Crypto Options Market Braces for Netflix Q3: Priced for 7.4% Earthquake

Wall Street's betting big on NFLX volatility—while crypto traders yawn.

The Options Gamble

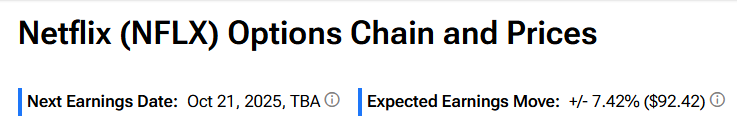

Traditional finance is sweating Netflix's Q3 earnings with a 7.4% implied move priced into options contracts. That's hedge fund money scrambling for protection against single-stock risk—something crypto portfolios solved years ago.

Digital Assets Don't Do Earnings Anxiety

Bitcoin never files quarterly reports. Ethereum doesn't host earnings calls. Crypto's 24/7 global market prices in news instantly—no waiting for CFOs to spin numbers during PowerPoint presentations.

While Netflix investors bite nails over subscriber counts, crypto traders are leveraging decentralized options protocols that make traditional derivatives look like stone tablets.

That 7.4% potential swing? Just Tuesday in DeFi—minus the SEC paperwork.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the Q3 earnings call, investors are likely to closely watch net additions, especially in international markets, and updates on engagement and revenue from the ad-supported plan.

Expectations From NFLX’s Q3 Results

Netflix has had a relatively quiet quarter, with shares down about 2% over the past three months. However, analysts expect the company to deliver a solid quarter.

Wall Street is expecting NFLX to report earnings of $6.96 per share, up 28.9% from the same period last year. Also, analysts project revenues of $11.51 billion, up from $9.78 billion in the year-ago quarter.

NFLX is benefiting from the shift in focus from pure subscriber growth to monetization and profitability. Also, the successful implementation of paid-sharing has driven major growth in paying members. Further, its advertising business is growing, aiding bottom-line expansion.

Finally, the company continues to expand its global footprint and content pipeline, to ensure long-term engagement.

Is NFLX Stock a Good Buy?

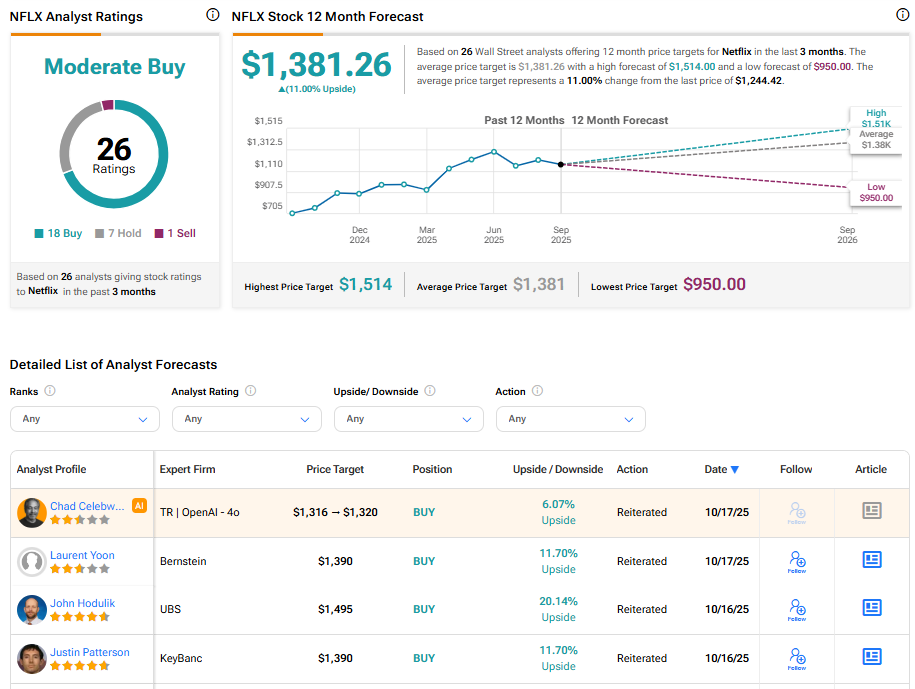

Turning to Wall Street, NFLX stock has a Moderate Buy consensus rating based on 18 Buys, seven Holds, and one Sell assigned in the last three months. At $1,381.26, the average Netflix stock price target implies a 10.93% upside potential.