Swift and Consensys Launch Blockchain Ledger to Revolutionize Global Payments

Global financial messaging giant Swift partners with blockchain powerhouse Consensys to overhaul cross-border payment infrastructure

The New Plumbing

Traditional payment rails get a blockchain backbone as two industry titans collide. Swift's massive network meets Consensys' Ethereum expertise in a play to modernize money movement across borders.

Cutting Out the Middlemen

Banks and financial institutions face potential disintermediation as the new ledger promises direct settlement capabilities. The system aims to slash transaction times from days to minutes while reducing costs that typically eat into corporate profits.

Wall Street's Cynical Take

Because nothing says innovation like two established players creating yet another solution that promises to change everything while maintaining their market dominance. The real test comes when actual transaction volume hits the network—not when press releases hit inboxes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last week, The Wall Street Journal reported that BYD’s August sales (based on new car registrations) in Europe tripled year-over-year to 9,130 vehicles across the European Union, according to the European Automobile Manufacturers’ Association. In fact, including the U.K., Iceland, Liechtenstein, Norway, and Switzerland, August registrations totalled 11,455 vehicles, reflecting robust demand for BYD’s electric and hybrid vehicles.

BYD Eyes International Growth

BYD’s 20% exports estimate for 2025 reflects a major jump from international sales of less than 10% of the total 4.26 million deliveries last year. The South China Morning Post cited Li Yunfei, BYD’s general manager of branding and public relations, who expects 800,000 to 1 million deliveries outside mainland China this year, compared with estimated total sales of 4.6 million units.

The company’s optimistic outlook for overseas sales is supported by enhanced logistics and new models. Yunfei highlighted that BYD’s own fleet of car-carrier ships is fueling the surge in exports. Notably, the company now has eight large vessels, with the largest one capable of transporting 9,200 vehicles.

Furthermore, BYD aims to double its showrooms in Europe to 2,000 in 2026 and create a complete local supply chain for its European production. The company’s assembly plant in Hungary, which boasts an annual capacity of 150,000 units, is scheduled to start production in early 2026. BYD also has factories in Thailand and Brazil.

BYD has grown rapidly in recent years, surpassing EV giant Tesla (TSLA) as the world’s top EV seller in 2024. The growing focus on international business comes as BYD and peers face intense competition and demand saturation in the Chinese EV market. In fact, BYD is facing regulatory scrutiny in China for triggering price wars by offering excessive discounts, which impact the margins of EV makers. Earlier this month, Reuters reported that BYD has lowered its 2025 deliveries goal to 4.6 million vehicles from 5.5 million units.

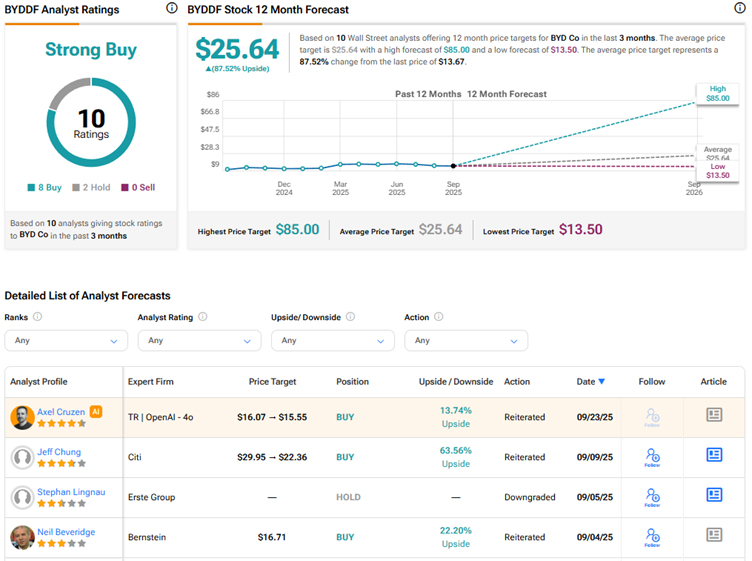

Is BYDDF Stock a Good Buy?

Despite ongoing challenges, Wall Street has a Strong Buy consensus rating on BYD Co. stock based on eight Buys and two Hold recommendations. The average BYDDF stock price target of $25.64 indicates 87.5% upside potential.