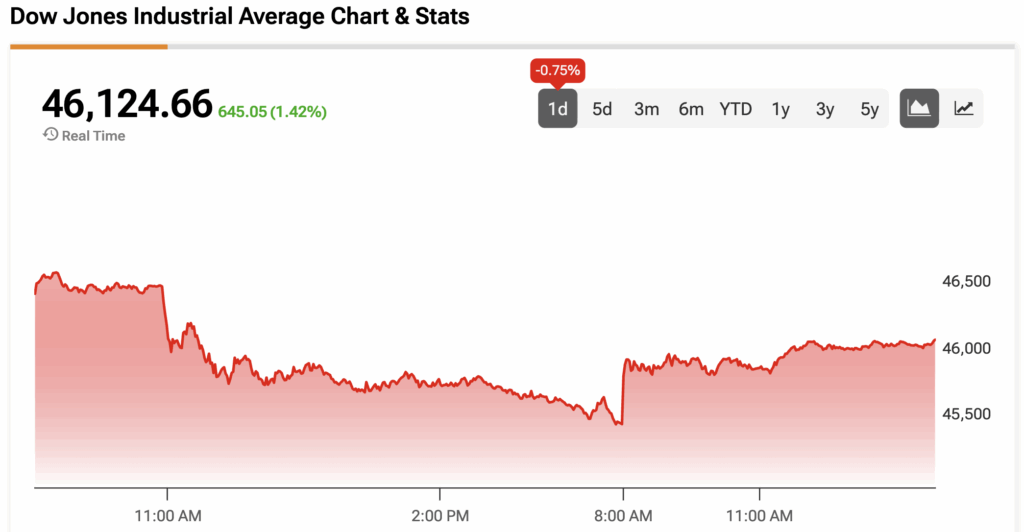

Dow Jones Index Today: DJIA Rebounds as Trump Softens China Tariff Stance, Pushes Gaza Peace Proposal

Markets breathe easier as geopolitical tensions ease

Trade War Thaw

Investors cheered the reduced tariff rhetoric, sending blue chips climbing as trade fears subsided. The measured tone suggests both economic giants might actually prefer making money over political posturing—revolutionary concept.

Middle East Gambit

While traders focused on China, the administration doubled down on Middle East diplomacy. Because nothing says 'stable markets' like betting on peace in a region that's been at war since biblical times.

Wall Street's Selective Hearing

The Street heard what it wanted—tariff threats fading—and ignored what it didn't. Classic market behavior: cherry-picking geopolitical developments while pretending this time is different. The DJIA's recovery proves once again that markets will rally on any excuse that doesn't involve actual economic fundamentals.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Over the weekend, TRUMP softened his stance, saying in a Truth Social post, “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I.”

In addition, Treasury Secretary Scott Bessent said he believes Trump will still meet with Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) Summit, which begins on October 31, as previously scheduled during a phone call between the two leaders.

Trump has an action-packed schedule today, with trips to both Israel and Egypt. In a speech to the Knesset, Israel’s Parliament, Trump declared the end of the Gaza war and the beginning of a new, peaceful era in the Middle East. “This isn’t only the end of a war, this is the end of an age of terror and death,” Trump said. “This is the historic dawn of a new Middle East.”

In Egypt, Trump met with several world leaders to discuss the Gaza peace plan and the future of the region. He said that “phase two” of the plan has begun, which includes the disarmament of Hamas and the creation of an interim government in Gaza. Furthermore, Trump, along with the leaders of Egypt, Qatar, and Turkey, signed the plan.

The Dow Jones is up by 1.42% at the time of writing.

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading all tech stocks within the index after Mizuho raised its NVDA price target to $225 from $205, citing the semiconductor company’s strong leadership position and projecting over $300 billion in data center revenue by 2028. Apple (AAPL) is also in the green, brushing off a warning from Jefferies that the iPhone-maker’s margins could take a hit if Trump chooses to hike China’s tariff rate.

Furthermore, Magnificent 7 peer Amazon (AMZN) is catching a bid after the company announced that it would hire 250,000 seasonal, full-time, and part-time workers during the holiday season for a third straight year.

Elsewhere, all four industrial stocks are trading higher, while four of the five financial stocks are in positive territory.

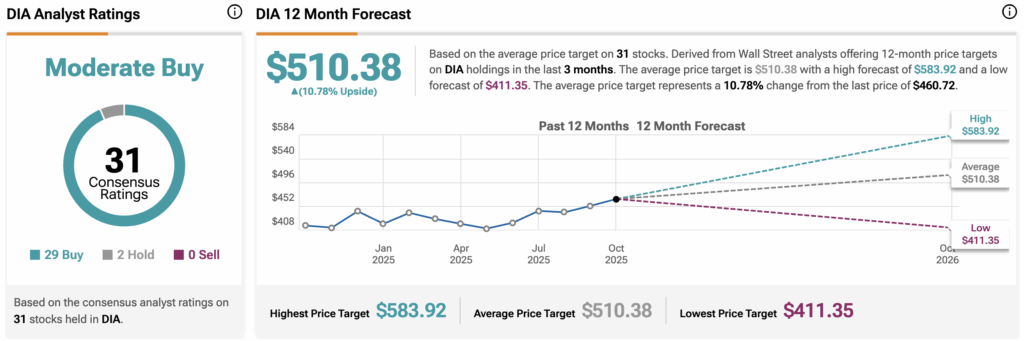

DIA Stock Moves Higher with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $510.83, implying upside of 10.78% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.