IPO Resurgence 2025: Figma, Bullish, Klarna Fuel $31 Billion Market Revival

Wall Street's comeback kids just rewrote the playbook.

The Rebound Nobody Saw Coming

Figma's design-first approach shattered expectations while Bullish leveraged crypto's institutional wave to dominate their debut. Klarna's buy-now-pay-later pivot proved even fintech skeptics wrong—for now.

Winners Circle Dynamics

These three players didn't just exceed targets—they redefined sector valuations overnight. The $31 billion surge signals investor appetite for hybrid models blending traditional metrics with disruptive tech.

Behind the Numbers

Market analysts whisper about unsustainable multiples while counting their paper gains. Because nothing says 'healthy market' like 20x revenue projections based on 'synergy potential.'

The IPO ice age officially thawed—but whether this marks a new spring or temporary thaw remains Wall Street's billion-dollar guessing game.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

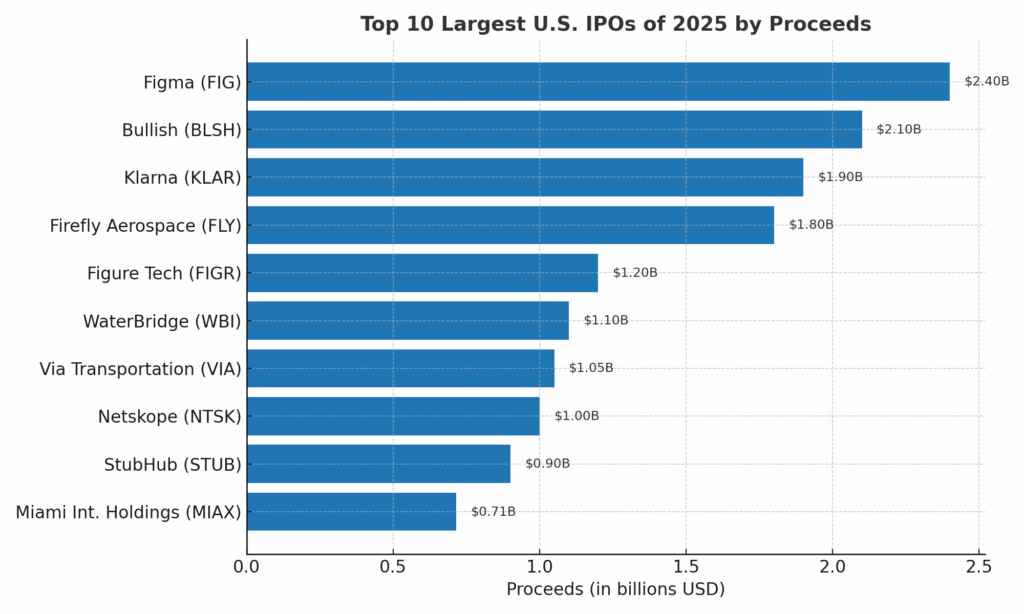

Money Raised and Market Leaders

In the first half of the year, IPOs raised more than $31 billion. That figure already beats the full-year total for 2024. Nasdaq accounted for $21.3 billion, while the NYSE added $8.7 billion. Technology and financial technology listings drove most of the volume.

The biggest deals included Figma Inc. (FIG) with $2.4 billion, Bullish (BLSH) with $2.1 billion, and Klarna Group Plc (KLAR) with $1.9 billion. Firefly Aerospace Inc. (FLY) raised $1.8 billion, while Figure Technology Solutions (FIGR), WaterBridge Infrastructure (WBI), and Via Transportation Inc. (VIA) each brought in more than $1 billion. Netskope Inc. (NTSK), StubHub Holdings Inc. (STUB), and Miami International Holdings (MIAX) rounded out the top ten with proceeds ranging from $715 million to $1 billion.

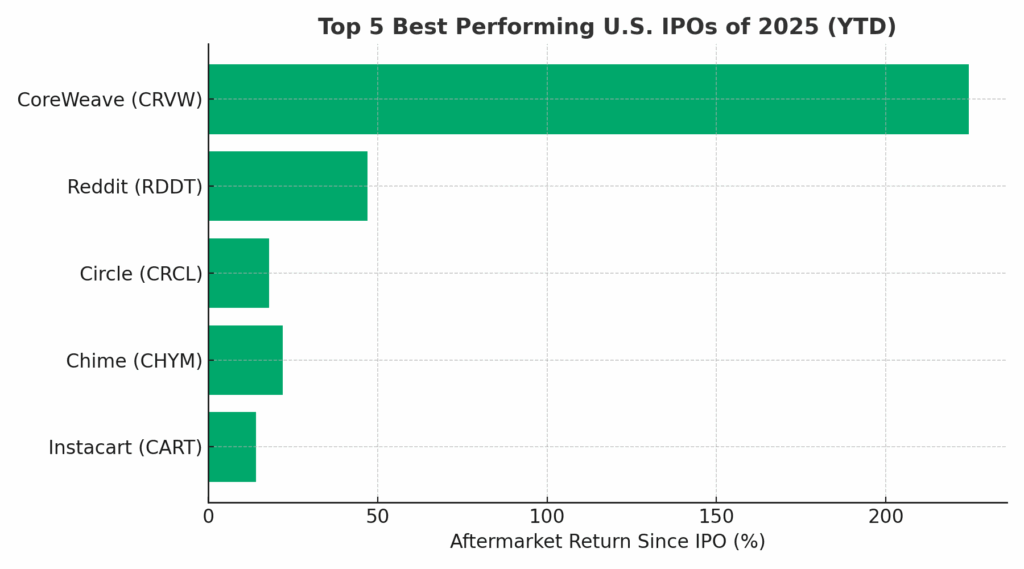

Aftermarket Hits and Misses

Some of the largest names have delivered standout gains. Reddit (RDDT) has surged nearly 47% year-to-date. CoreWeave (CRWV) has climbed about 225%, and Circle (CRCL) has advanced close to 18%. These moves show clear investor support for companies tied to cloud, data, and digital networks.

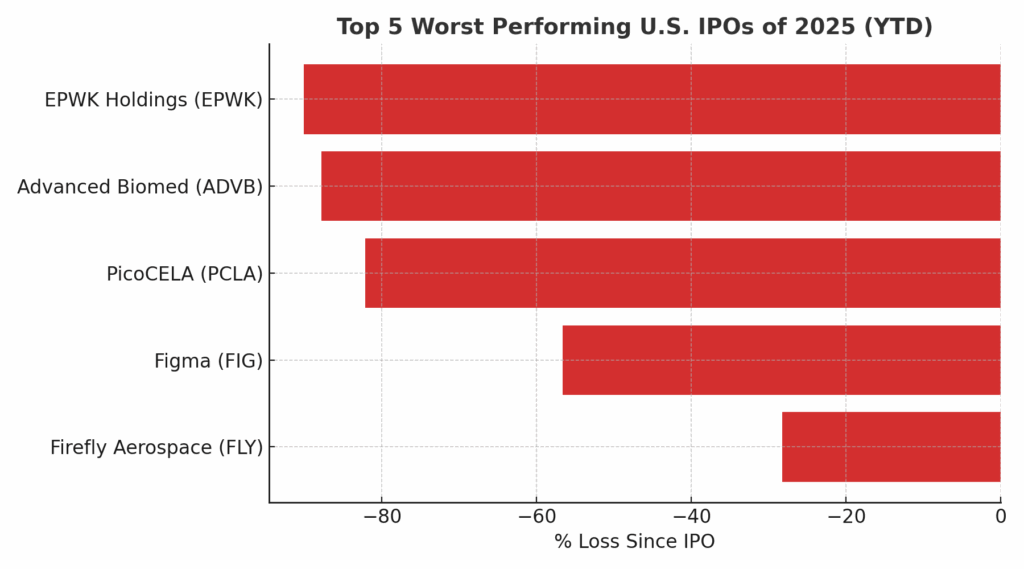

Others have struggled. Figma Inc. (FIG), despite its hyped debut, has declined by about 57% since August. Firefly Aerospace Inc. (FLY) has dropped about 28% since listing in mid-August, while eToro (ETOR) trades NEAR $41, about 39% lower year-to-date.

The sharpest declines have been concentrated in smaller and riskier names. Advanced Biomed Inc. (ADVB) has fallen almost 88% since April. EPWK Holdings Ltd. (EPWK) has slid 90% from its spring debut. PicoCELA Inc. (PCLA) has declined by roughly 82% since February. These figures highlight how outcomes in the IPO market can diverge widely depending on sector and demand.

Outlook

Momentum remains strong with more deals expected in the final quarter. With IPOs already outpacing recent years in both count and capital, 2025 is shaping up to be the most active year since the peak of 2021. While technology and financial technology continue to lead in size and returns, the gap between winners and laggards shows that investors remain selective.