Fed Rate Cut Unleashes New Fintech Titans: SOFI, COIN, UPST, HOOD, and AFRM Lead the Charge - Mizuho

Wall Street's sleeping giants just woke up—and they're hungry.

The Fed's latest move didn't just adjust numbers on a screen; it rewired the entire fintech battlefield. Lower rates mean cheaper capital, smoother lending, and a turbocharged environment for digital finance platforms to thrive.

SOFI’s leveraging the shift to expand its lending verticals. COIN’s riding the crypto resurgence with institutional inflows climbing. UPST’s AI-powered lending models are suddenly more profitable. HOOD’s zero-fee structure looks even smarter now. And AFRM? It’s positioned to dominate buy-now-pay-later as consumer credit gets cheaper.

Mizuho’s analysis suggests we’re not looking at a short-term bounce—this is a structural realignment. The old guards of finance? Still trying to update their Excel macros.

Welcome to the era where fintech doesn’t compete with banks—it replaces them.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mizuho Highlights Fintech Winners

Mizuho highlighted several fintech names that stand to gain as rates MOVE lower. Among bank processors, the firm named FIS (FIS) and Fiserv (FI) as key beneficiaries, explaining that when rates fall, customers tend to hold larger balances in transaction accounts, which helps drive growth for these companies.

On the trading side, Mizuho pointed to Robinhood (HOOD), Coinbase (COIN), and eToro (ETOR) as likely beneficiaries. The analysts noted that lower rates often drive higher trading volumes, which in turn lift commission revenue. Based on this view, the firm raised its price target on Coinbase to $300 from $267, while keeping a Neutral rating.

In consumer lending, Mizuho sees Upstart (UPST), Affirm (AFRM), and SoFi Technologies (SOFI) as well positioned. The analysts explained that lower rates improve credit spreads and encourage loan growth, creating a more supportive environment for these companies. Reflecting this view, the firm raised its price target on SoFi to $31 from $26 per share.

Not All Fintechs Benefit from Rate Cuts

Not every company in the fintech space will gain from falling interest rates. Mizuho flagged Circle Internet Group (CRCL), the issuer of the USDC stablecoin, as a clear loser. The firm explained that USDC’s revenue is fully tied to yields, so lower rates directly reduce the company’s earnings.

The analysts also reviewed large payment networks and financial services firms. PayPal (PYPL) may see only a limited benefit, while Visa (V) and MasterCard (MA) could face mixed outcomes depending on transaction volumes across different markets.

Which Is the Best Fintech Stock to Buy?

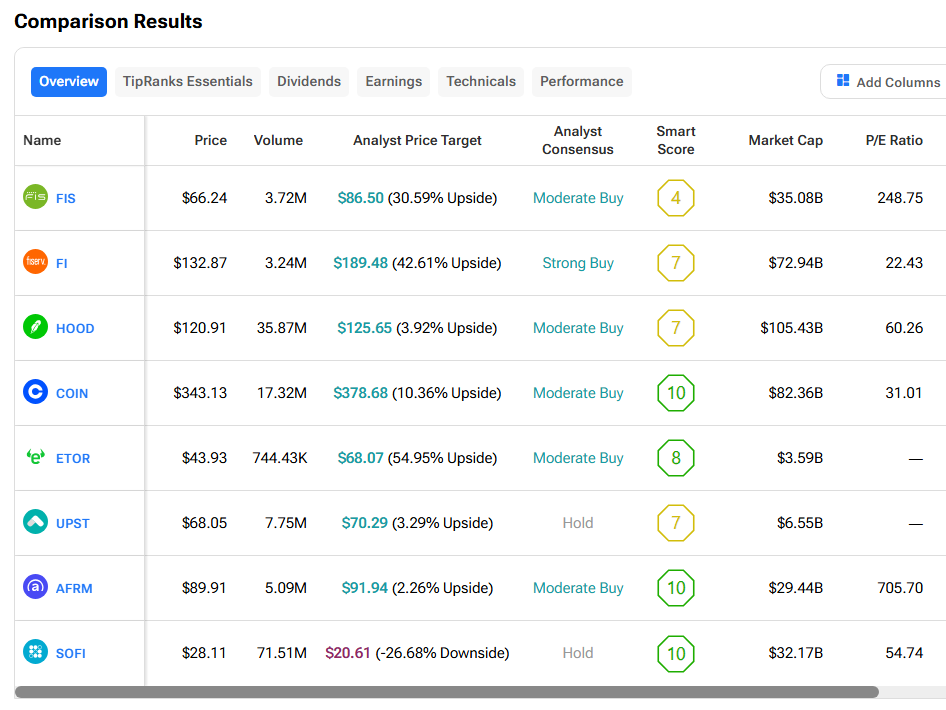

We used the TipRanks Stock Comparison Tool to see which fintech names highlighted by Mizuho look most attractive to Wall Street. Investors should still do their own research before making any decision.

Currently, Fiserv holds a Strong Buy consensus rating with the highest upside potential of about 43%. FIS also shows solid upside of over 30%, though it carries a Moderate Buy rating. Meanwhile, eToro stands out with nearly 55% upside and a Moderate Buy rating, reflecting bullish analyst sentiment despite its smaller market cap.