The Microsoft Pivot: MSFT Stock Notches Up on Strategic Mind Changes

Microsoft's latest strategic shifts send NASDAQ ticker MSFT climbing as the tech giant rewrites its playbook.

The Reinvention Gambit

Redmond's course corrections span cloud infrastructure, AI integration, and enterprise solutions—proving even tech titans need occasional reboots. The market responds with upward momentum, rewarding flexibility in an industry that punishes stagnation.

Wall Street's mood swings faster than a crypto trader's portfolio—today's genius is tomorrow's restructuring charge. But when Microsoft pivots, investors listen, even if they're not entirely sure what the buzzwords mean.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, the plan to bring out a data center in Caledonia met with opposition, not only from area residents, but also from area elected officials. The “community feedback” that Microsoft got was sufficient for it to pull the plug on plans, and look for somewhere else to build. A Microsoft statement noted, “We remain committed to investing in Southeast Wisconsin and look forward to working with the Village of Caledonia and Racine County leaders to identify a site that aligns with community priorities and our long-term development goals.”

Microsoft also pulled the plug on a planned sublease listing, which offered 480,000 square feet at Millennium Corporate Park. It also may be planning to increase its lease at the Redmond Town Center, reports noted. Both of these are likely in keeping with Microsoft’s recent return-to-office (RTO) mandates. Returning to the office requires enough space to return to, though Microsoft will be leaving money on the table with this without the payments on the sublease deal.

Xbox Game Pass Price Hikes Fall Flat in Some Countries

Meanwhile, concerns that Microsoft’s Xbox Game Pass Ultimate may not be the bargain that it once was seem to be prompting a bit of a sea change, at least in some countries. While it was not immediately clear which countries will benefit from the delay, the reports suggest that the delay is the result of “local requirements” in the regions in question.

So the massive gamer outrage seen has nothing to do with it, and Microsoft will be hiking prices over the users’ objections. That may come back to haunt Microsoft later, but prices raised can be lowered, if enough people drop the service.

Is Microsoft a Buy, Hold or Sell?

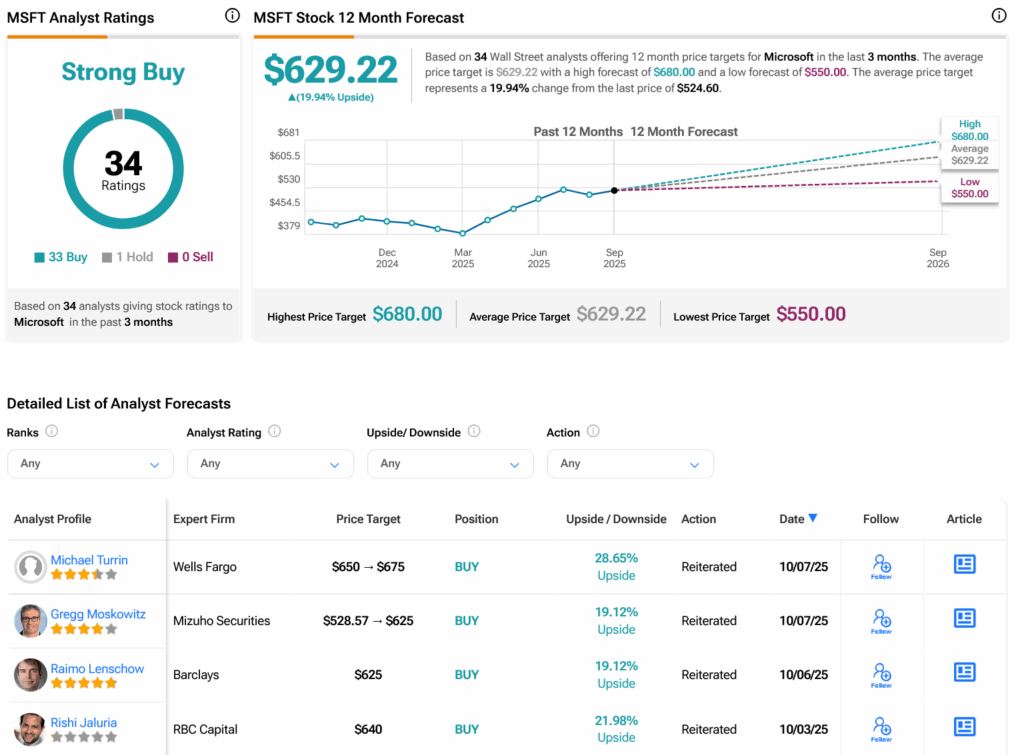

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 25.52% rally in its share price over the past year, the average MSFT price target of $629.22 per share implies 19.94% upside potential.

Disclosure