XRP Plummets as 470 Million Token Avalanche Hits Market—Here’s What’s Next

XRP just got hammered—hard. A staggering 470 million tokens flooded the market, sending prices into a tailspin and leaving traders scrambling.

Supply Shock or Strategic Dump?

That kind of volume doesn’t happen by accident. Whether it’s whales cashing out or institutions rebalancing, the move screams volatility—and opportunity for those brave enough to dive in.

Market Reacts—As Always

Liquidity surged, order books tilted, and stop-losses triggered like dominoes. Classic crypto behavior: panic sells first, asks questions later. Meanwhile, traditional finance types are probably nodding sagely about 'speculative bubbles' from their leather chairs.

Where Does XRP Go From Here?

History says crypto bounces—often harder than it falls. This isn’t XRP’s first rodeo, and it won’t be its last. Keep an eye on accumulation patterns; smart money loves a fire sale.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Institutions offloaded a staggering 470 million XRP between August 21 and 22, hammering the price down and locking it under $2.92 resistance. What could have been a breakout turned into another harsh reminder that sellers are still in control.

Institutions Pull the Trigger

The dump came from institutions. This was confirmed by volume spikes that left fingerprints across major exchanges. On-chain settlement even surged 500% to 844 million tokens on August 18, one of the biggest bursts this year. Adoption is real, but price action told a different story.

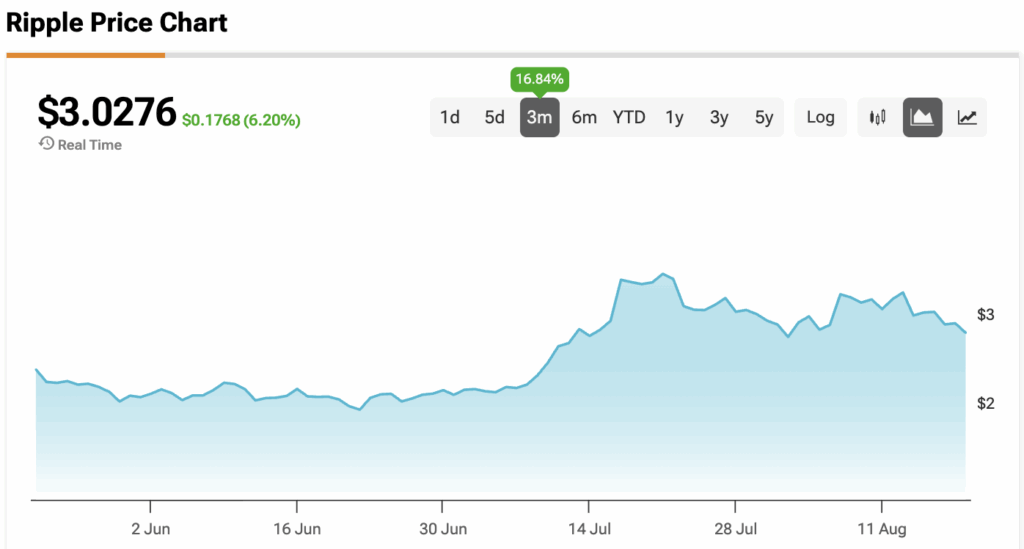

XRP slid 3.1% over 24 hours, falling from $2.89 to $2.80. The sharpest rejection came at $2.92 on nearly 70 million in volume. By the final trading hour on August 22, XRP sank another 2.5% on surging sell pressure, locking in a bearish continuation.

SEC Delays Add to the Pressure

The regulatory backdrop only makes things worse. The SEC pushed back decisions on XRP ETF applications, including Nasdaq’s CoinShares () filing, until October. This delay keeps institutional money waiting and leaves the token under a cloud of uncertainty.

Meanwhile, a security assessment ranked XRP dead last out of 15 blockchains. For traders already hesitant, headlines like this reinforce the bearish mood.

Traders Watch $2.80 like a Hawk

For now, the chart has become a battle zone. Sellers are holding the line at $2.92 while support is fading around $2.80 to $2.85. Each test of support looks weaker than the last.

If $2.80 breaks, the next stop could be $2.75 in a hurry. To flip sentiment, bulls need to smash through $2.92 and then reclaim $3.00. Until then, XRP stays pinned under pressure.

The irony is adoption metrics look strong. Settlement volumes are up, and whales are still active. But the price keeps getting dictated by institutional flows and regulatory delays.

At the time of writing, XRP is sitting at $3.0276.