Tesla Q3 Earnings: 5 Critical Takeaways as TSLA Stock Tumbles

Tesla's third-quarter results hit the market like a cold shower—and investors are reaching for the towels.

The Numbers Don't Lie

Revenue missed. Margins compressed. Delivery targets looking shaky. The usual Tesla magic seemed to short-circuit this quarter, sending shares down hard in after-hours trading.

Production Pains

Factory upgrades disrupted output. New model ramp-ups ate into profitability. The Cybertruck's production costs? Let's just say they're still figuring out the economics of building stainless steel tanks for the masses.

The China Question

Competition in the world's largest EV market intensifies by the day. Local manufacturers are undercutting on price while matching—sometimes exceeding—Tesla's tech specs.

Autopilot's Regulatory Speed Bumps

Regulatory scrutiny tightens as full self-driving faces more roadblocks. The promised robotaxi revolution? Still parked in the development garage.

Energy Business: Bright Spot or Distraction?

While Tesla's energy storage division shows growth, some analysts wonder if it's enough to offset the automotive slowdown. Solar roof installations? Let's call them 'deliberately paced.'

Wall Street's verdict came fast and furious—another quarter where promises outpaced performance. Because in today's market, even the most visionary companies need to deliver more than just dreams and PowerPoint slides.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street analysts have begun to react to the news, with Jefferies analyst Philippe Houchois describing the earnings event as having “more repetition than news.” Below are other key takeaways from the earnings call.

Tesla’s Revenue Jumps to $28.1 Billion

Despite reporting earnings per share of $0.50, below Wall Street’s expectations of 55 cents per share, Tesla’s earnings jumped 12% year over year to $28.1 billion, propelled by higher global vehicle deliveries and expansion in energy generation and storage. The growth defied Tesla’s lower earnings from selling environmental credits to other automakers that need them to meet government standards.

Also important to note, Tesla’s free cash flow rose dramatically from $146 million to nearly $4 billion, showing that the EV Maker has more cash to fund its expansion.

Elon Musk Rides Robotaxi Dream

During the event, CEO Elon Musk outlined big plans for the company’s future, including the rollout of robotaxis. Musk noted that the company is “scaling quite massively” in this regard, and further boasted that the Tesla vehicles have the “highest intelligence density of any AI [system] out there.”

Furthermore, Musk assured that its robotaxis will require no safety drivers in Austin within the next few months. The CEO added that the company is looking to operate the robotaxi in about eight to 10 metro areas in Nevada, Florida, and Arizona, among others, by the end of the year.

This comes as Tesla continues to expand its full self-driving (FSD) testing efforts amid criticism, including from U.S. lawmakers.

Execs Highlight Full Self-Driving Plans

During the call, Vaibhav Taneja, Tesla’s chief financial officer, also noted that the company continues to record “decent progress” in the adoption of its FSD vehicles. Taneja disclosed that increased production at the company’s megafactory in Shanghai, China, has enabled the EV maker to better handle tariff-related costs.

Adding to this, Musk noted that people are “quite amazed” by the self-driving capabilities of Version 14 of Tesla’s FSD software, released earlier this month. Chipping in, Mike Donoughe, the executive vice president of vehicle engineering and manufacturing, pointed out that Tesla is meeting its planned timeline for producing its electric semi trucks, with large-scale production set to begin in the second half of next year.

Musk Hypes Tesla’s AI, ‘Incredible’ Optimus Robot

In the robotics space, Musk continued to boast about the company’s humanoid robots. The billionaire chief executive noted that the Optimus robot will be “so real people will need to poke it to see that it’s not real”. He even added that it will become an “incredible surgeon.”

On Tesla’s push for artificial intelligence, Musk noted that the AI5 chip, the next-generation of Tesla’s AI processors designed for its FSD push and robotics, will be 40 times better than the earlier A14 version.

Musk Responds to Criticism on $1 Trillion Pay Package

Tesla’s board proposal to pay Musk $1 trillion in total compensation if some key ambitious targets are met also received attention during the event. While Taneja enjoined stakeholders to vote for the package, Musk called two key shareholders lampooning the package “corporate terrorists” who have previously championed “many terrible” ideas.

Shareholders will vote on the proposal on November 6 this year. If approved, the package will make Musk the first trillion-dollar chief executive in the world.

Is Tesla a Buy, Sell, or Hold?

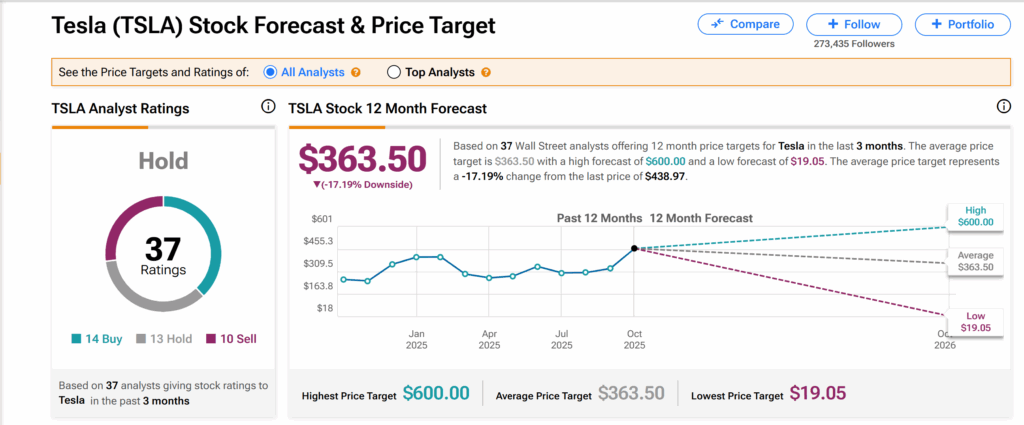

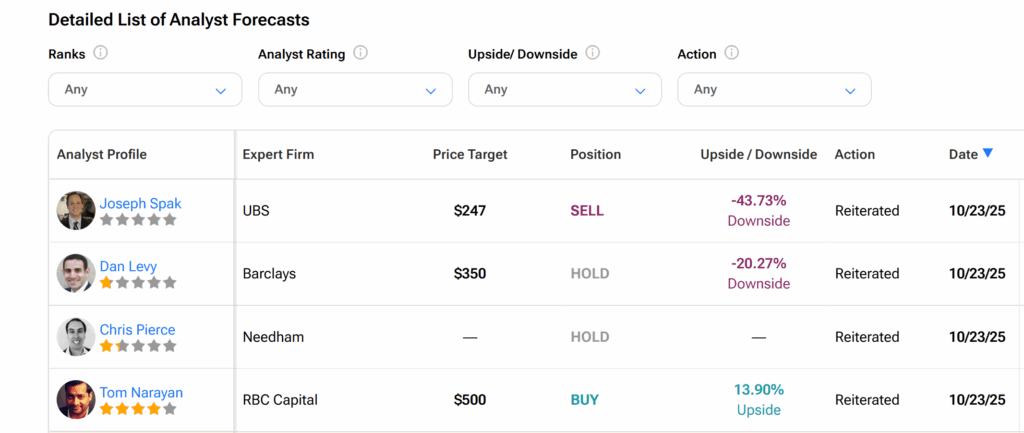

Meanwhile, Tesla’s shares currently have a Hold rating on Wall Street. This is based on 15 Buys, 13 Holds, and 10 Sells assigned by 38 Wall Street analysts over the past three months. Moreover, the average TSLA price target of $363.50 indicates more than 17% downside risk.