Costco’s Stock Slips Despite Earnings Beat: Market Ignores Strong Financial Results

Costco delivers another earnings surprise—and investors respond by hitting the sell button.

BEATING EXPECTATIONS, LOSING FAVOR

The wholesale giant smashed analyst estimates across key metrics, posting numbers that should have triggered rally mode. Instead, shares dipped in after-hours trading as Wall Street demonstrated its signature fickle nature.

THE WALL STREET PARADOX

When solid fundamentals collide with market sentiment, logic often gets left in the discount aisle. Costco's performance exceeded projections on revenue and profit margins, yet traders focused on peripheral concerns rather than core strength.

MARKET REALITY CHECK

Sometimes beating estimates isn't enough—you need to beat them by the exact margin analysts secretly hoped for. Another reminder that traditional markets operate on emotional algorithms rather than pure mathematics. At least crypto traders are transparent about their volatility.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For what was its Fiscal fourth quarter, the Seattle-based company reported earnings per share (EPS) $5.87, which was above the $5.81 consensus forecast on Wall Street. Revenue in the period totaled $86.16 billion, which topped the $86.06 billion that had been expected among analysts.

Same-store sales growth of 6.4% bested the 5.9% that was anticipated on Wall Street. E-commerce sales ROSE 13.6% during the latest quarter from a year earlier. COST stock has struggled this year as analysts and investors express concerns about the company’s growth trajectory as the U.S. economy shows signs of cooling off.

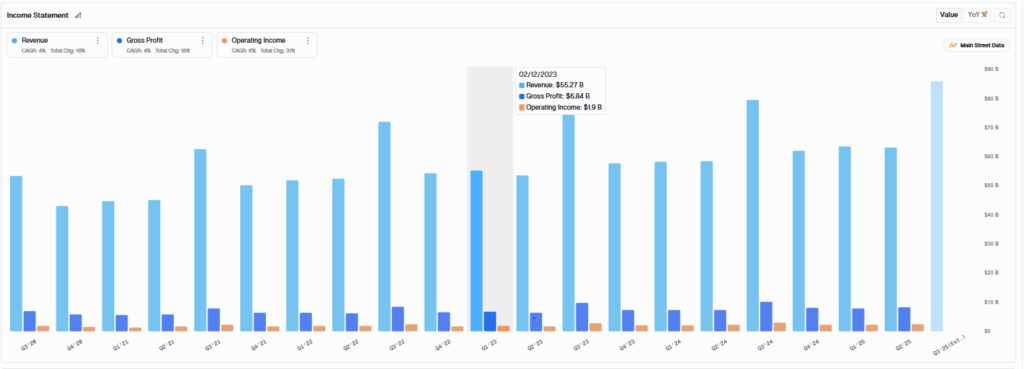

Costco’s income statement.: Main Street Data

Decelerating Growth

Costco’s same-store sales growth, which was reported along with the company’s August sales data, marks two consecutive quarters of deceleration. Costco announced that it opened a total of 24 new store locations during the quarter as it continues to expand.

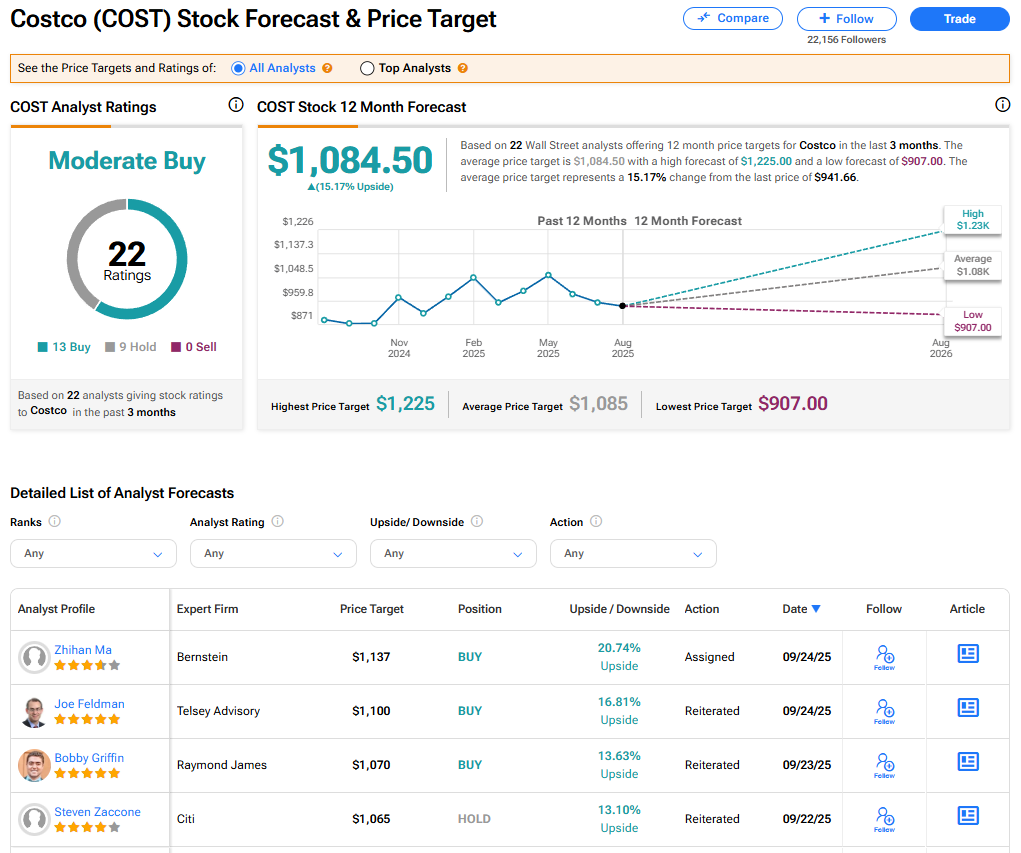

Is COST Stock a Buy?

The stock of Costco Wholesale has a consensus Moderate Buy rating among 22 Wall Street analysts. That rating is based on 13 Buy and nine Hold recommendations issued in the last three months. The average COST price target of $1,084.50 implies 15.17% upside from current levels. These ratings could change after the company’s financial results.