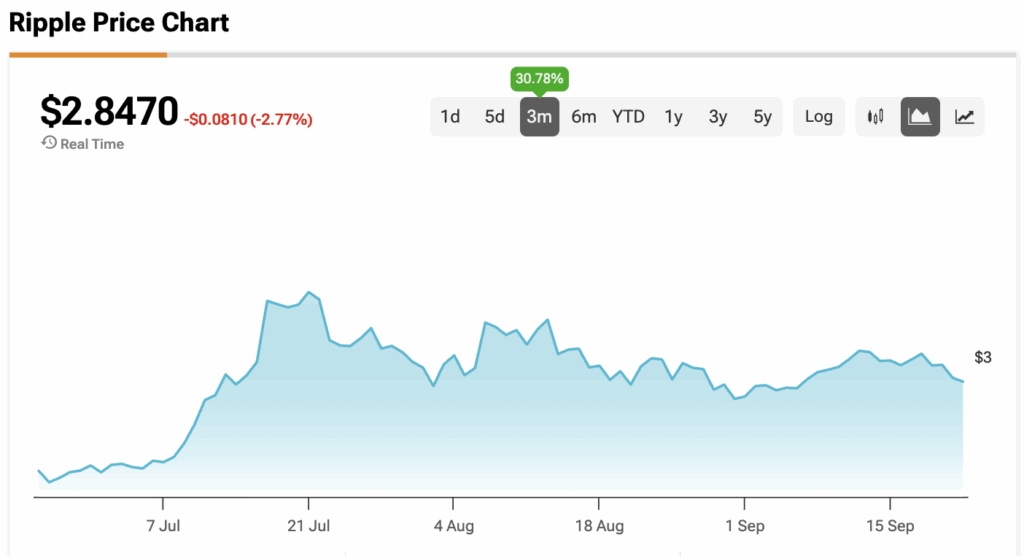

XRP Price Faces Major Collapse Risk After Plunging Below $3 Threshold

XRP teeters on the edge as support levels crumble beneath the psychological $3 barrier.

Technical Breakdown

Market analysts point to weakening momentum indicators and declining trading volumes. The asset struggles to maintain its position after failing to hold critical resistance zones.

Market Sentiment Shifts

Traders reposition portfolios while institutional interest shows signs of stagnation. The broader crypto market's volatility compounds XRP's specific challenges.

Regulatory Overhang

Ongoing regulatory uncertainty continues to cast shadows over recovery prospects. Some traditional finance commentators smirk about crypto's 'natural selection' process—as if their own sector never sees volatility.

What's Next for XRP?

All eyes remain on key support levels. Either a dramatic recovery or further decline awaits—there's no middle ground in crypto markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move coincided with mass liquidations across the broader crypto market, which left XRP exposed after its sharp rally earlier in September. Heavy profit-taking added to the pressure and accelerated the drop.

ETF Hype Fades into Outflows

ETF headlines have not been enough to keep buyers engaged. Even with the debut of the REX-Osprey XRP ETF (XRPR) and talk of additional launches in October, XRP has recorded $68.63 million in net outflows over the past several days.

The inability to hold above $3.00 during this period of ETF excitement shows how fragile investor confidence has become. Instead of building on the momentum, many market participants appear to be cutting exposure and moving to the sidelines.

XRP’s Technical Picture Turns Bearish

Charts confirm the breakdown. XRP is now trading below its 30-day moving average at $2.89, which signals that the short-term trend has shifted toward sellers.

The Relative Strength Index has dropped to 38 after sitting near overbought levels earlier this week. This sharp MOVE indicates that selling pressure has intensified, although RSI is approaching oversold territory. A dip closer to 30 could open the door to a temporary rebound if sellers begin to tire.

What to Expect Next

The $2.80 support level has become the key price level for traders. A clear break lower WOULD confirm a bearish continuation and put the $2.70 region in play if weak sentiment continues.

If buyers can defend $2.80 and push XRP back above the $2.89 to $2.90 range, that could mark the first step toward stabilization. Traders will be looking to to see if today’s crash develops into a deeper correction or if it sparks a recovery attempt.

At the time of writing, XRP is sitting at $2.8470.