Hyperliquid NFT Storm: Sells for $467K - Defying Crypto Winter

Digital collectible shatters expectations as NFT market shows surprising resilience

The Price Tag That Turned Heads

A single Hyperliquid NFT just commanded $467,000 at auction - enough to buy a luxury penthouse in some cities, or as Wall Street analysts might call it, 'pocket change during their lunch break.' The sale cuts through recent market pessimism like a hot knife through butter.

Market Mechanics Defying Gravity

While traditional finance wrestles with inflation numbers, this digital asset bypasses conventional valuation models entirely. The buyer isn't just acquiring pixels - they're betting on Web3 infrastructure while traditional VCs still struggle to pronounce 'metaverse.'

Liquidity Where You Least Expect It

The Hyperliquid ecosystem continues generating eye-watering numbers that would make your average hedge fund manager reconsider their career choices. At $467,000 per NFT, we're witnessing either brilliant speculation or the financial equivalent of setting money on fire for warmth - only time will tell which.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A better-than-expected report could fuel further gains in TSLA stock, keeping the company in the spotlight for growth-focused investors. Investor excitement around TSLA has largely been driven by Optimism for self-driving technology, with a positive Q3 report potentially fueling the rally.

Tesla Q3 Delivery Forecasts

Wall Street currently projects Tesla’s Q3 2025 deliveries at around 447,000 vehicles, down about 3% from the 463,000 cars sold in Q3 2024, according to FactSet. Some analysts, including Tesla researcher Troy Teslike, are more optimistic, forecasting deliveries closer to 472,000 vehicles, which WOULD represent a 2% increase from last year.

Notably, Goldman Sachs expects Tesla to deliver 455,000 units in Q3. Meanwhile, Deutsche Bank projects 461,500 vehicles, roughly flat year-over-year but up 20% from the previous quarter.

Even with modest growth or a slight decline, the third quarter is expected to show improvement compared with the first half of 2025. During that period, Tesla delivered 721,000 cars, marking a 13% drop from the same time last year.

Tesla Eyes Q3 Delivery Beat

Firstly, Tesla sales likely benefited from consumers rushing to purchase vehicles before the $7,500 federal EV tax credit neared expiration, driving a short-term boost in demand.

Moreover, the revamped Model Y, featuring an updated design, improved comfort, and new technology, is expected to drive higher deliveries after early 2025 production and sales lulls. Tesla also completed an intensive factory revamp earlier this year to retool production for the new Model Y.

Furthermore, Tesla sales have been affected by Elon Musk’s political affiliations and controversial statements. However, his recent step back from politics and renewed focus on the company should help ease these concerns.

What Is the Price Target for Tesla Stock?

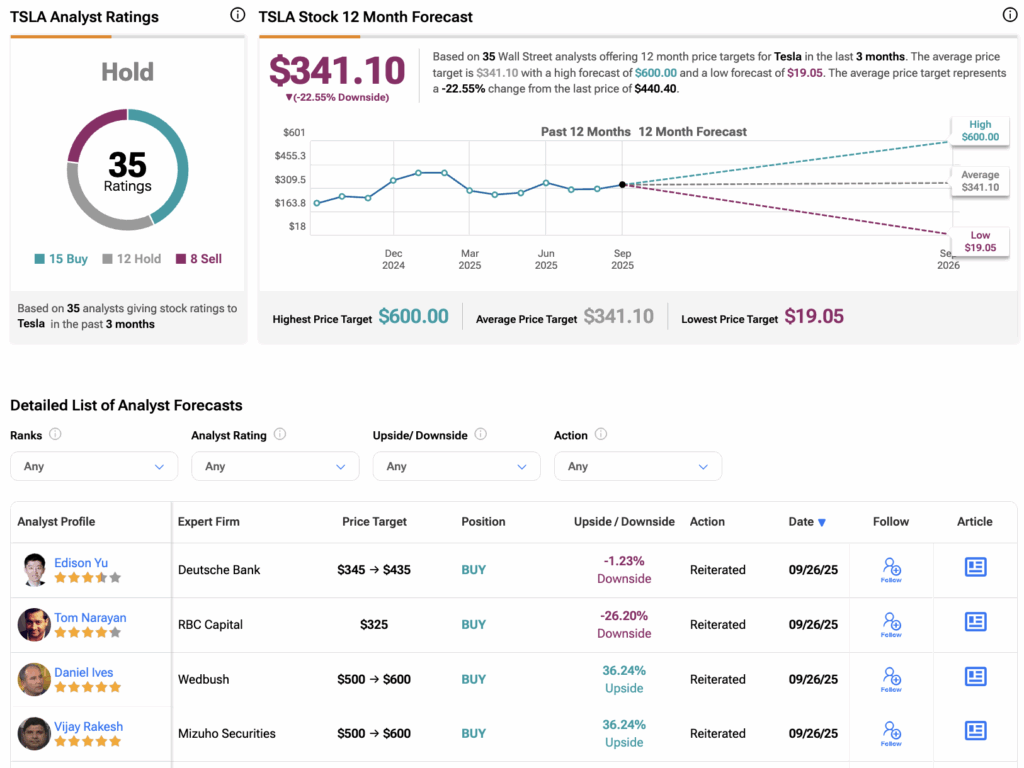

According to TipRanks, TSLA stock has received a Hold consensus rating, with 15 Buys, 12 Holds, and eight Sells assigned in the last three months. The average Tesla stock price target is $341.10, suggesting a potential downside of over 20% from the current level.