Qatar’s Banking Giant Leaps into JPMorgan’s Blockchain Network - Payments Revolution Accelerates

Traditional finance's blockchain adoption hits warp speed as Middle Eastern banking heavyweight joins Wall Street's digital payments race.

The Blockchain Bandwagon Gains Momentum

Qatar's largest financial institution just plugged into JPMorgan's blockchain infrastructure, signaling that even the most conservative banking giants can't ignore distributed ledger technology anymore. The move positions the Qatari bank alongside other global financial players already leveraging blockchain for near-instant settlements.

Cutting Through Banking Red Tape

This integration bypasses traditional correspondent banking networks that typically add days to international transfers. Instead of waiting for multiple intermediaries to manually verify transactions, the blockchain network processes payments in minutes—proving that sometimes the most revolutionary changes come from within the system itself.

Wall Street Meets the Desert

The partnership represents another victory for enterprise blockchain adoption, showing that the technology isn't just for crypto anarchists anymore. When banking traditionalists start embracing distributed ledgers, you know the financial landscape is shifting beneath everyone's feet—even if they're still pretending blockchain and cryptocurrency are completely separate things.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Warren Buffett-backed company is reportedly working with advisors on a potential sale, which WOULD create one of the world’s largest independent petrochemicals units. The divestment is expected to be announced in the coming weeks, provided there are no last-minute hurdles.

OXY Is Set on a Debt Reduction Drive

A potential multi-billion-dollar deal could help Occidental reduce the heavy debt it took on from past acquisitions, including the $55 billion purchase of Anadarko Petroleum in 2019 and $12 billion purchase of CrownRock in 2023. As of June 30, 2025, the company’s long-term debt stood at $23.34 billion. Since announcing the CrownRock deal in late 2023, Occidental has already sold more than $4 billion in assets and paid down $7.5 billion in debt.

Selling the OxyChem unit would allow the company to go well beyond its original goal of raising $4.5 to $6 billion through asset sales after the CrownRock acquisition. This MOVE also follows a series of divestitures, including the recent sale of four Permian Basin development assets in August 2025.

Ongoing Challenges in the Petrochemical Market

Occidental’s decision comes at a challenging time for petrochemical producers. Industry profits have declined due to oversupply from new capacity in the U.S. and Middle East, coupled with increased output from China. Several companies have already implemented large-scale layoffs as a result of these pressures.

Meanwhile, the oil and gas industry is also struggling with a prolonged drop in oil prices. OXY stock has lost 2.4% year-to-date, while rivals Chevron (CVX) has surged more than 14% and ExxonMobil (XOM) has gained nearly 12%.

Is OXY Stock Good to Buy?

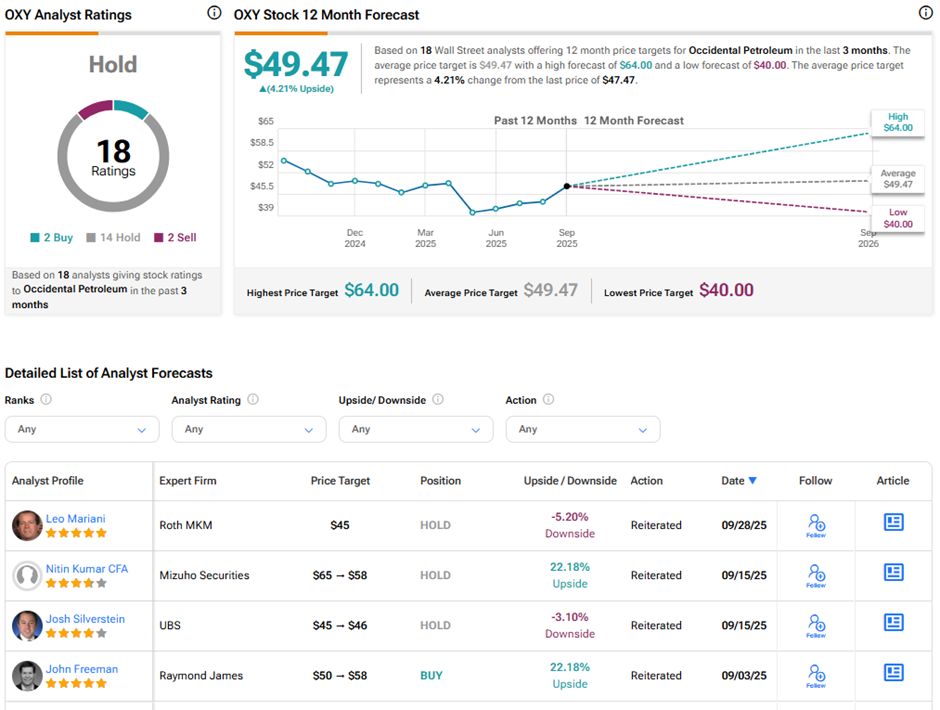

Despite debt reduction progress, analysts remain cautious on Occidental’s long-term outlook. On TipRanks, OXY stock has a Hold consensus rating based on two Buys, 14 Holds, and two Sell ratings. The average Occidental Petroleum price target of $49.47 implies 4.2% upside potential from current levels.