Warner Bros. Discovery (NASDAQ:WBD) Surges as Morgan Stanley Hikes Price Target on ’Stronger than Expected Performance’

Media giant defies streaming headwinds with unexpected momentum.

Morgan Stanley just placed a bigger bet on Warner Bros. Discovery—and the market's following suit. The financial giant boosted its price target for WBD after the entertainment conglomerate delivered what analysts called 'stronger than expected performance' across key metrics.

The Streaming Wars Aren't Over Yet

While competitors struggle with subscriber churn and content costs, Warner Bros. Discovery appears to be finding its footing. The company's diversified approach—spanning theatrical releases, cable networks, and streaming services—seems to be paying off where pure-play streamers are stumbling.

Wall Street Takes Notice

Morgan Stanley's target hike signals growing confidence in the media company's ability to navigate industry turbulence. The move comes as traditional entertainment companies face unprecedented pressure from digital disruption and changing consumer habits.

Of course, this being Wall Street, the optimism comes with a side of 'we'll believe it when we see sustained quarterly results'—because nothing gets analysts more excited than the chance to reverse their position next earnings season.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

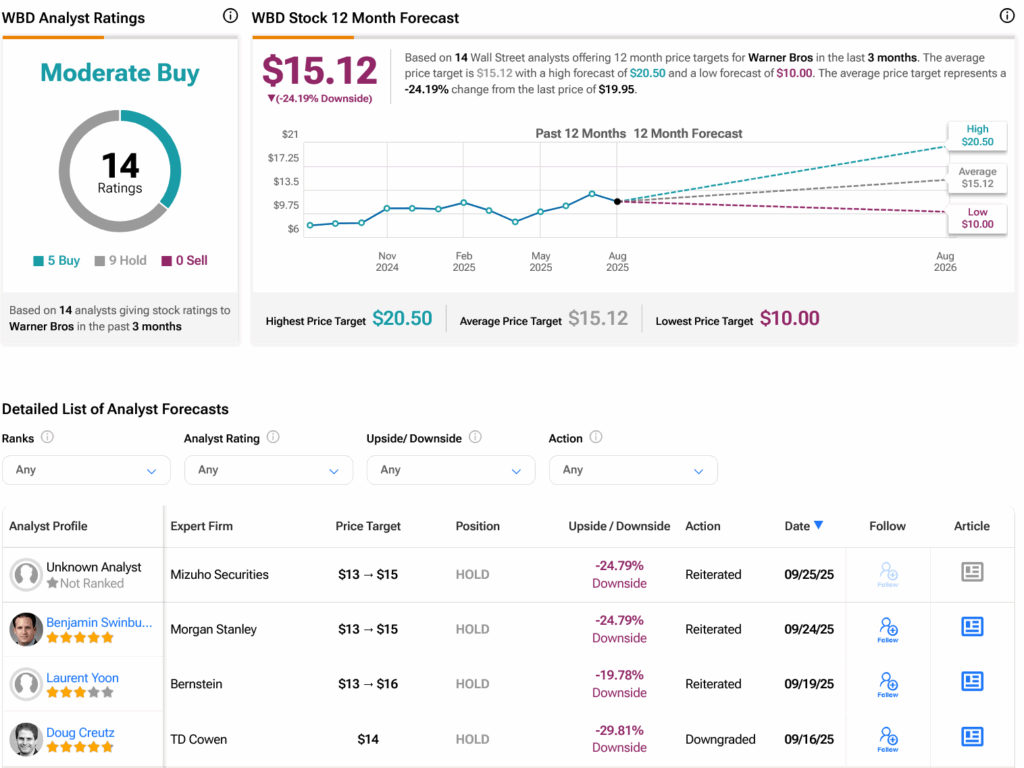

Morgan Stanley, via analyst Benjamin Swinburne—who has a five-star rating on TipRanks—hiked his price target from $13 to $15 per share, while maintaining an Equal Weight rating on the stock. The merger was not really what fired up Swinburne’s interest, but rather a better performance than expected in year-to-date numbers.

But the merger certainly played a factor in things. Swinburne pointed out that the merger is fueling a “bull case” for Warner stock that could see shares ultimately go as high as $22 each. And, Swinburne acknowledged, the “bull case” may not even need a merger to succeed. The bull case could ultimately reach that level “fundamentally,” reports noted.

Cramer Weighs In

That was not all, however. As it turns out, well-known CNBC analyst Jim Cramer stepped in to weigh in on the whole merger concept, and he is wondering the same thing we are: just how big a factor is Netflix in all of this?

Cramer noted, “But David, this is possible, I’m gonna throw a bomb at you. We all keep saying, well, Disney (DIS) can’t be Netflix (NFLX). Comcast (CMCSA) can’t be Netflix. Well because they have too much baggage with carriage, could this be any chance that they’ve been modelling this off of Netflix?” While admittedly, the idea that Netflix WOULD buy Warner might seem like a bit of a long shot, there are certainly valid reasons to get in on that action. Production facilities and a huge content library would likely outweigh the image dissonance that comes from the anti-cable owning a major cable operation.

Is WBD Stock a Good Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 138.80% rally in its share price over the past year, the average WBD price target of $15.12 per share implies 24.19% downside risk.

Disclosure