AMD Stock Plummets: What’s Behind the Crash Despite Blowout Earnings and Wall Street Cheerleading?

AMD just posted stellar earnings—so why did the stock get bulldozed?

Analysts are pounding the table with buy ratings, but shareholders got steamrolled anyway. Here’s the ugly truth Wall Street won’t spell out.

The numbers don’t lie (but the market does)

Strong fundamentals? Check. Bullish upgrades? Check. So what gives? Maybe the ‘smart money’ already priced in perfection—and is now taking profits while retail investors hold the bag.

The semiconductor seesaw

Chip stocks live and die by cyclical swings. Even rock-solid earnings can’t defy gravity when the sector rotation winds blow. AMD’s drop reeks of institutional traders flipping positions—not a fundamental breakdown.

The closer

: Next time Wall Street hypes ‘can’t-miss’ earnings, remember: their price targets work better as reverse indicators. (Bonus cynicism: If analysts could time the market, they wouldn’t be analysts.)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

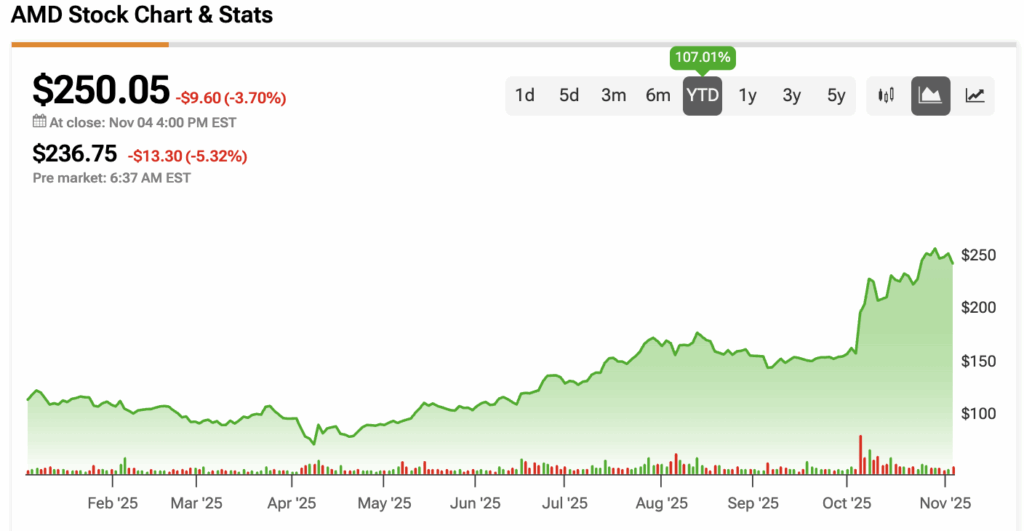

The drop reflects a classic case of profit-taking after a strong rally. AMD stock has gained more than 30% in the past three months, fueled by Optimism around AI chips and a long-term supply deal with OpenAI. Many traders appear to be locking in gains ahead of the next round of macroeconomic data and sector earnings, which could inject fresh volatility into the broader semiconductor market.

Valuation and Market Context Pressure the Stock

While AMD’s results were solid, some investors pointed to high expectations that may have left little room for upside surprise. The company’s guidance was in line with forecasts rather than sharply higher, which can weigh on a stock that has already priced in a strong AI future.

Analysts also noted that broader market weakness is playing a role. Technology shares have been under pressure as investors rotate out of high-growth names amid renewed concerns about stretched valuations and global demand for chips. With Nvidia (NVDA), Intel (INTC), and other peers also facing selling pressure, AMD’s dip appears more connected to sentiment than fundamentals.

Is AMD a Good Stock to Buy?

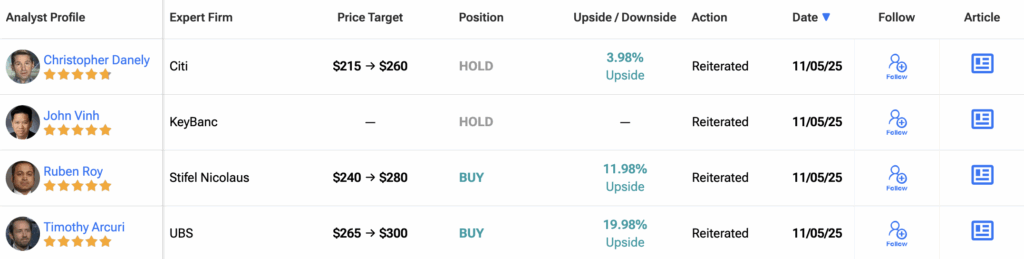

Despite the pullback, Wall Street remains confident about AMD’s longer-term story. Based on 39 Wall Street analysts offering 12-month price targets for Advanced Micro Devices (AMD) in the past three months, the stock holds a Moderate Buy consensus rating. Out of these, 29 analysts rate AMD a Buy, 10 recommend a Hold, and none suggest a Sell.

The average 12-month AMD price target stands at $255.77, representing a potential 2.3% upside from the latest closing price.

AMD’s decline this week looks less like a loss of faith and more like a pause in a strong uptrend. Investors remain bullish on its AI exposure and long-term partnerships, but near-term volatility could persist as traders rebalance portfolios and assess whether the next wave of AI spending justifies current valuations.