Tesla Stock (TSLA) Slips as BYD Snatches Europe’s EV Crown Again - What Wall Street Missed About Digital Assets

Tesla's European stumble reveals more about traditional finance's blind spots than BYD's manufacturing prowess.

The Real EV Race Isn't About Cars

While analysts obsess over quarterly delivery numbers, they're missing the bigger picture: the underlying financial infrastructure supporting this transition. Legacy automakers chasing electric vehicle dominance while relying on century-old payment systems is like building a spaceship with bicycle parts.

Digital Infrastructure Gap

TSLA's minor dip matters less than the systemic inefficiencies in global capital flows that cryptocurrency solutions are already solving. Smart contracts could automate supply chain payments faster than any corporate treasury department.

Wall Street's myopic focus on stock prices ignores how blockchain technology is reshaping value transfer itself—something that'll impact automotive financing more profoundly than any quarterly sales crown.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s Look at the Numbers

According to the European Automobile Manufacturers’ Association (ACEA), Tesla’s EU sales fell 36.6% to 8,220 cars, cutting its market share from 2% last year to 1.2%. In contrast, BYD sold 9,130 vehicles, marking a 201.3% increase and boosting its market share to 1.3%. When including the U.K., Norway, and other EFTA (European Free Trade Association) countries, Tesla’s sales dropped 22% year-over-year to 14,831 cars.

Meanwhile, Stellantis (STLA) saw its first year-over-year sales increase in Europe since February 2024, with registrations rising 2.2%. Stellantis returned to sales growth in Europe, supported by rising demand for plug-in hybrid (PHEV) and battery-electric (BEV) vehicles.

Overall, the ACEA reported that EU passenger-car registrations ROSE 5.3% in August, reaching 677,786 vehicles.

Europe Remains a Tough Road for Tesla

Tesla has struggled to grow car sales in 2025 due to stronger competition, an aging lineup, and concerns that CEO Elon Musk’s ties to the TRUMP administration may have put off some eco-conscious buyers. August numbers show another weak month for Tesla in Europe, as it continues to lose ground to local and Chinese rivals. Chinese brands, in particular, have used PHEVs to reduce the impact of EU tariffs on Chinese-made EVs and to attract European drivers.

Globally, Tesla sold 721,000 cars in the first half of the year, down about 13%. Wall Street expects around 447,000 vehicles to be sold in the third quarter, a 3% drop from 463,000 in the same period last year.

Is Tesla Stock a Buy, Sell, or Hold?

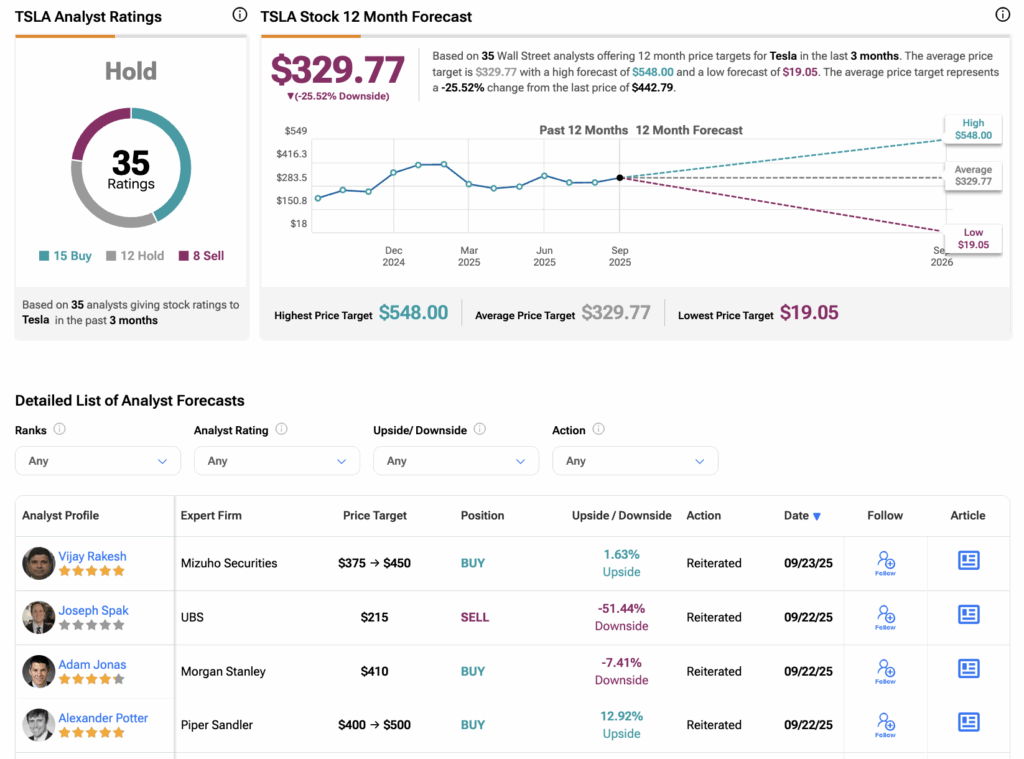

According to TipRanks, TSLA stock has received a Hold consensus rating, with 15 Buys, 12 Holds, and eight Sells assigned in the last three months. The average price target for Tesla shares is $329.77, suggesting a potential downside of 25.5% from the current level.

See more TSLA analyst ratings