MODV Soars 55%: What’s Fueling ModivCare’s Meteoric Rally Today?

ModivCare just pulled off a jaw-dropping market move—rocketing 55% in a single session. Here’s the breakdown behind the surge.

Earnings Blowout or Strategic Pivot?

Numbers don’t lie. When a stock rips more than half its value in hours, something fundamental—or wildly speculative—is at play. MODV’s leap signals either blockbuster financials or a market narrative shifting into overdrive.

Healthcare Meets Hypergrowth

ModivCare operates at the crossroads of healthcare and logistics—a sector ripe for disruption. If today’s explosion is any indication, investors are betting big on tech-driven care delivery models outpacing traditional players.

Wall Street’s Whiplash Moment

Let’s be real—55% moves aren’t for the faint of heart. They’re either genius foresight or the kind of volatility that gives fund managers night sweats. In a market obsessed with quick wins, MODV’s sprint is a reminder: sometimes the biggest gains happen in hours, not quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The RSA will provide ModivCare with $100 million in debtor-in-possession (DIP) financing, which the company will use to fund the restructuring process and continue ongoing operations. It will have over $100 million in liquidity and reduce its debt by $1.1 billion after the bankruptcy. This will also reduce its annual cash interest.

According to ModivCare, this restructuring will result in a “stronger, sustainable organization, positioned for growth and well-equipped to meet the critical needs of members across its non-emergency medical transportation, personal care services and remote patient monitoring service lines.”

ModivCare Stock Movement Today

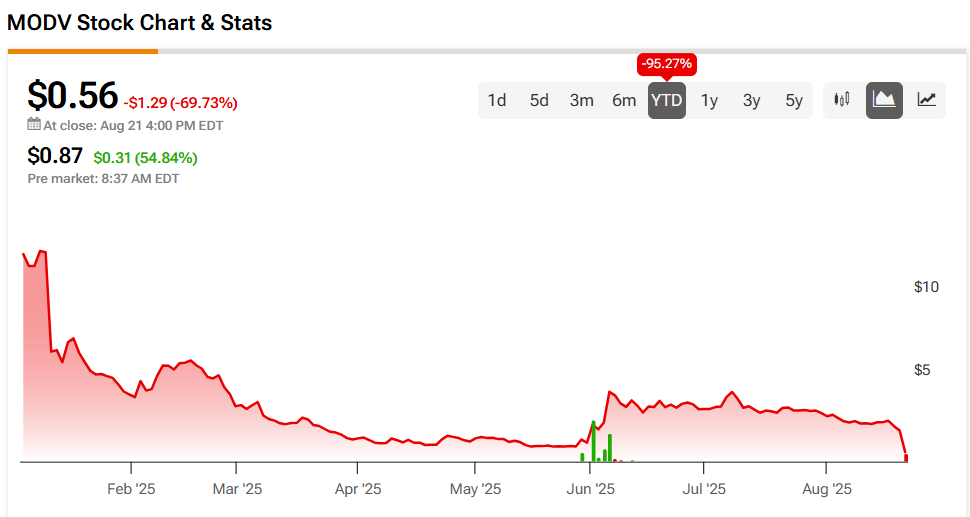

ModivCare stock has been on a wild ride since its bankruptcy announcement. MODV stock was up 54.84% in pre-market trading on Friday, following a 69.73% drop yesterday. The shares have also fallen 95.27% year-to-date and 97.9% over the past 12 months.

Today’s news brought heavy trading to ModivCare stock. This saw some 46 million shares traded as of this writing, compared to a three-month daily average of about 350,000 units.

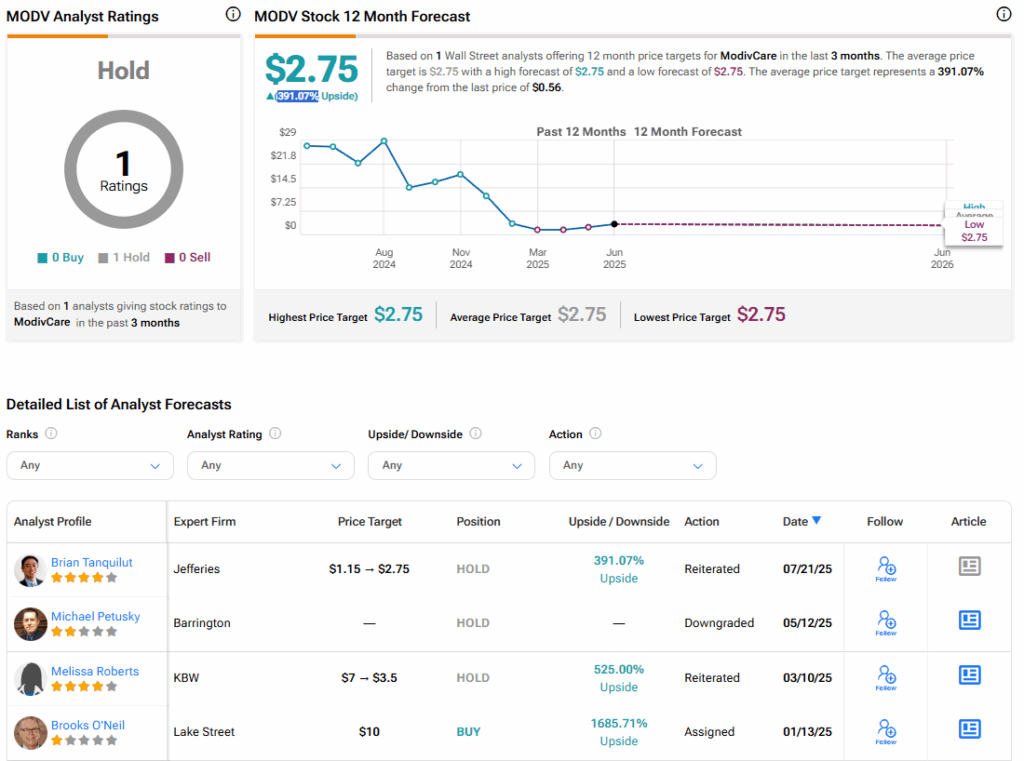

Is ModivCare Stock a Buy, Sell, or Hold?

Turning to Wall Street, only one analyst has covered ModivCare stock in the past three months. Four-star Jefferies analyst Brian Tanquilut rates MODV stock a Hold with a $2.75 price target, representing a potential 391.07% upside for the shares. The analyst’s stance may change following today’s bankruptcy news.