Alibaba (BABA) Stock Soars on $53 Billion AI Revolution and Nvidia Partnership Fueling Investor Frenzy

Alibaba just dropped a $53 billion AI bomb—and Wall Street can't get enough.

The Chinese tech giant's massive artificial intelligence push, coupled with a strategic Nvidia partnership, sent BABA shares skyrocketing as investors bet big on the AI gold rush.

Nvidia's Seal of Approval

When the semiconductor kingpin joins your dance card, markets pay attention. The Nvidia deal signals serious AI credibility—something Alibaba desperately needs amid fierce domestic competition.

$53 Billion Reality Check

That's not pocket change, even for Alibaba. The colossal investment targets AI infrastructure, cloud computing, and next-gen applications that could redefine China's tech landscape.

Traders piled in like it was 1999—because nothing gets financiers hotter than big numbers and bigger promises. The rally suggests investors believe Alibaba can actually execute this vision rather than just announce another corporate PowerPoint fantasy.

Of course, Wall Street's memory lasts about as long as a crypto bull run—today's AI darling could be tomorrow's metaverse casualty. But for now, $53 billion buys a lot of optimism.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Qwen3-Max and Strategic Alliances

Alongside the spending news, Alibaba introduced a new large language model called Qwen3-Max. With more than one trillion parameters, the company said it delivers stronger performance in coding and autonomous agent tasks than rivals. Alibaba also announced its first data centers in Brazil, France, and the Netherlands. These additions mark an effort to extend its cloud reach beyond China while moving closer to international clients.

In addition, Alibaba Cloud revealed a partnership with Nvidia (NVDA). According to Bloomberg, the deal will bring Nvidia’s Physical AI software stack to Alibaba’s platform, helping developers build models for robotics, autonomous vehicles, and smart environments. The collaboration stands out, given the current trade limits between the U.S. and China; yet, both companies are advancing as demand for AI tools fuels new alliances.

Ark Returns and Marvell’s Buyback

Investor sentiment was further lifted when Cathie Wood’s Ark Investment Management reopened a position in Alibaba for the first time since 2021. The MOVE added to signs of renewed institutional interest in the stock.

Meanwhile, Marvell Technology (MRVL) announced a $5 billion stock buyback program along with a $1 billion accelerated purchase. The company said it plans to keep its focus on data center growth while also returning capital to shareholders.

In short, Alibaba’s expanded AI plan and its new partnership with Nvidia underscore its push to secure a larger role in the global AI race. At the same time, the broader market has responded with fresh momentum for companies tied to growth in this area.

Is BABA Stock a buy?

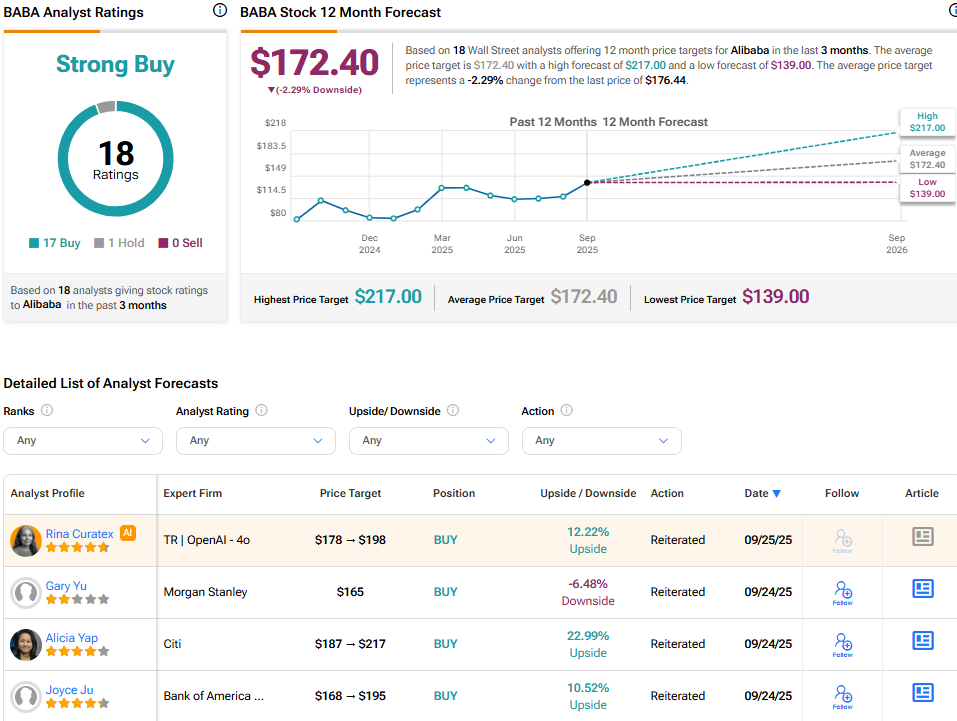

On the Street, Alibaba scores a Strong Buy consensus, based on 18 analysts’ ratings. The average BABA stock price target stands at $172.40, implying a 2.29% downside from the current price.