Disney (DIS) Finally Unleashes Game-Changing ESPN Streaming App - Cord-Cutters Rejoice!

Mickey Mouse enters the streaming arena guns blazing—ESPN's standalone app just dropped, and it's looking to disrupt the entire sports media landscape.

The Content Playbook

Disney bypasses traditional cable bundles, delivering live games, highlights, and analysis directly to fans. No more paying for channels you never watch—just pure sports adrenaline.

Wall Street's Skeptical Stance

Because nothing says 'innovation' like another streaming service competing for subscription dollars in an already saturated market. Investors remain cautiously optimistic, wondering if this move will actually move Disney's needle—or just add to the digital clutter.

Score one for the cord-cutters, but will it score for shareholders?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the same time, Disney CEO Bob Iger stated that the company no longer views linear TV and digital platforms separately. Instead, the goal is to manage them together as one integrated ecosystem. As for pricing, cable subscribers will be able to log in and stream with no extra charge, while everyone else will choose from several plans. The first is the ESPN Unlimited plan, which costs $29.99/month or $299.99/year and includes over 47,000 live events like NCAA championships and major tennis tournaments. There’s also a bundle with Disney+ and Hulu for $35.99/month with ads, or $44.99/month without ads.

In addition, Disney is rolling out a more affordable ESPN Select tier that offers more than 32,000 live events, studio shows, and on-demand replays for $11.99/month or $119.99/year. Interestingly, existing ESPN+ subscribers will automatically be shifted to this plan. Additional bundles include the Disney+, Hulu, and ESPN Select package for $16.99/month with ads or $26.99/month without. Meanwhile, ESPN is boosting its content lineup through new deals with WWE (TKO)—reportedly worth $325 million a year—and a partnership with the NFL that involves acquiring the NFL Network.

Is DIS Stock a Good Buy?

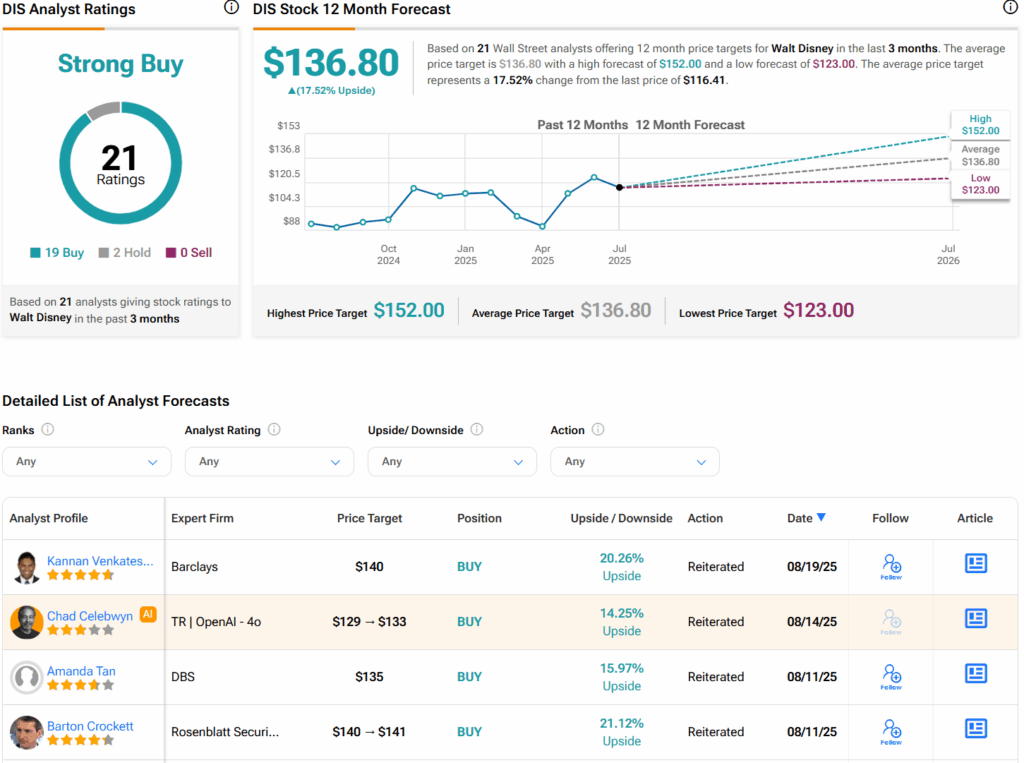

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 19 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average DIS price target of $136.80 per share implies 17.5% upside potential.