Fitell Stock (FTEL) Plummets 13% Today: What’s Driving the Sudden Drop?

Another fitness stock takes a brutal beating as FTEL investors scramble for exits.

The Numbers Don't Lie

Fitell's 13% nosedive leaves shareholders wondering if the company's growth story has hit a wall. The drop mirrors the kind of volatility that makes traditional finance guys clutch their pearls—while crypto traders shrug and check their Bitcoin charts.

Market Reality Check

Fitness tech stocks face relentless pressure as consumer spending patterns shift. Fitell's sudden decline suggests deeper challenges than just a bad day at the market. Sometimes the market cuts through the hype like a hot knife through protein powder.

Wall Street's favorite pastime: overreacting to single-day moves while missing the bigger picture entirely.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fitell noted that this won’t be the last time the company purchases Solana tokens. It intends to use a significant portion of the net proceeds from its $100 million facility to acquire more of the crypto. It also said it will use up to 70% of net proceeds from subsequent closings to acquire additional SOL tokens.

Sam Lu, CEO of Fitell, said, “This initial $10 million purchase, in one day following our $100 million financing announcement, manifests FTEL’s execution and commitment to our newly launched Solana treasury strategy. With committed institutional support, we look forward to expanding our SOL position, in addition to growing staking revenue, and drive long-term value for shareholders.”

Fitell Stock Movement Today

Fitell stock was down 13% in pre-market trading on Wednesday, following a 9.93% rally yesterday. The shares have decreased 3.2% year-to-date and 51.96% over the past 12 months.

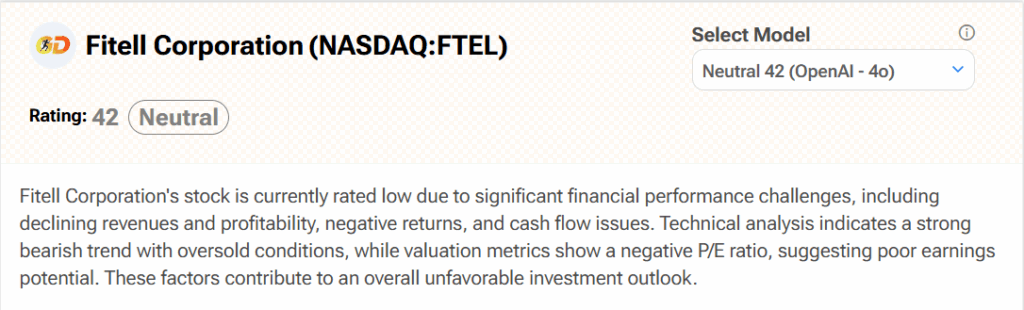

Is Fitell Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Fitell is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates FTEL stock a Neutral (42) with no price target. It cites “significant financial performance challenges, including declining revenues and profitability, negative returns, and cash FLOW issues” as reasons for this stance.