Amazon’s Ad-Supported Prime Video Hits 315M Users – Bullish Signal for AMZN Stock?

Amazon just dropped a bombshell: its ad-tier Prime Video service now reaches 315 million eyeballs. That's a streaming war chest even Netflix would envy.

For AMZN shareholders, this could be the monetization rocket fuel they've been waiting for. Advertising revenue streams are higher-margin than e-commerce fulfillment – and Bezos' empire is sitting on a goldmine of viewer data.

Wall Street analysts will likely upgrade projections, though let's be real – they're still using 20th century metrics to value a company that's quietly building the ad-tech infrastructure of Web3.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Prime Video’s ad-supported service is a version of Amazon’s streaming platform that allows users to watch content with ads included, instead of paying the full subscription price for an ad-free experience. The surge to 315 million ad-supported viewers highlights Prime Video’s growing role in streaming and digital ads, creating new ways for the company to earn revenue. For investors, this milestone could raise confidence in AMZN stock as the company makes more from its larger audience and stays competitive in streaming.

315M Viewers and Counting

The 315 million figure represents the unique monthly audience for Prime Video’s ad-supported content, including original and licensed series, films, live sports, events, and free live channels. This estimate is based on Amazon’s internal data from September 2024 to August 2025, with some variations by region.

Speaking at the event, Jeremy Helfand, Vice President of Prime Video Advertising, said, “Reaching over 315 million monthly ad-supported viewers globally is a transformative milestone for Prime Video.”

He highlighted that Prime Video now reaches viewers in 16 countries. This growth highlights the platform’s larger audience and the opportunities it creates for advertising, as Amazon explores new ways to connect content with viewers.

What Does It Mean for Investors?

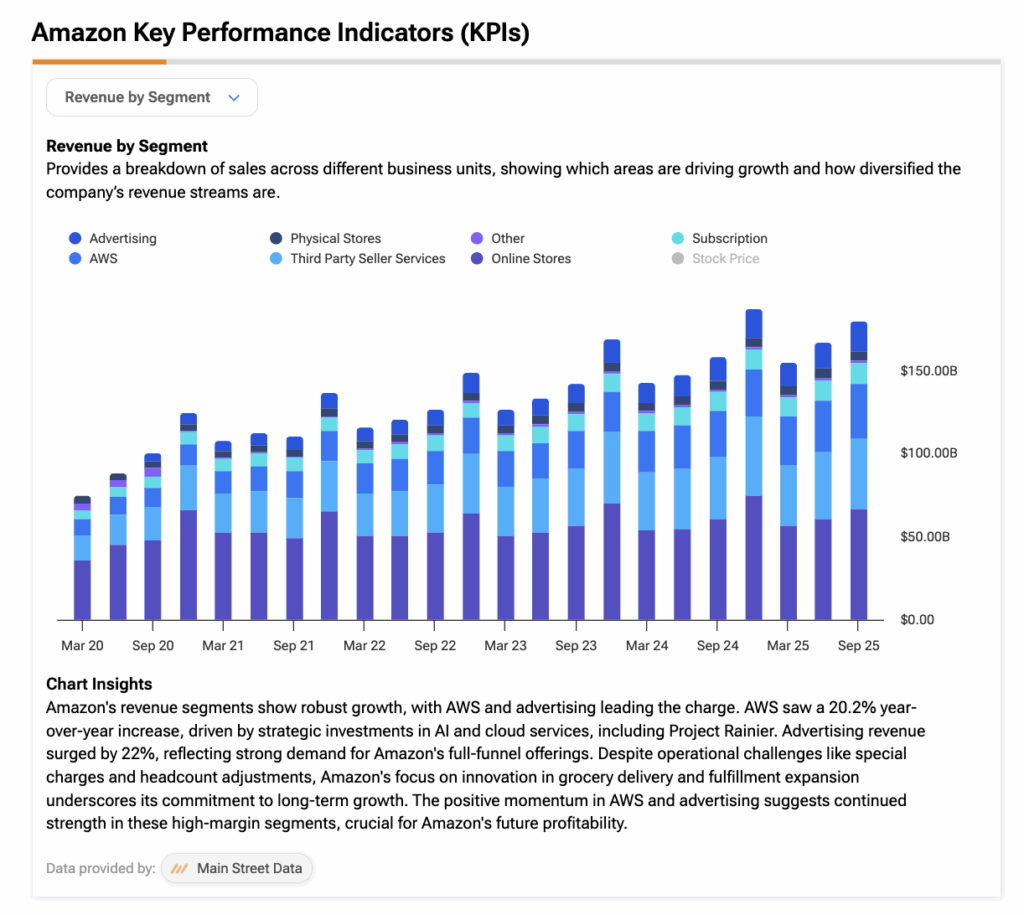

In Q3 2025, Amazon’s Subscription revenue grew by 11% year-over-year to $12.57 billion. Notably, the company’s Subscription revenue mainly includes annual and monthly Prime membership fees. It also includes revenue from digital content such as movies, TV shows, audiobooks, music, e-books, and other non-AWS subscriptions. Below is a screenshot showing a breakdown of Amazon’s revenue across its various segments.

Amazon is strengthening its Prime Video platform by growing its ad-supported audience, which now exceeds 315 million monthly viewers globally. For investors, the large ad-supported audience signals new revenue streams beyond subscriptions.

It also shows that Prime Video can attract and retain viewers, which could help the tech giant to stay competitive in streaming. While this doesn’t guarantee immediate stock gains, it points to long-term growth potential for Amazon and its ability to monetize a massive global audience.

What Is the Price Target for AMZN Stock?

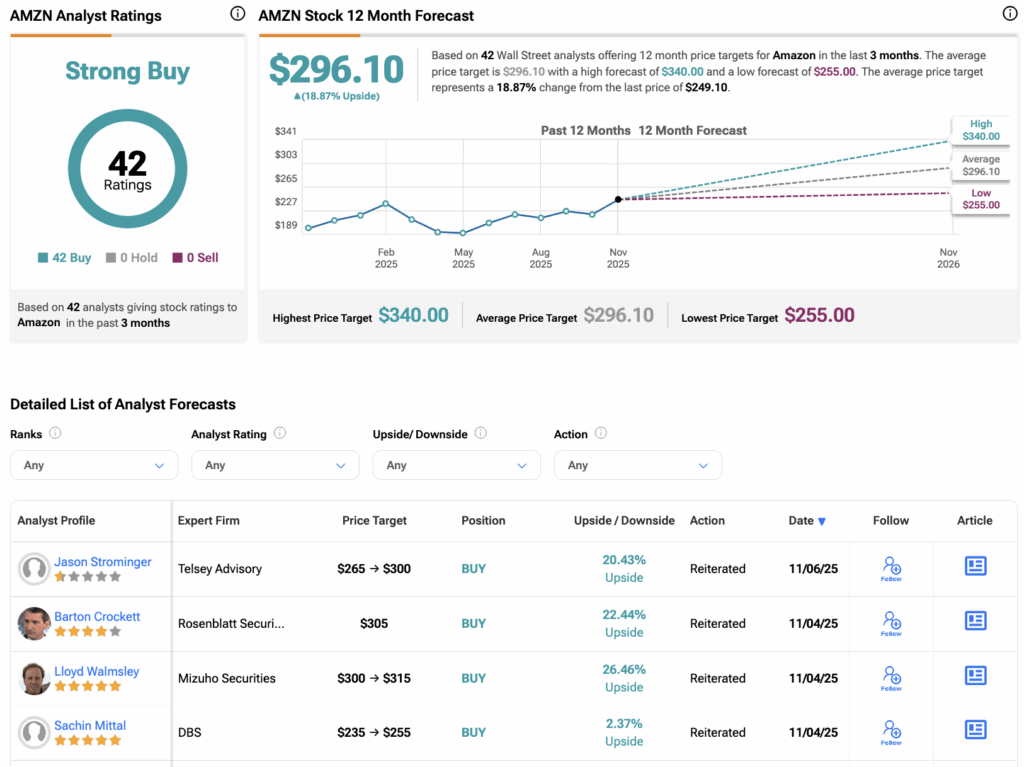

According to TipRanks, AMZN stock has a Strong Buy consensus rating based on 42 Buys assigned in the last three months. At $296.10, the Amazon average share price target implies an upside of 19% from the current level.