Canadian REITs Rally as Housing Market Rebounds: XRE ETF Climbs on Surging Home Sales

Real estate investors are breathing easier as Canada''s property market shows signs of life. The iShares S&P/TSX Capped REIT Index ETF (XRE) is riding the wave of renewed buyer activity—proving once again that even bricks and mortar need a blockchain to be exciting these days.

The turnaround comes as national price declines stabilize, creating a rare moment of optimism in the traditionally sluggish REIT sector. While your crypto portfolio might still be outperforming, at least now your landlord can afford that yacht upgrade.

Active trading patterns suggest institutional money is betting on sustained recovery. Whether this marks a genuine turnaround or just another speculative bubble remains to be seen—but in Canadian real estate, the house always wins eventually.

Confident Investing Starts Here:

- Easily unpack a company''s performance with TipRanks'' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks'' Smart Value Newsletter

Between April 2025 and May 2025, reports noted, the Canadian MLS Systems recorded a gain of 3.6% in home sales. This is actually the first upward tick since November 2024. The biggest gains were seen in Calgary, Ottawa, and the Greater Toronto Area, and represented not only a gain in total home sales, but also a halt in price declines. This suggested that, perhaps, the housing market is closing in on equilibrium. Newly-listed properties were up 3.1%, and the Home Price Index was virtually unchanged, declining approximately 0.2% against the preceding month.

Naturally, it is too early to suggest a pattern has been established herein; this is just one month’s data, after all. But some are already starting to wonder if the slowdown in housing from before was not simply an outgrowth of the tariffs. Those did bring quite a bit of uncertainty, after all, and now that the market is seeing what the tariffs actually look like, a more stable reality may be asserting itself.

Starts Slump

But a different development entirely may be contributing to these issues, though perhaps, not for a while yet. While new listings are coming in, and price declines are halting, housing starts are also slowing up. The pace of housing starts dropped 0.2% in May against figures from April, noted the Canada Mortgage and Housing Corp.

This may make a certain amount of sense; the houses that were started before need to be built now, so it stands to reason that starts may drop off after a bit. But with signs of prices and buying on the rise again, perhaps now is not the time to slow home construction. This is particularly true given what we already know about housing shortages in Canada.

Is the iShares S&P / TSX Capped REIT Index ETF a Good Buy Right Now?

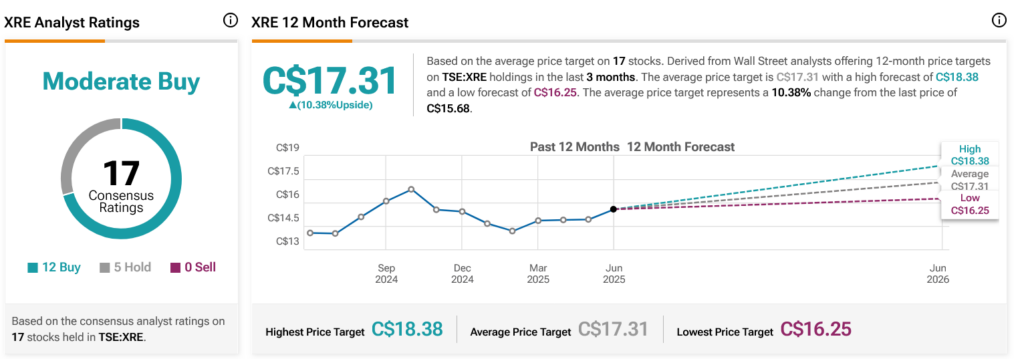

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:XRE shares based on 12 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 8.73% rally in its share price over the past year, the average TSE:XRE price target of C$17.31 per share implies 10.38% upside potential.

Disclosure