This Is Why Lucid (LCID) Is Attracting Former Tesla Buyers

Lucid Motors just flipped the EV script—and Tesla loyalists are taking notice.

Why the sudden shift? Three factors are driving the exodus.

Range That Actually Delivers

Lucid's 520-mile EPA rating isn't just beating Tesla—it's rewriting the rulebook on electric endurance. No more range anxiety theater.

Luxury That Doesn't Compromise

While Tesla chases volume, Lucid built a cockpit that makes Mercedes blush. Real materials, actual craftsmanship—not another minimalist apology.

The Musk Fatigue Factor

Elon's Twitter circus finally has consequences. Serious buyers want electric vehicles, not quarterly drama subscriptions.

Wall Street's watching the premium EV space heat up—though let's be honest, most analysts still can't tell a battery cell from a prison cell.

One thing's clear: the EV revolution finally has a credible alternative to the Tesla monopoly.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And although Winterhoff admitted that Lucid still faces some big challenges going forward, he also pointed to some positive signs, such as Uber’s (UBER) growing interest in the company. In fact, Uber has increased its stake in Lucid and placed an order for 20,000 units of the upcoming Lucid Gravity, which is an SUV that will compete with the Tesla Model X. He also stated that Lucid’s next big step will be launching a more affordable SUV in the $50,000 range.

Interestingly, Winterhoff also said that the Model S hasn’t changed in 12 years, but that’s not entirely accurate. Indeed, Tesla gave the car a major performance upgrade with the Plaid version in 2021 and refreshed it again in 2024. While the outside looks similar to the original, much of the interior and technology has been updated. That said, sales of the Model S and Model X have dropped over time, and Tesla is now working to make them more appealing by offering a new “Luxe” package to attract buyers.

Which EV Stock Is the Better Buy?

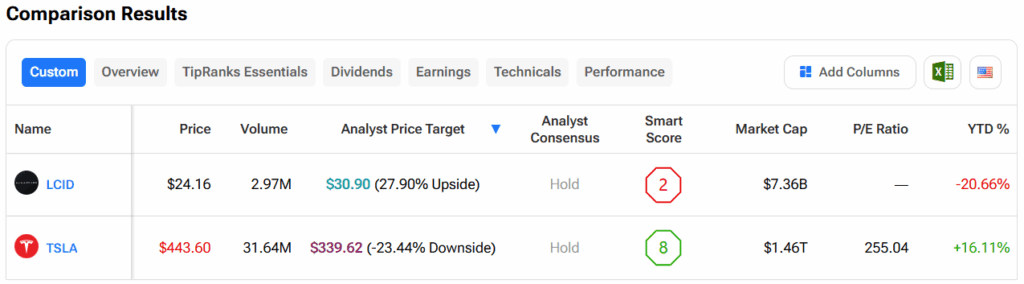

Turning to Wall Street, out of the two stocks mentioned above, analysts think that LCID stock has more room to run than TSLA. In fact, LCID’s price target of $30.90 per share implies almost 28% upside versus TSLA’s 23.4% loss.