BREAKING: SEC Withdraws Delays on Solana and XRP ETFs - Crypto Markets Poised for Liftoff

The regulatory dam just cracked—SEC pulls back on Solana and XRP ETF delays in a surprise move that's sending shockwaves through digital asset markets.

Regulatory Thaw Emerges

After months of regulatory gridlock, the Securities and Exchange Commission abruptly reversed course on two of the most anticipated crypto investment vehicles. The timing couldn't be more perfect—just as institutional money starts circling the crypto space like sharks smelling blood in water.

Market Implications Unleashed

Solana's lightning-fast network and XRP's banking ambitions suddenly look a lot more attractive to Wall Street's suits. This isn't just about regulatory approval—it's about mainstream financial infrastructure finally catching up to blockchain innovation.

Traditional finance analysts are already scrambling to update their spreadsheets while crypto natives just shrug and say 'told you so.' The SEC's sudden pivot suggests even regulators can't ignore the tidal wave of institutional demand forever—though they'll probably still find ways to slow-walk the inevitable.

Another reminder that while traditional finance debates paperwork, crypto builds the future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Experimental Release

Released quietly as a post on the developer forum Hugging Face, DeepSeek said that the V3.2-Exp was an “experimental release” that was more efficient to train and better at processing long sequences of text than previous iterations.

The Hangzhou-based company described the latest model as an “intermediate step toward our next-generation architecture.”

It said in the post that it “builds upon V3.1-Terminus by introducing DeepSeek Sparse Attention—a sparse attention mechanism designed to explore and validate optimizations for training and inference efficiency in long-context scenarios.”

It added, again directed at tech boffins,: “This experimental release represents our ongoing research into more efficient transformer architectures, particularly focusing on improving computational efficiency when processing extended text sequences.”

DeepSeek shook-up the U.S. tech sector earlier this year with its R1 model, which was just as effective as other models but cost just $294,000 to train.

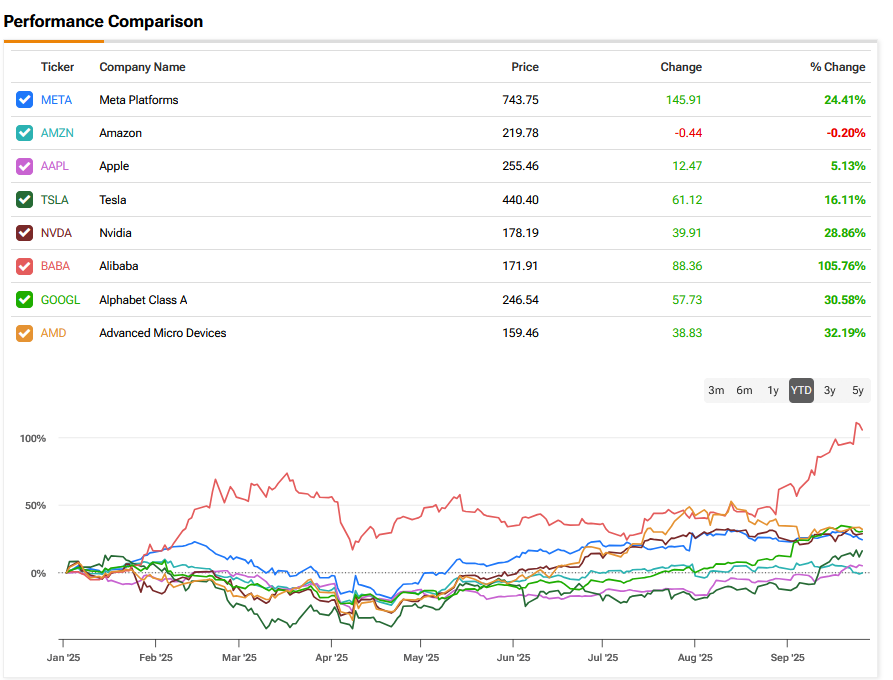

It prompted global investors to dump tech stocks as they worried the new models could threaten the dominance of AI leaders including Nvidia and Advanced Micro Devices (AMD).

Although, they have broadly recovered since then – see above.

Nanoseconds Behind

The DeepSeek post came just 24 hours after Nvidia CEO Jensen Huang says China is just “nanoseconds behind” the U.S. in chipmaking and that Washington should stop trying to wall off the market.

Huang argued that allowing companies like Nvidia to sell into China WOULD serve American interests by spreading U.S. technology and extending its geopolitical influence. “We’re up against a formidable, innovative, hungry, fast-moving, underregulated [competitor,” Huang said, talking about the pedigree of China’s engineers.

His comments come as Nvidia hopes to ship its H20 AI GPU to Chinese customers again, following a months-long pause tied to new U.S. export rules. Nvidia is reportedly already working on a successor chip designed to comply with current restrictions while offering better performance.Chinese AI developer DeepSeek has released its latest model confirming the opinion of rival Nvidia that the country is just “nanoseconds” behind the U.S. when it comes to innovative technology.

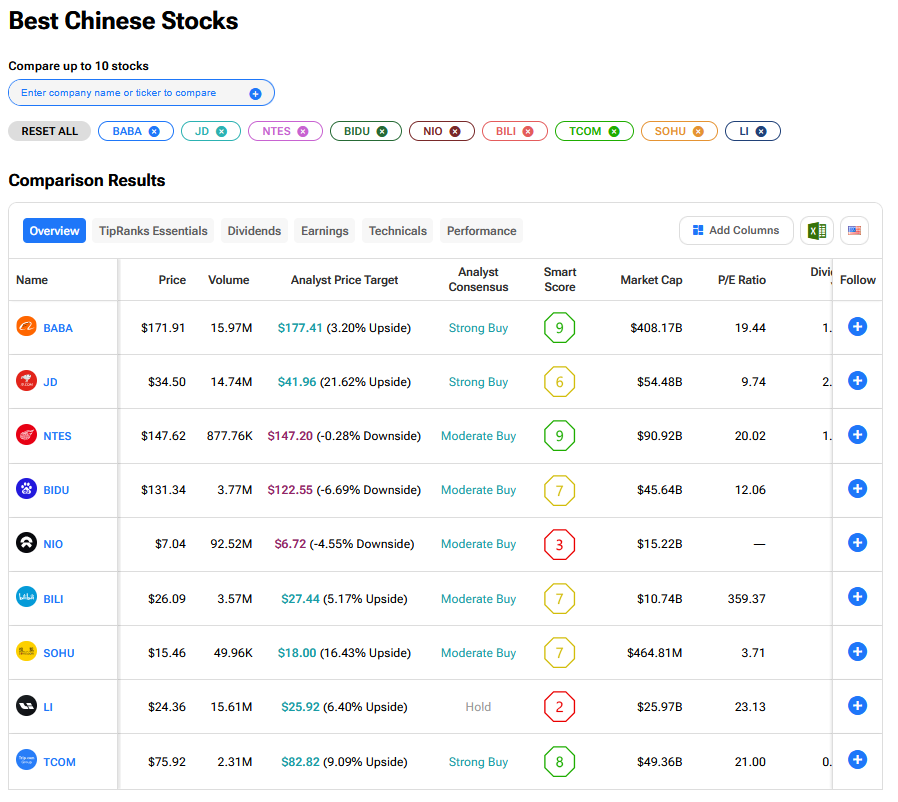

What are the Best Chinese Stocks to Buy Now?

We have rounded up the best Chinese stocks to buy now using our TipRanks comparison tool.