Goldman Sachs Warns: ’Hold Your Horses’ on Oklo Stock Amid Nuclear Energy Hype

Wall Street's gold-plated oracle just pumped the brakes on one of tech's hottest tickets.

The Reality Check

Goldman Sachs analysts slammed the pause button on Oklo's meteoric rise—issuing a cautious stance that sent ripples through energy trading desks. Their conservative valuation model clashes with retail investors' nuclear energy fantasies.

Market Whiplash

Traders who chased the pre-revenue hype now face sobering resistance levels. The firm's technical analysis suggests consolidation before any meaningful breakout—a classic case of institutional temperance crashing retail's momentum party.

Nuclear's Narrative Problem

While advanced fission technology promises revolutionary power solutions, Goldman's report highlights regulatory hurdles that could delay commercial deployment by quarters. The disconnect between prototype excitement and revenue reality grows wider.

Because nothing says 'prudent investment' like betting on unproven technology before breakfast—Wall Street's version of buying lottery tickets with other people's money.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The surge has come against a backdrop of what Goldman Sachs analyst Brian Lee sees as the “early stages of a resurgence” for the nuclear energy industry, fueled by favorable policies and strong electricity needs from data centers.

At a time of an intensifying race to develop small modular reactors (SMRs) in the US, OKLO has built one of the largest order backlogs, with a project pipeline exceeding 14GW. That said, the company has not yet finalized a power purchase agreement (PPA) with any clients and OKLO remains a pre-revenue company.

That has made it a “catalyst-driven stock,” and while the analyst sees potential for “continued near-term catalysts,” he believes the company needs to secure finalized customer agreements and a reliable supply of HALEU (High-Assay Low-Enriched Uranium) to sustain accelerated deployments beyond 2035.

In the meantime, OKLO is progressing with its sodium-cooled fast fission design, the Aurora Powerhouse, aiming for commercialization by late 2027 or early 2028. It intends to do so by following an own-and-operate model, taking responsibility for the full lifecycle – covering technology design, licensing, construction, customer offtake agreements, and ongoing operations and maintenance.

While the company plans to use EPC contracts and other partnerships to ease some of the load, Lee estimates it will still need to raise about $14 billion through the mid-2040s so the business can keep on operating until it is able to generate sufficient free cash FLOW to sustain itself. Although the own-and-operate approach gives OKLO greater control over its operations, Lee sees the substantial capital requirements as a “meaningful risk to OKLO’s success.”

The licensing process is another hurdle. Oklo has yet to secure approval but intends to submit its combined operating license application (COLA) for the 75MW Aurora Powerhouse to the Nuclear Regulatory Commission in Q4. The timing could be favorable thanks to the Advance Act, which is expected to lower licensing costs. Even so, Lee cautions that the review, despite being streamlined by Oklo’s custom COLA, will likely still take 24–36 months – and the outcome is by no means guaranteed.

Lee also thinks OKLO’s fuel strategy is innovative but adds further risk. The Aurora Powerhouse’s HALEU fuel can run on freshly enriched HALEU, downblended stockpiles, or recycled nuclear waste, giving it flexibility. However, the global fuel supply chain is built almost entirely around LEU, and scaling HALEU will demand a lot of investment and take years to develop.

So, what does this all mean for investors? Lee initiated coverage of OKLO with a Neutral rating and $117 price target, implying the shares are fully valued. (To watch Lee’s track record, click here)

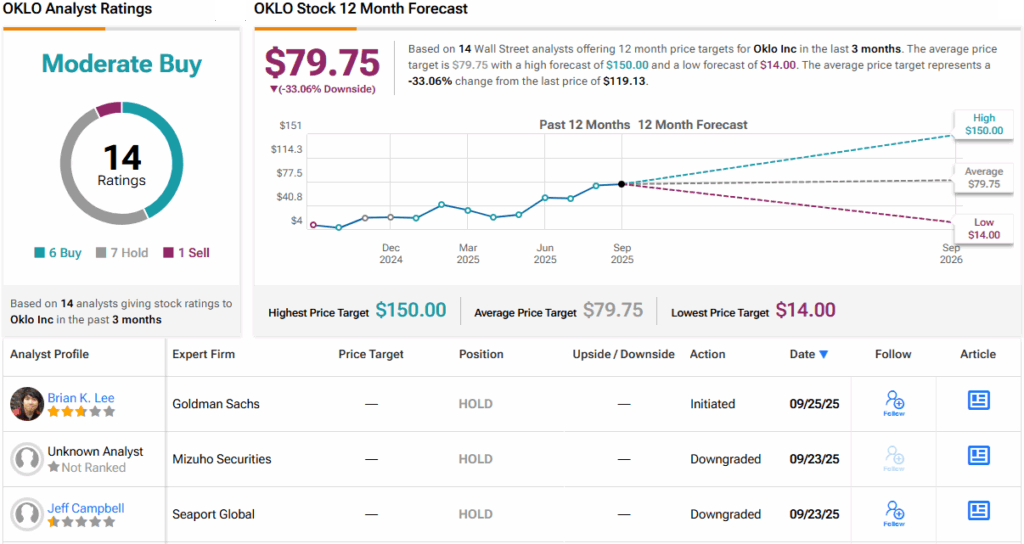

OKLO stock represents something of a conundrum on Wall Street right now. On the one hand, the stock claims a Moderate Buy consensus rating, based on a mix of 6 Buys, 7 Holds, plus 1 Sell. However, the average price target lands at $79.75, a figure that sits 33% below the current share price. It will be interesting to see whether analysts update their targets or downgrade their ratings shortly. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.