price target is $149. UAL stock’s consensus price target is $114.07, implying a 9.55% upside.